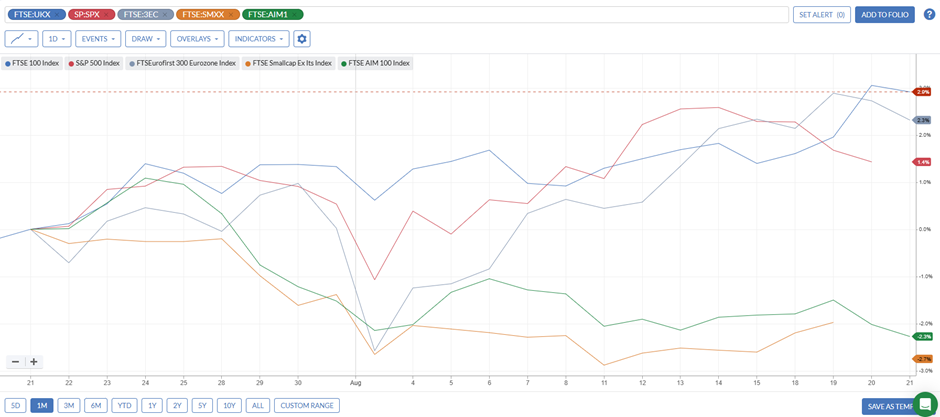

It is likely to be another quiet week for results, given the Summer holidays in the Northern Hemisphere and the UK Bank Holiday on Monday. The Summer malaise doesn't seem to have impacted broader indices, with the FTSE, S&P and Eurozone indices all gently rising over the last month. However, small caps and AIM stocks have wilted in the heat:

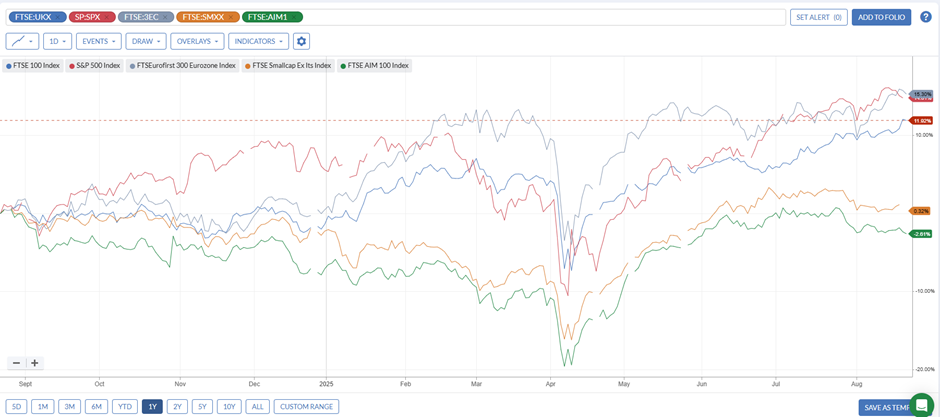

With large caps again dominating returns over the last year, investors must be wondering when, if ever, this trend will reverse:

Here's what we can look forward to next week:

Economic Calendar

Monday 25th Aug |

||

Tuesday 26th Aug |

||

13:30 |

United States |

Durable Goods Orders |

14:00 |

United States |

House Price Index |

15:00 |

United States |

Consumer Confidence New Home Sales |

Wedensday 27th Aug |

||

07:00 |

Germany |

Consumer Confidence |

15:30 |

United States |

Crude Oil Stocks |

Thursday 28th Aug |

||

09:00 |

Euro Area |

M3 Money Supply |

10:00 |

Euro Area |

Consumer Confidence Economic Confidence |

13:30 |

United States |

Initial Jobless Claims |

Friday 29th Aug |

||

07:00 |

UK |

Nationwide HPI |

07:00 |

Germany |

Import Price Index Retail Sales |

13:30 |

United States |

Balance of Trade Personal Spending Personal Income |

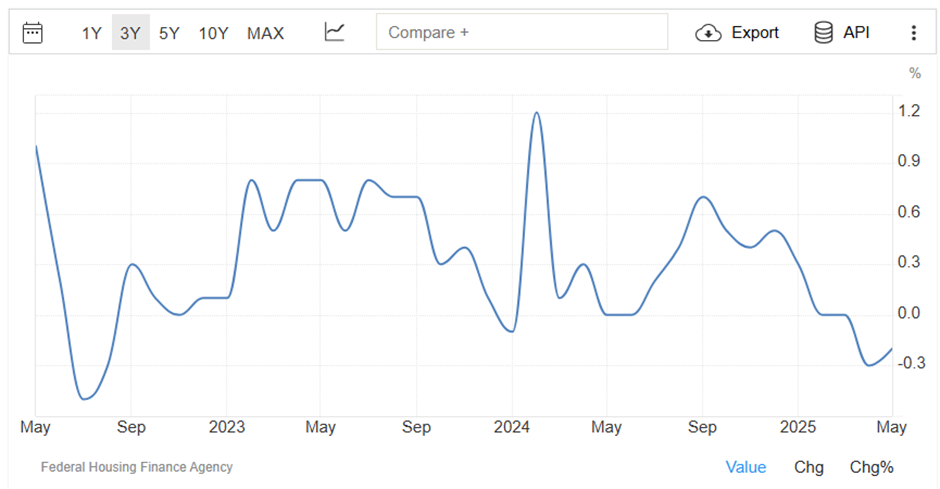

This week's economic news will be dominated by house price data. The US appears to be reacting to tariff uncertainty and rising long-term interest rates, dipping into negative year-on-year in April and May:

[Graph: Trading Economics]

This may be a bellwether for general consumer confidence, and a further negative print on Tuesday could indicate further economic pain to come.

Closer to home, Nationwide reports its latest index figures on Friday. June figures came in at 2.1% annualised, versus a 3.3% consensus, suggesting that things are getting worse:

[Graph: Trading Economics]

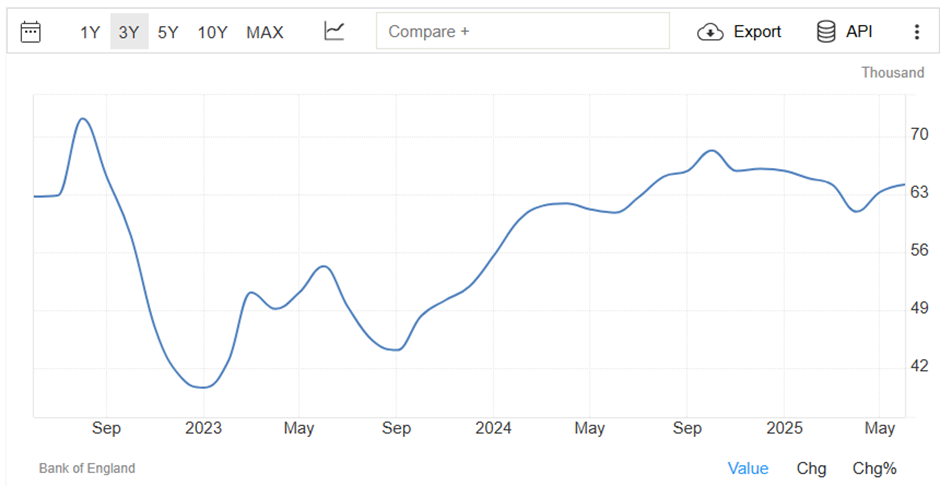

Forward indicators are mixed. BOE mortgage approvals appear to have stabilised:

[Graph: Trading Economics]

Whereas RICS survey data indicates further pain ahead:

[Graph: Trading Economics]

Whatever the figures are,…