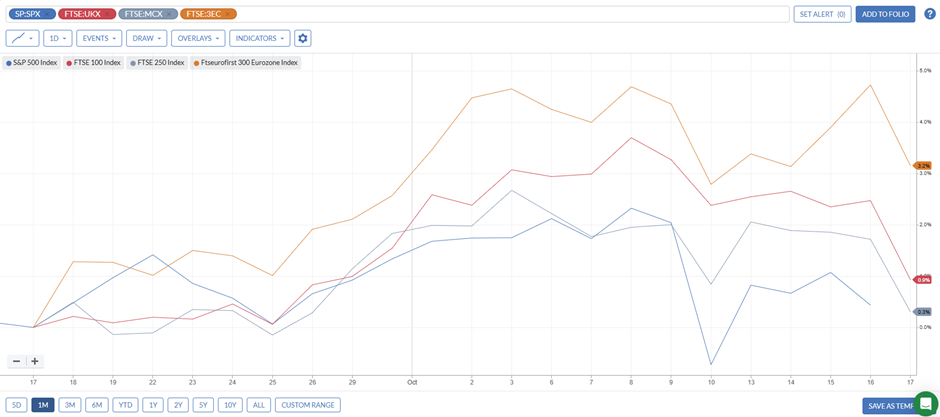

It has been a risk-off period for US and global indices lately, as concerns about U.S. regional bank problems and renewed U.S.–China trade tensions have weighed on sentiment. This has reversed generally positive trends for the rest of the month:

The biggest moves have been in the commodity sector, with oil down but gold making a huge weekly gain and surging to new highs above $4,300/oz as investors fled to safe havens amid banking and geopolitical worries.

Investors interested in learning more about investing in gold producers can read my two-part introduction to the sector here & here.

Here's what we can look forward to next week:

Economic Calendar

Monday 20 Oct |

||

03:00 |

China |

GDP Growth Industrial Production Retail Sales |

07:00 |

Germany |

Current Account |

09:00 |

Euro Area |

Producer Price Index |

Tuesday 21 Oct |

||

07:00 |

UK |

Public Sector Net Borrowing |

Wednesday 22 Oct |

||

00:50 |

Japan |

Balance of Trade |

07:00 |

UK |

Consumer Price Index (CPI) Retail Price Index (RPI) Producer Price Index (PPI) |

15:00 |

United States |

Crude Oil Inventories |

Thursday 23 Oct |

||

13:30 |

United States |

Initial Jobless Claims Continuing Claims |

15:00 |

United States |

Existing Home Sales |

15:00 |

Euro Area |

Consumer Confidence |

Friday 24 Oct |

||

00:30 |

Japan |

Inflation (CPI) |

07:00 |

UK |

Retail Sales GFK Consumer Confidence |

08:30 |

Germany |

Manufacturing PMI |

13:30 |

United States |

Consumer Price Index |

15:00 |

United States |

New Home Sales |

UK & US inflation

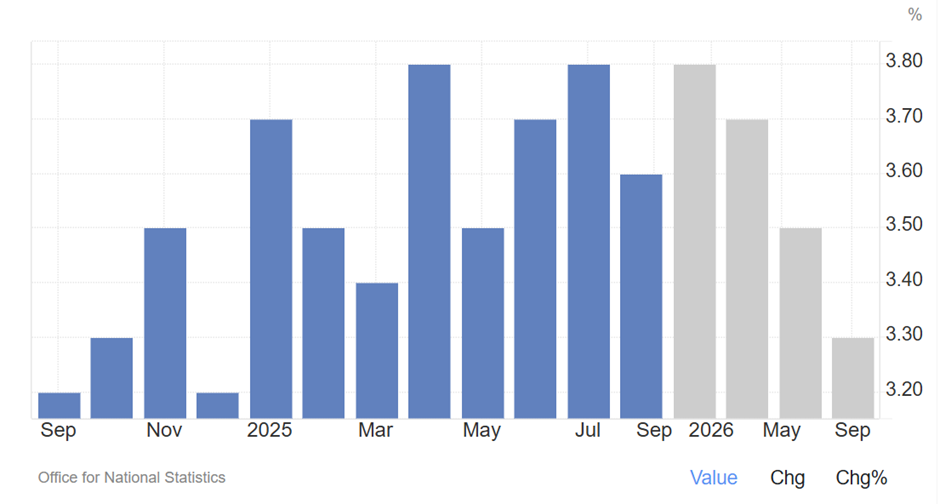

UK September CPI is due from the ONS on 22 October. Expectations are for the CPI to peak around 4.0% year-on-year, driven by higher food & services inflation and sticky wage growth. This is clearly above the BoE's 2% target, which is why the bank has been cautious about further cuts in interest rates.

[All charts in the section: Trading Economics]

This is more likely to surprise to the upside than the downside in the near term due to services & food momentum. We shouldn't be counting on UK interest rate cuts soon, despite…