It was a volatile week in the US, with tech stocks selling off on Monday in response to claims that a Chinese company had developed AI algorithms that needed far less computing power. The rest of the week saw partial recovery. Although it meant that the FTSE100 had a rare week in the sun, outperforming the S&P500.

Here’s what we can look forward to next week:

Economic Calendar

Monday 3rd |

||

01:45 09:00 09:30 15:00 |

China Euro Area UK United States |

Manufacturing PMI |

10:00 |

Euro Area |

Inflation |

Tuesday 4th |

||

15:00 |

United States |

Job Openings |

Wednesday 5th |

||

00:30 09:00 09:30 15:00 |

Japan Euro Area UK United States |

Services PMI |

Thursday 6th |

||

12:00 |

UK |

BOE Interest Rate Decision MPC Meeting Minutes |

Friday 7th |

||

07:00 |

UK |

Halifax House Price Index |

13:30 |

United States |

Unemployment Rate Non-Farm Payrolls |

15:00 |

United States |

Consumer Sentiment |

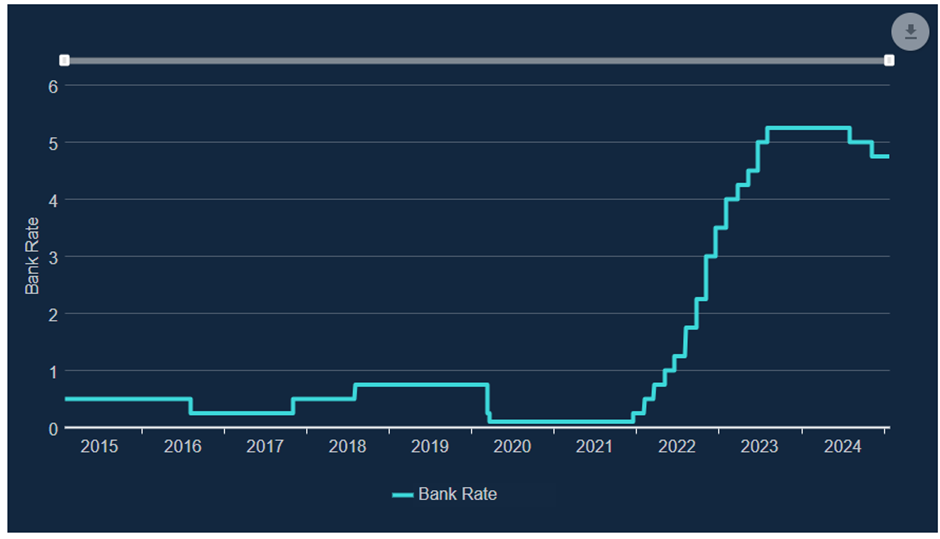

The key news next week will be UK interest rates. Since the base Rate peaked at 5.25% in August 2023, there have been two 25bps cuts in August and November 2024:

The Bank of England is forecast to make a further 25bps next week.

Companies Reporting

UK Trading Updates |

UK Financial Results |

US Financial Results |

|

Monday 4 Feb |

Entain Vodafone |

Palantir |

|

Tuesday 4 Feb |

DCC Future (AGM) SSE |

Crest Nicholson (Finals) Diageo (Interims) NWF (Interims) |

Alphabet Merck PepsiCo AMD Pfizer Paypal Mondelez |

Wednesday 5 Feb |

Grainger (AGM) | GSK (Q4 Results) Made Tech (Interims) Pressure Technologies (Finals) |

Disney Qualcomm Boston Scientific Uber Ford |

Thursday 6 Feb |

Compass Syncoma |

AstraZeneca (Finals) |

Amazon Phillip Morris S&P Global Honeywell KKR ConocoPhillips Motorola |

Friday 7 Feb |

Victrex (AGM) | Ashmore (Interims) |

Big Pharma

Big Pharma will be in focus next week as we have AstraZeneca (LON:AZN) Finals and GSK (LON:GSK) Q4 Results being reported. Both companies have underperformed the FTSE100 over the last year:

With GSK underperforming by almost 20%. Broker downgrades, particularly to FY25, seem to be the…