The FTSE is still clinging to a slender lead against the S&P 500 year-to-date. However, both indices continue to lag the Eurozone index:

Perhaps more notably, a strong week for the S&P means that this is hitting all-time highs:

This is surprising, given the backdrop that includes a potential US war with Iran. The other thing that makes this strength surprising is that the "90-day pause" on Trump's tariffs expires on 9 July. The market is betting on TACO – Trump Always Chickens Out. This may be true. However, there is potential for a significant amount of market-moving noise before he inevitably caves. Despite these risks, the VIX trades at the bottom of its recent range (although higher than the first few months of 2025).

This could mean that those looking to protect their portfolio by using put options may be getting a good price.

Here's what we can look forward to next week:

Economic Calendar

Monday 30th Jun |

||

09:30 |

UK |

BOE Mortgage Approvals Nationwide HPI |

15:00 |

Germany |

CPI Inflation |

Tuesday 1st Jul |

||

10:00 |

Euro Area |

Inflation Rate |

15:00 |

United States |

Job Openings |

Wednesday 2nd Jul |

||

10:00 |

Euro Area |

Unemployment Rate |

15:30 |

United States |

Crude Oil stocks |

Thursday 3rd Jul |

||

13:30 |

United States |

Non-Farm Payrolls Unemployment Rate |

Friday 4th Jul |

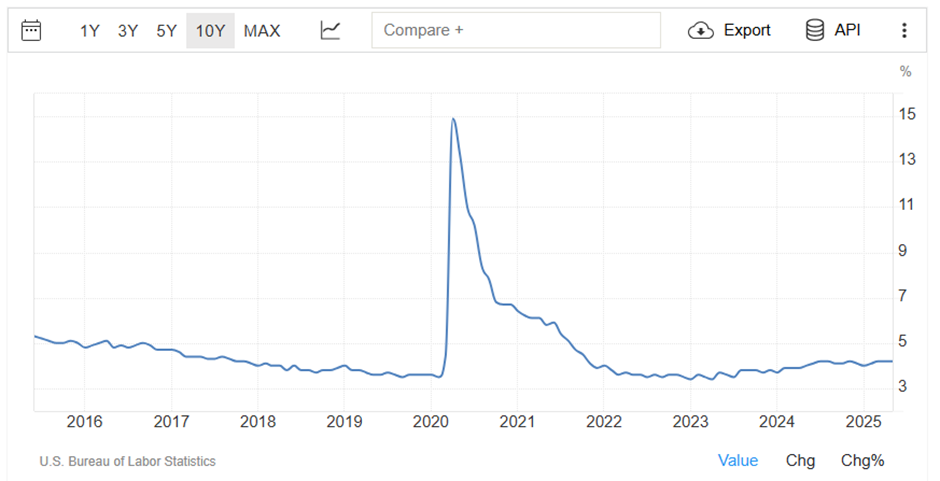

This week's economic news will be dominated by employment data, with both the Eurozone and the United States releasing their unemployment rate. There have been no surprises in 2025 with the rate hovering around the current 4.2%. This has been both consistent and in line with consensus estimates. Economists predict it will remain around the same levels, which indicates an economy neither in distress nor particularly hot, compared to long-term norms:

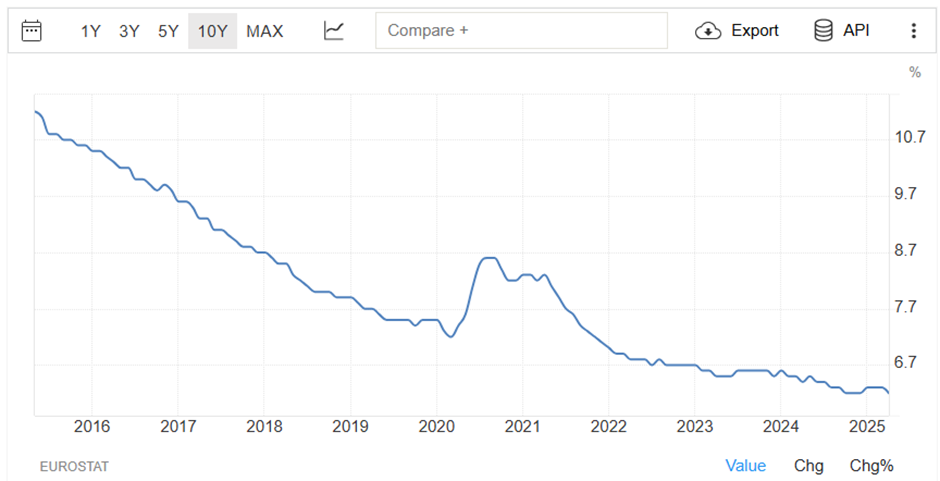

[Graphs in this section from Trading Economics]

While the Euro area still has a higher rate of unemployment, this has been in a longer-term structural decline:

Investors will appreciate the stronger consumer demand this brings, and the rate…