Markets

It has been a hectic news week, with many companies releasing end-of-year or Christmas trading updates. Given the worrying economic backdrop, it is surprising the number of companies that are beating expectations. In many cases, I can’t help feeling that companies may have guided conservatively in order to beat. The lack of market reaction to many “ahead” statements backs up this assertion.

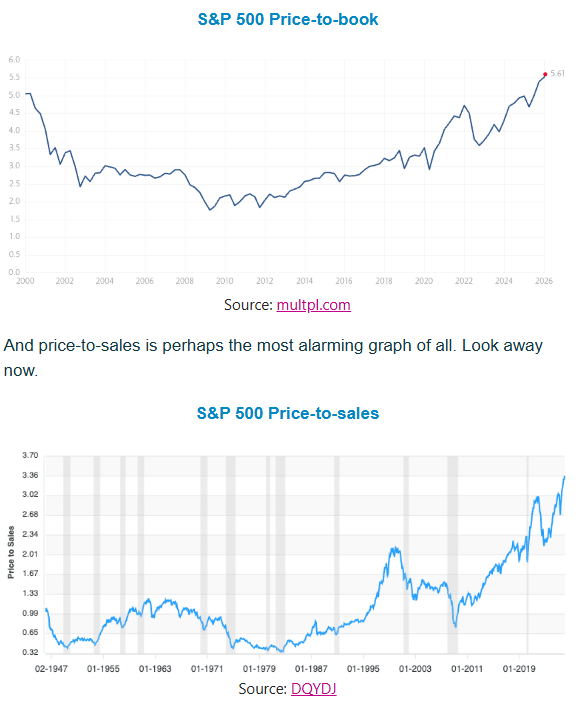

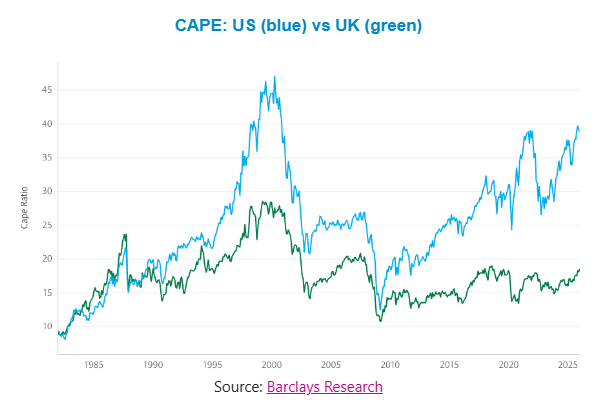

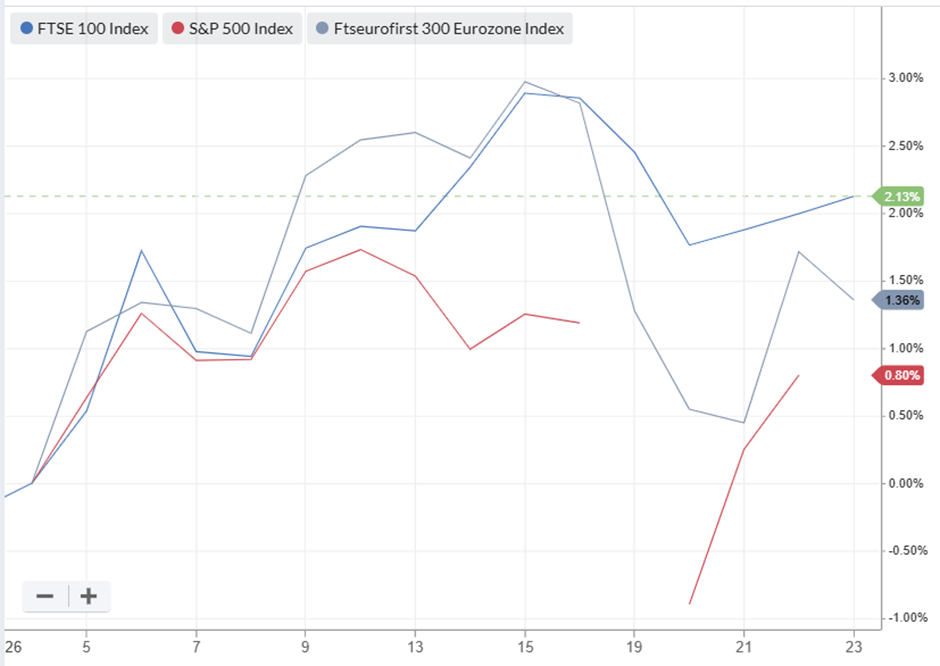

Given all the political noise, it has been surprising how well the major indices have held up so far this year:

However, that uncertainty has certainly helped gold to continue to shine:

I’m no great chartist, but it feels like it will take quite some push for the gold price to clear $5k/oz. However, I certainly wouldn’t bet against the barbarous relic, at least in the short term.

Here's what we can look forward to next week:

Economic Calendar

Monday 26 Jan |

||

13:30 |

United States |

Durable Goods Orders |

Tuesday 27 Jan |

||

14:00 |

United States |

Case-Shiller Home Prices |

23:50 |

Japan |

BoJ MPC Meeting Minutes |

Wednesday 28 Jan |

||

07:00 |

Germany |

Consumer Confidence |

19:00 |

United States |

Fed Interest Rate Decision |

Thursday 29 Jan |

||

05:00 |

Japan |

Consumer Confidence |

13:30 |

United States |

Balance of Trade Initial Jobless Claims |

Friday 30 Jan |

||

07:00 |

UK |

Nationwide HPI |

09:00 |

Germany |

GDP Growth |

09:30 |

UK |

Mortgage Lending Mortgage Approvals BoE Consumer Credit |

US Interest Rates

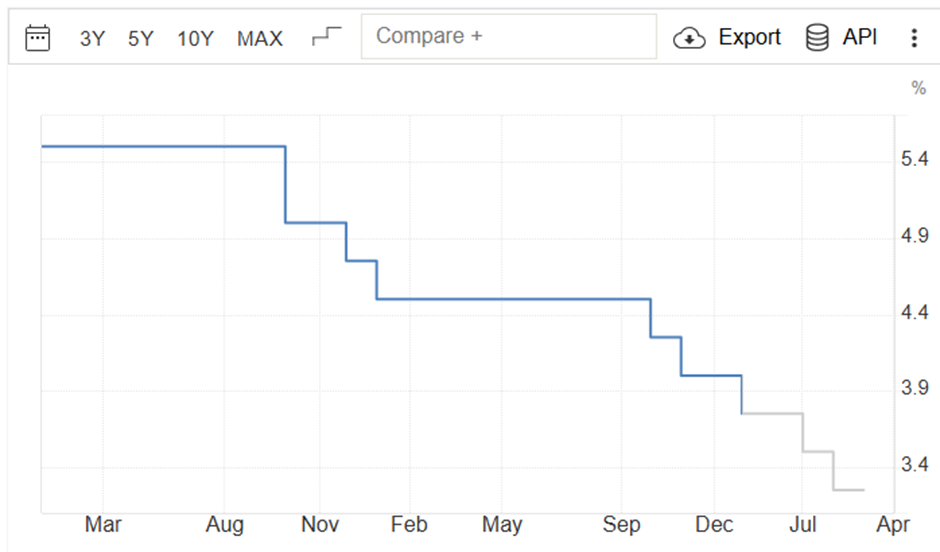

The US Federal Funds Rate is forecast to be held at 3.75% on Wednesday. This should be a pause before continuing its downward trajectory later in the year:

[All charts in this section: Trading Economics]

There is considerable political uncertainty surrounding the Fed, with Trump being highly critical of Jerome Powell. His administration even appears to have instigated a criminal investigation against Powell in order to try to force him to lower interest rates. This seems to have exasperated a normally calm and restrained public servant who isn’t budging on rates. Powell’s term is up in…