Welcome to this week's edition of The Week Ahead. There’s probably only going to be one piece of news that really grabs UK investors’ attention next week – Wednesday’s Autumn Budget.

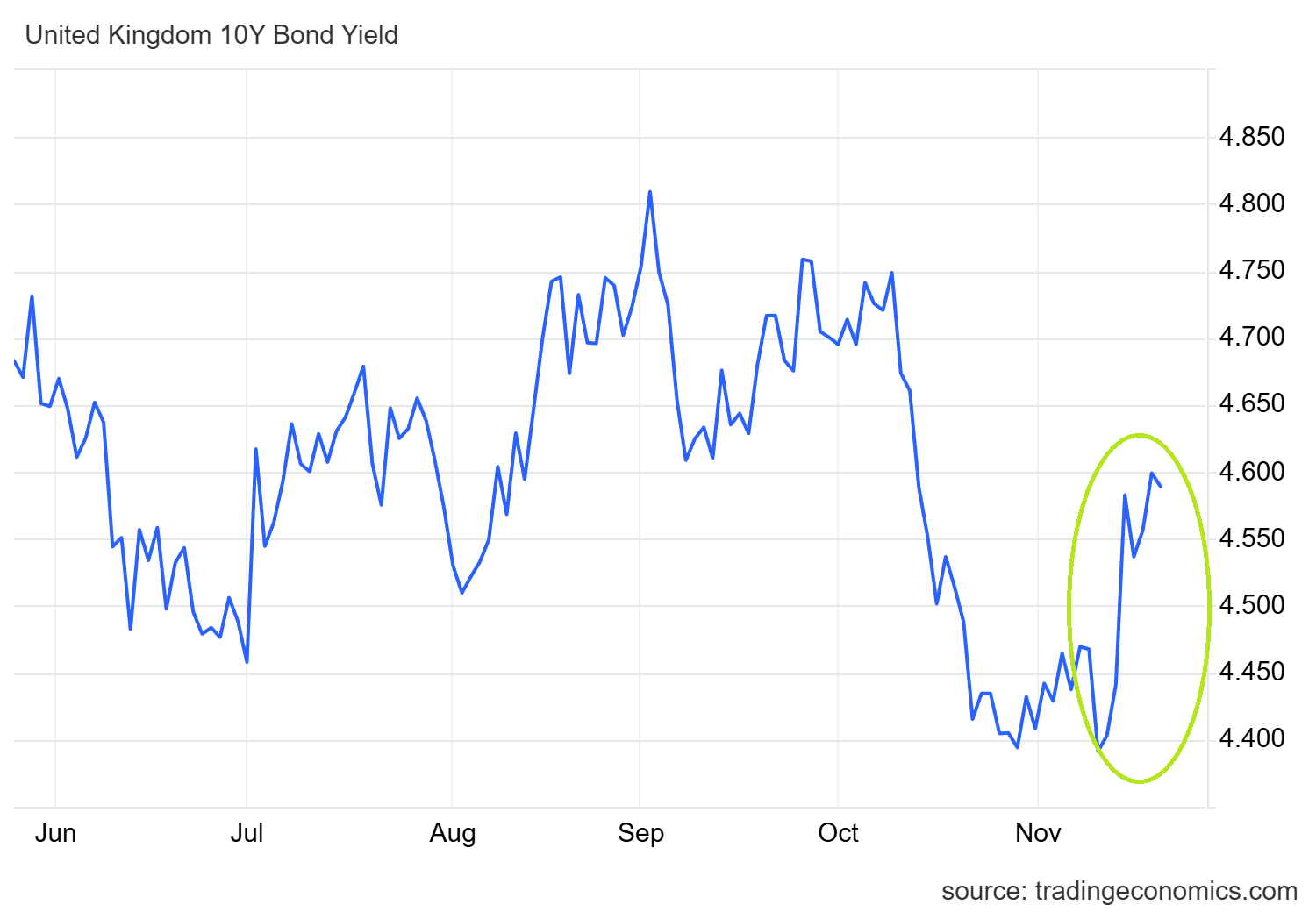

The bond market shuddered at the end of last week when it became clear that plans to raise income tax had been shelved. Bond yields have stabilised this week, but Friday’s news that public sector borrowing overshot forecasts again in October is a painful reminder of the challenges the Chancellor is facing:

We’ll have to wait until Wednesday to see what measures will replace the revenue that might have been generated by an income tax rise. One possible measure that could prove effective against a backdrop of wage inflation is a further freeze in personal tax thresholds.

The difficulty for a government that needs to raise money is that any effective change is likely to be unpopular with someone. So perhaps our best hope is that changes will be effective, even if they are unpopular.

Judging from fellow investors with whom I chatted at Mello this week, expectations are low. Whether it’s ISAs, pensions, dividends, inheritance tax or a new mansion tax, many seemed to be expecting a personal hit from the Budget.

Perhaps fortunately – given how many companies are blaming Budget uncertainty for their indifferent performance – we don’t have long to wait now.

Nvidia knocks it out of the park again

One uncertainty that was resolved – at least temporarily – this week was over whether NVIDIA (NSQ:NVDA) Q3 earnings would disappoint the market.

In the event, the AI chip giant unveiled some crushingly strong quarterly figures.

Nvidia’s third-quarter revenue of $57bn was 62% higher than one year ago and 22% higher than in Q2. Net income for the period rose by 65% year-on-year to $31.9bn, giving a staggering 56% post-tax profit margin.

However, debate continues to rage over whether current AI spending represents a bubble. Unsurprisingly, Nvidia CEO Jensen Huang doesn’t think so, instead pointing to a “virtuous cycle” in his comments this week:

Compute demand keeps accelerating and compounding across training and inference — each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups,…