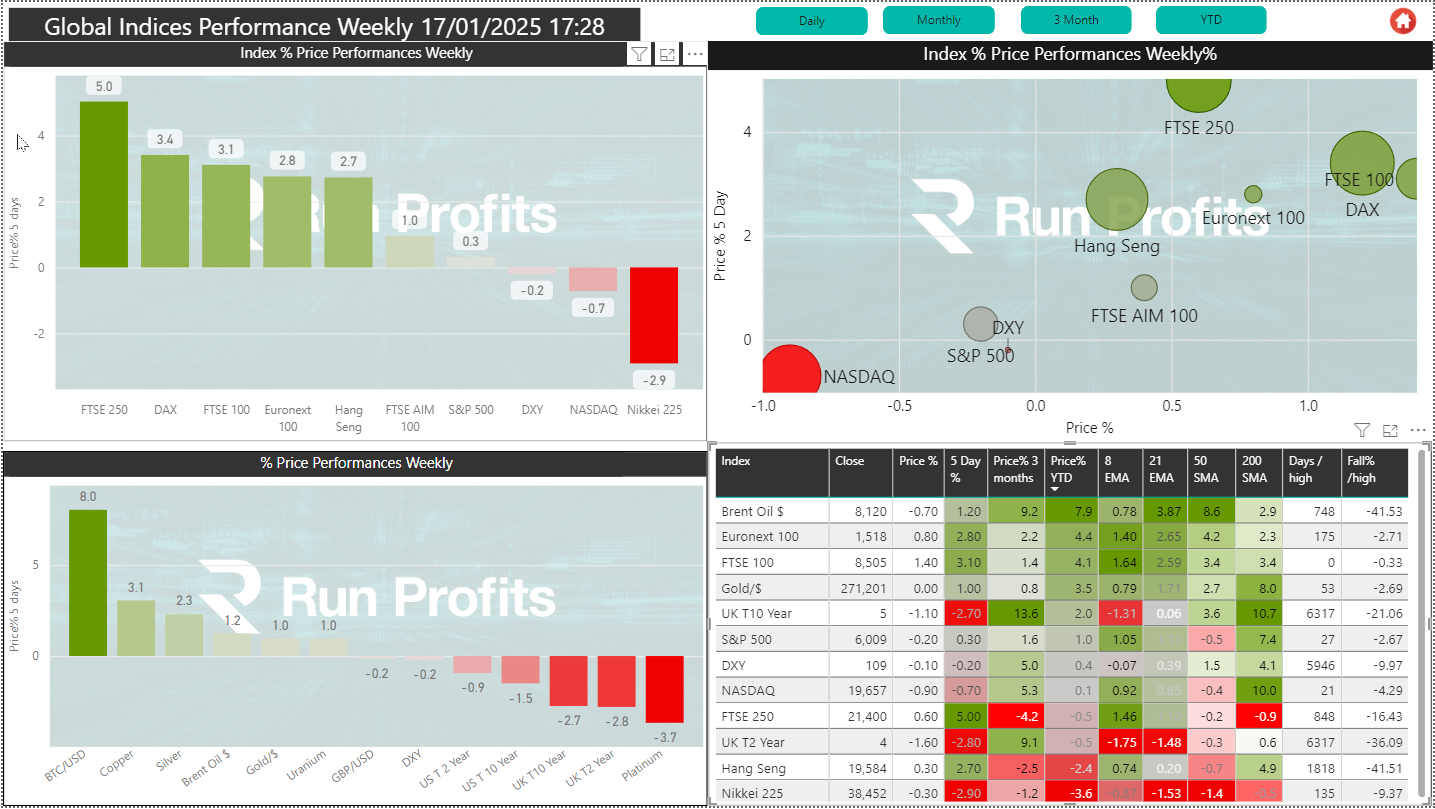

News flow has picked up in the UK this week which, combined with some positive economic announcements, has prompted some cautious optimism in the equity markets.

On Wednesday we heard that inflation figures for December weren’t as bad as many had feared, falling to 2.5% (from 2.6% in November). This was followed by lower than expected inflation data in the US, which may have opened the door to a quicker cut to base rates. The Bank of England will make its next decision on 6 February and traders are currently forecasting an 80% chance of a 0.25 point cut to the rate, which currently stands at 4.75%

The inflation data has sparked a rally in the price of bonds, providing some respite after a rough start to 2025. The yield on 10-year gilts fell to 4.73% on Wednesday, their best day since 2023.

The FTSE has rallied slightly in response - a welcome change after bond markets received the most positive inflows for the first few weeks of the year.

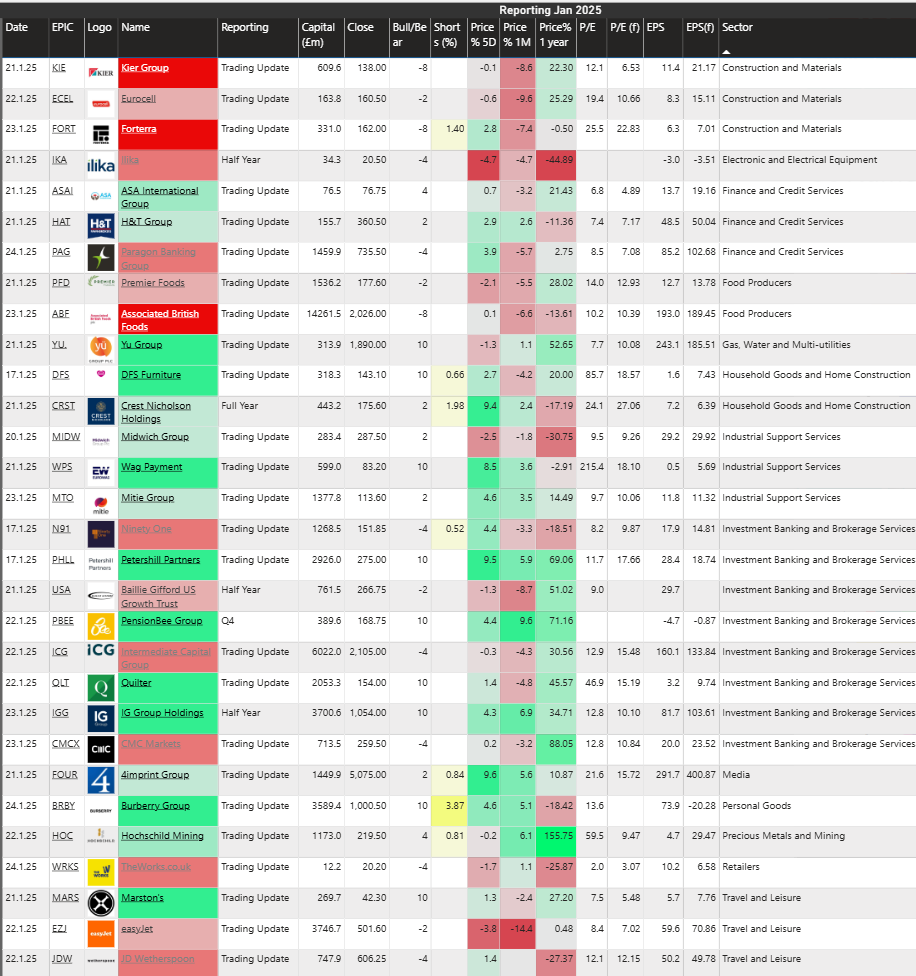

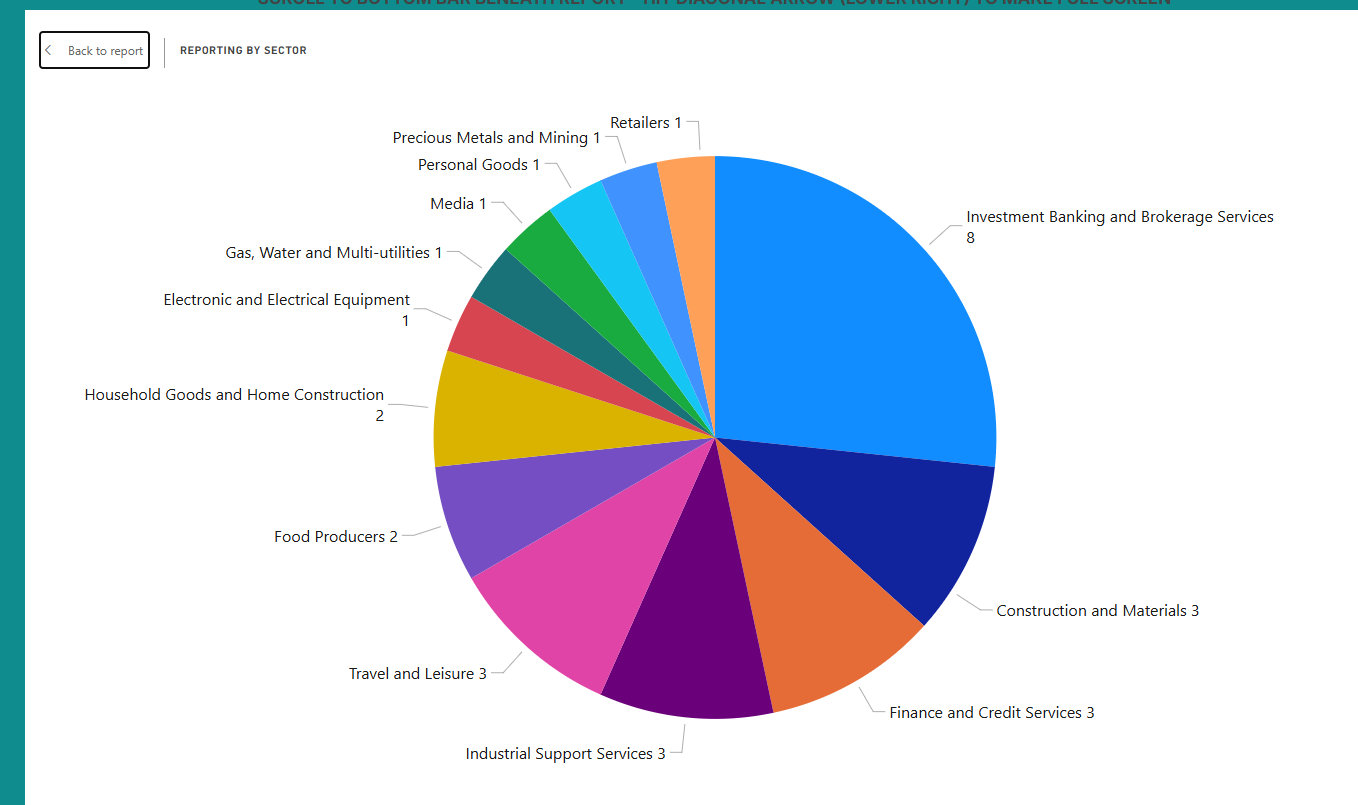

In company news, I must extend my congratulations to Graham, Roland and Mark who have done a remarkable job this week summarising all the trading statements and company updates. You can catch up on all of their analysis via this blog.

There are a few stories which caught my eye:

IG’s £160m acquisition of Freetrade. Graham likes IG as an investment and I like it as a customer, but I am non-plussed by this acquisition. Freetrade has £2.5bn in assets under management, which is less than what IG’s customers held in cash in their portfolios at the last set of results. The average portfolio size is just £3,400 (which is too little to make money off) and each customer contributed an average of £38 in revenue last year which, as my Dad pointed out to me yesterday, is less than the local sweet shop makes from children who drop in on their way home from school.

Frontier Developments which enjoyed a big share price leap after instilling some confidence in this week’s trading statement. I covered FDEV in the last week ahead. It’s had a torrid time in the last few years, despite its strong product offering. But in the first four weeks of the 2025 financial year,…