For the last few weeks, two of Stockopedia’s tech gurus have been building a dashboard to help us generate more and better market insights. It’s a brilliant system which we’re hoping to use to improve both the quality and the depth of our companies and markets analysis.

The plan is to keep building and adding new screens and insights to the system, but to start with, we’ve put together a screen to identify companies reporting financial results in the coming week. The dashboard also shows us the consensus analyst expectations and the companies’ track record for meeting expectations. There are still some creases to be ironed out, but here is a preview of the screen results for the rest of the week.

| Company | Event | Date | Last normalised EPS | EPS Forecast | 6m price change |

| James Halstead | Annual results | 01/10/2024 | 10.2p | 9.9p | -12% |

| JD Sports Fashion | Interim results | 02/10/2024 | 12.1p | 12.9p | 15% |

| Pinewood Technologies | Interim results | 02/10/2024 | 11.9p | 10.1p | -53% |

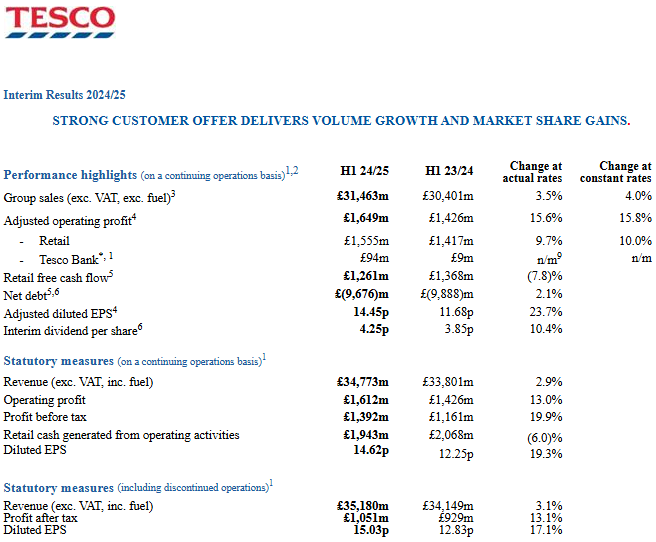

| Tesco | Interim results | 03/10/2024 | 24.8p | 25.8p | 22% |

| Galliford Try Holdings | Annual results | 03/10/2024 | 18.6p | 22.8p | 26% |

| J D Wetherspoon | Annual results | 04/10/2024 | 102p | 43.1p | 1.1% |

Allergy Therapeutics - still waiting on the numbers

Allergy Therapeutics (LON:AGY) was one of the first companies that I covered when I became a financial journalist. On paper, it’s not a terrible small cap pharma company. Although it has never been shy of investing in innovative new drugs, it had a suite of already approved medicines which actually make money. In fact for a brief period between 2019 and 2021, the company was profitable.

For anyone with the fortitude to invest in the small cap pharma space, it’s important to look for companies with an ability to fill their coffers without simply leaning on their investors (or, worse, their debtors - because no bank is going to offer generous rates to a loss making pharma company). Allergy Therapeutics’ medicines for (you guessed it) allergies have kept the company alive despite multiple disappointing drugs trials.

At the time of writing, the company is one of our top ranked Momentum stocks. It’s had a good year, despite the woes of Aim - the market on which it is listed - and the share price is up 144% in the year to date.

But that is only small comfort to anyone who has held Allergy Therapeutics for longer than a year. The shares were suspended for six months at the start of 2023 after the company failed to put together its annual results.

Investors who have enjoyed the momentum of the last 12 months should be concerned that the latest set of numbers (which were…

.JPG)