Most of the major indices have been flat this week, with UK Large & Midcaps being a bright spot as the FTSE100 & FTSE250 rose 2%:

UK Small and Midcaps remain the global laggards year-to-date, suggesting that renewed confidence in UK large caps has yet to trickle down to smaller companies.

It’s been a volatile couple of weeks for gold. Last week, I noted that it had risen strongly, making all-time highs. By mid-week this week, it had given back last week’s gains on dollar strength, testing the psychologically important $4,000/oz level. It ends the week somewhere in the middle and is likely to remain there unless it definitively breaks $4,400/oz on the upside or that $4,000/oz resistance on the downside:

Here's what we can look forward to next week:

Economic Calendar

Monday 27 Oct |

||

08:00 |

Germany |

Business Climate |

12:30 |

United States |

Durable Goods Orders |

Tuesday 28 Oct |

||

07:00 |

Germany |

Consumer Confidence |

Wednesday 29 Oct |

||

05:00 |

Japan |

Consumer Confidence |

09:30 |

UK |

BoE Consumer Credit Mortgage Approvals Mortgage Lending |

18:00 |

United States |

Fed Interest Rate Decision |

Thursday 30 Oct |

||

05:00 |

Japan |

BoJ Interest Rate Decision |

10:00 |

Euro Area |

GDP Growth |

12:30 |

United States |

GDP Growth |

13:15 |

Euro Area |

ECB Interest Rate Decision |

Friday 31 Oct |

||

07:00 |

UK |

Nationwide HPI |

10:00 |

Euro Area |

Inflation (CPI) |

08:30 |

Germany |

Manufacturing PMI |

12:30 |

United States |

Personal Spending |

15:00 |

United States |

New Home Sales |

Interest Rates

Next week, we have three key interest rate decisions: the US, the Euro Area, and Japan.

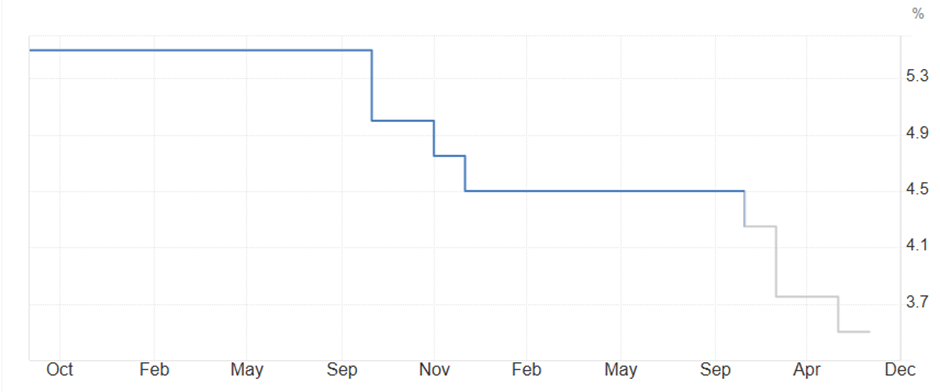

In the US, market expectations are for a further 25bps cut to 4.0% in October, despite the September inflation print showing mixed signals. The key factor appears to be evidence of labour market weakness:

[All charts in this section: Trading Economics]

In the Euro Area, the market expects no change to the current 2.15% until September next year, so this is unlikely to be a surprise.…