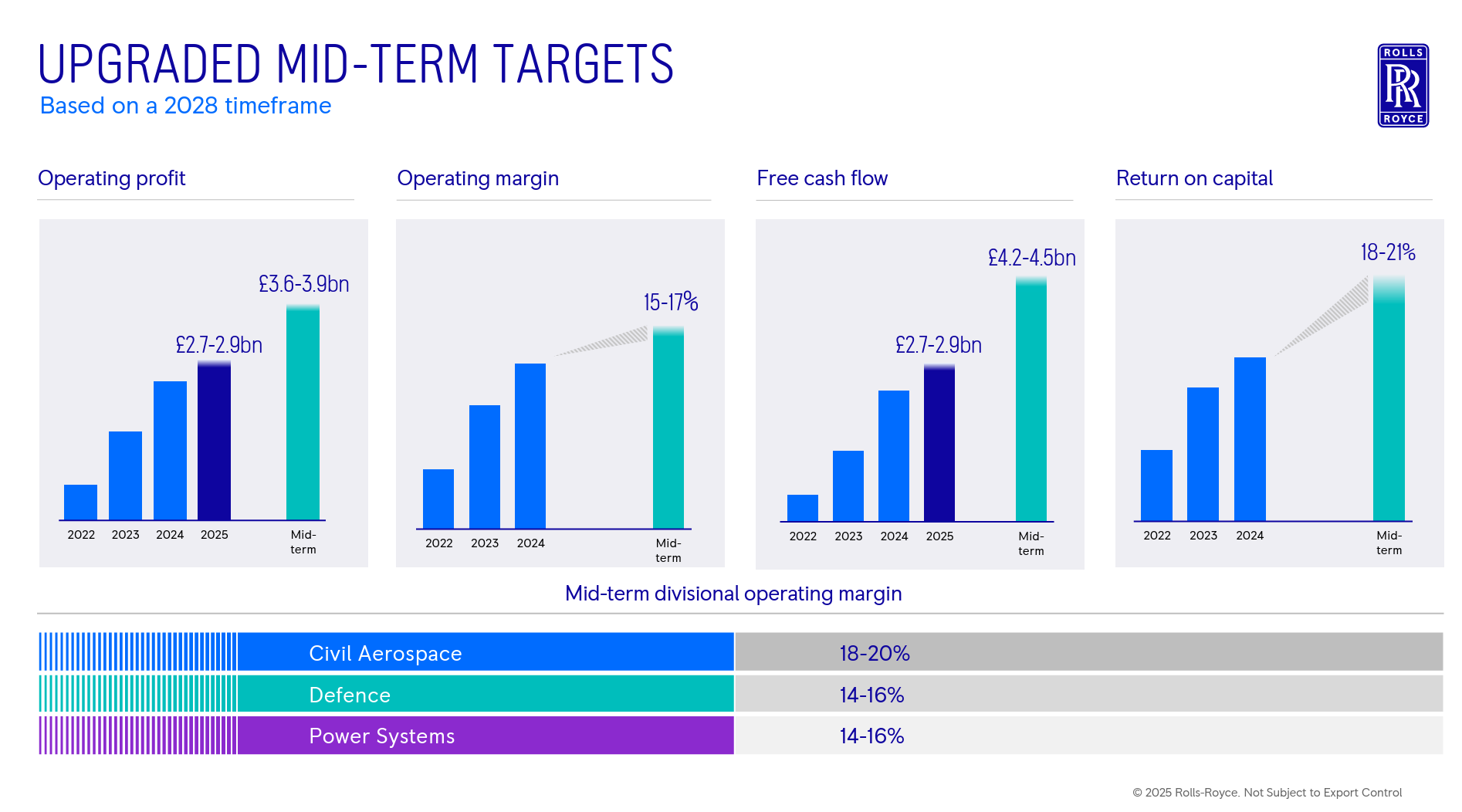

This week, European equities continued their strong start to the year, outpacing their US counterparts for the first time in over a decade. The STOXX 600 notched further record highs mid-week, fueled by strong performances across banking, energy, and defence stocks.

In particular, Europe’s defence sector has surged on expectations of increased military spending, with names like BAE Systems (LON:BA.) and Rheinmetall AG (ETR:RHM) posting double-digit gains before retreating slightly. It seems that investors, who have long been sceptical of the continent’s growth prospects, are beginning to recognise the relative value on offer compared to a seemingly stretched US market.

Across the Atlantic, Meta Platforms (NSQ:META) has been the clear leader of the Magnificent Seven this year, with its shares up nearly 16%. Apple and Tesla have struggled, though, with some initial cracks starting to appear. All eyes will now be on NVIDIA (NSQ:NVDA), the last to report, as it prepares to release its full-year results on Wednesday.

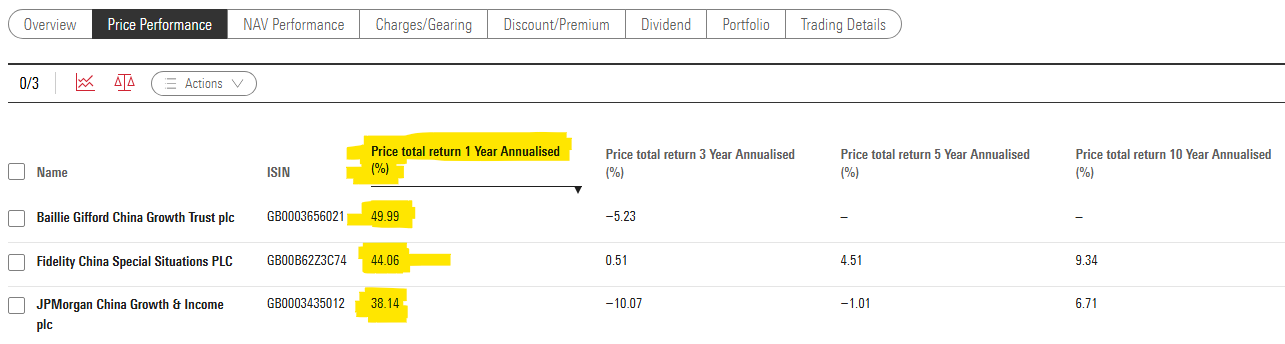

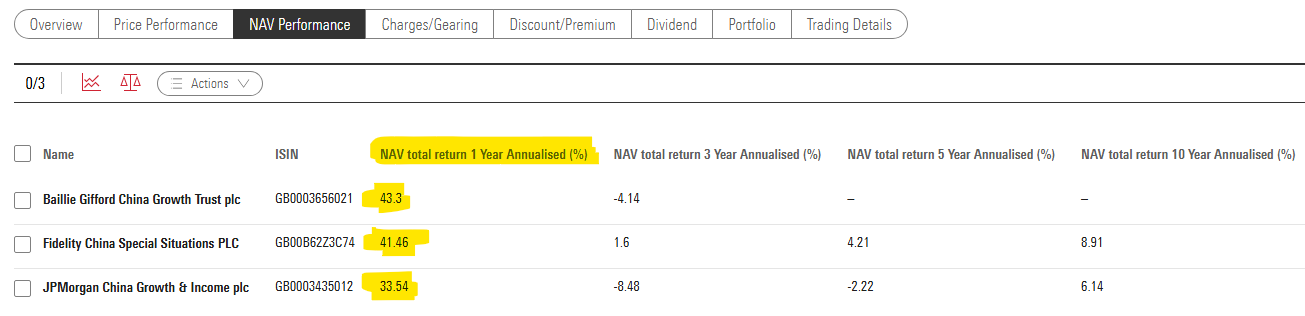

After an extended period of U.S. stock market dominance, we may be seeing some early signs of capital being rotated elsewhere - whether into European equities, Japanese stocks, or, more controversially, Chinese markets.

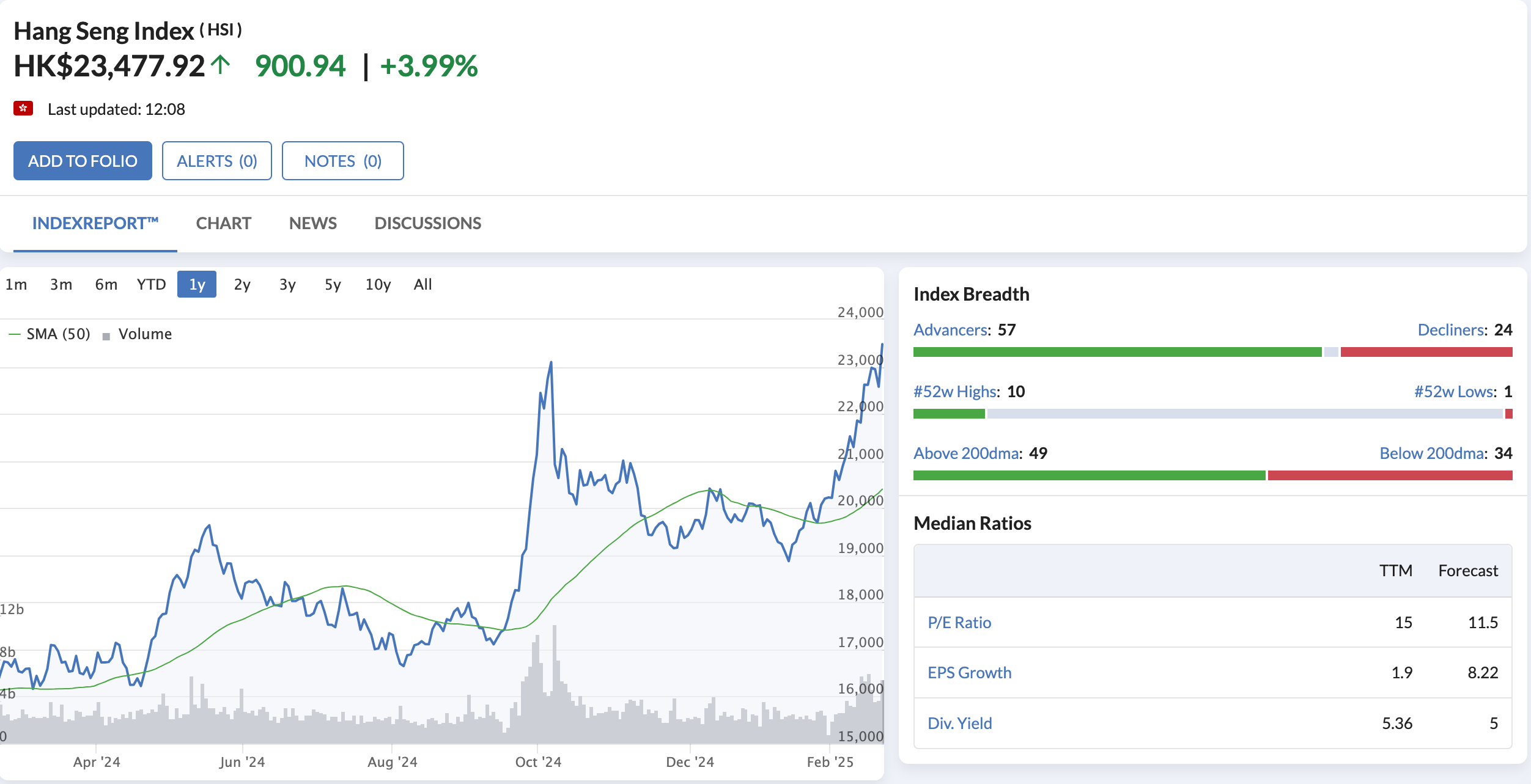

China’s stock market has been on a tear after a tough few years. The Hang Seng is up nearly 20% year-to-date, with heavyweights like Alibaba Holding (NYQ:BABA), PDD Holdings (NSQ:PDD), and BYD Co (PNK:BYDDY) leading the charge. Alibaba has been at the forefront of China’s stock market resurgence, surging 70% year to date and outpacing many of its peers.

Temu owner, Pinduoduo, has also leveraged its cost-conscious appeal to expand market share and BYD continues to dominate the EV space. Even Baidu (NSQ:BIDU), often overshadowed in the AI race, has gained renewed attention.

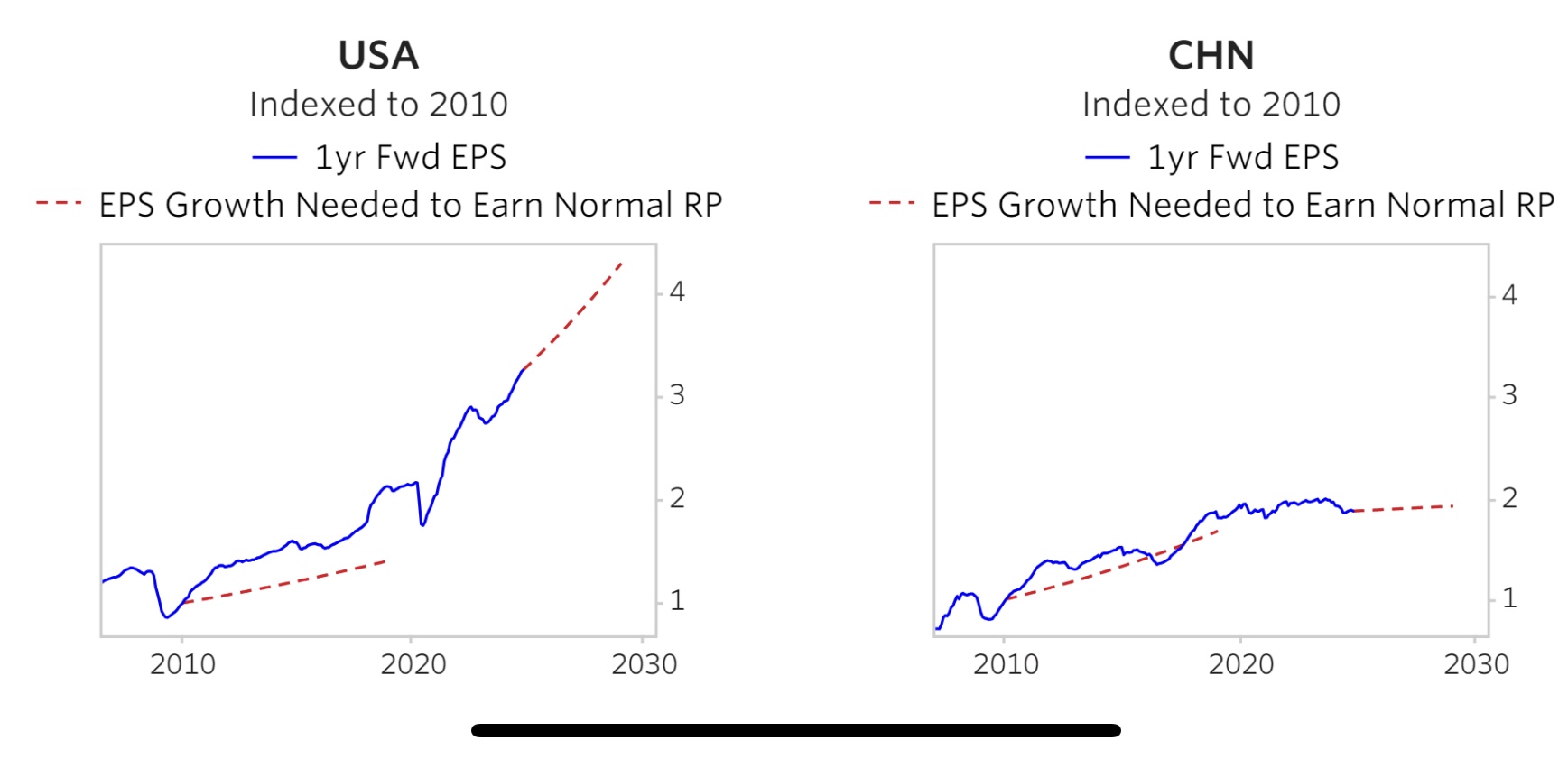

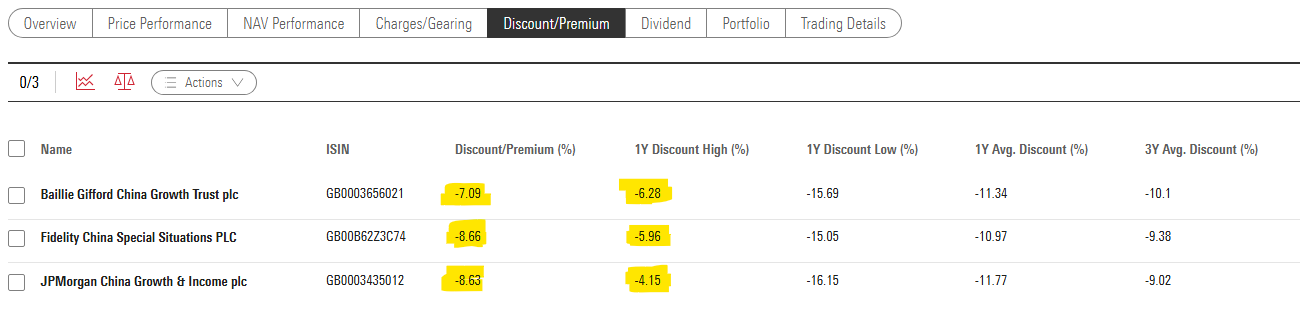

For the brave, China offers undeniable value. The region remains very cheap relative to its long-term potential (forecast P/E of 11.5 for the Hang Seng), but structural risks persist.

Geopolitical tensions, unpredictable regulation, and ongoing (deflationary) economic challenges mean investors must tread carefully. I’ve personally dabbled in Alibaba shares over the years, seeing potential in its entrenched e-commerce dominance and cloud computing ambitions. But even here, plenty of patience is required—regulatory uncertainty and a perceived lack of visibility…