Welcome back to The Week Ahead. We’re gearing up for a mammoth week of earnings in the UK next week as the floodgates open on Wednesday and results season gets underway.

Given the impending flow of company news, perhaps it’s just as well that the economic news scheduled for next week is relatively limited.

There may be more focus on geopolitical events as President Trump said on Thursday that Iran needs to reach a deal in the next 15 days “or bad things will happen”. The US has already staged a substantial military build-up in the Middle East which is said to be similar to that seen before the 2003 Iraq war – enough to sustain a significant air campaign.

Opinions vary on the impact attacks could have on oil markets and broader stability in the region. Last June’s Iran-Israel conflict – which ended with the US bombing Iran – only caused a short-lived blip in oil prices, but there’s always the risk of a more severe reaction.

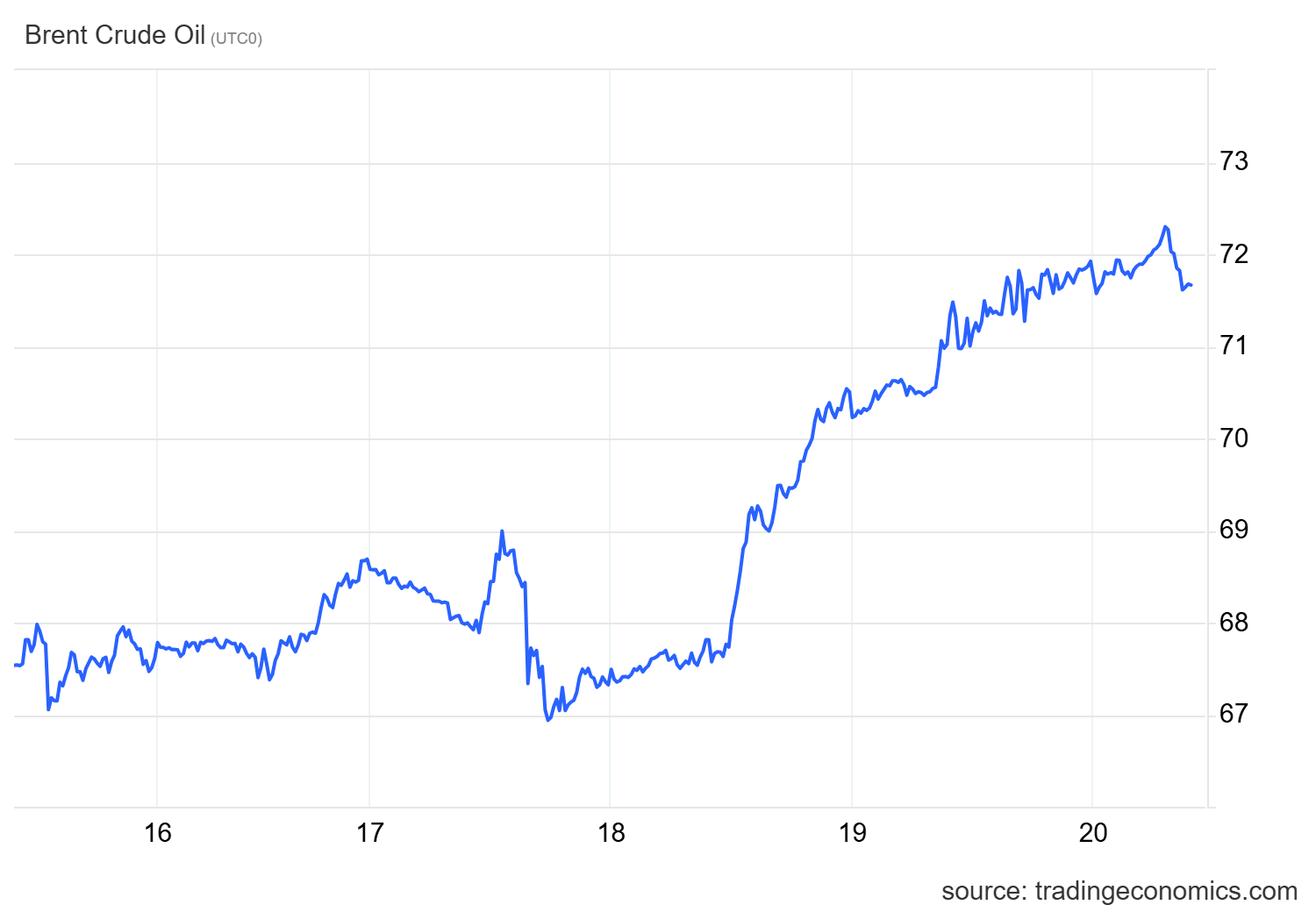

As uncertainty has risen, oil and gold have both risen this week, although only quite modestly:

UK Housing: one other area of interest for UK investors could be the housing market. Land Registry data showed prices for flats and detached properties fell across London and the South East in December. I would guess this suggests problems with demand and affordability, respectively.

Prices elsewhere rose though, so it may be interesting to see what this Friday’s Nationwide House Price index update shows. The UK’s largest lender uses mortgage approval data for its survey rather than completed sales, so is a little more timely than the Land Registry.

Company news

NVIDIA (NSQ:NVDA) is set to report its fourth quarter and full-year earnings on Wednesday week. The world’s largest company by market cap at c.$4.5tn will no doubt make many headlines, but I’m not sure there is much I can contribute to the debate.

However, there are a number of UK companies reporting next week whose prospects we do often consider in the Daily Report, including a FTSE 250 stock that’s a potential casualty of the rapid growth in AI services.

MONY (LON:MONY)

The owner of MoneySuperMarket.com is due to report its…