Hello and welcome to this week’s edition of the Week Ahead!

This will mostly be an interest rate edition, taking a quick look at recent central bank decisions and then looking ahead to the decision that’s coming up next week for the UK.

Federal Reserve: the US is in the throes of political strife over a government shutdown, but I’ll put that to one side and focus on what the Fed had to say about its last interest rate cut. Note however that the shutdown means that some official US economic data is not currently being published.

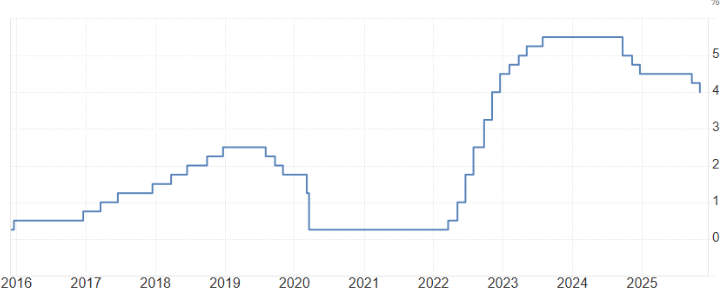

Here’s a 10-year chart of the Fed Funds rate. The latest cut takes it to 3.75% - 4.0%:

Source: tradingeconomics.com

The latest FOMC statement opens as follows:

Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated.

The Fed has the so-called dual mandate - it’s explicitly tasked with both maximum employment and price stability (rather than just price stability).

This means that even if inflation is higher than its 2% long-run target, it can still, without embarrassment, keep rates low in order to boost economic activity.

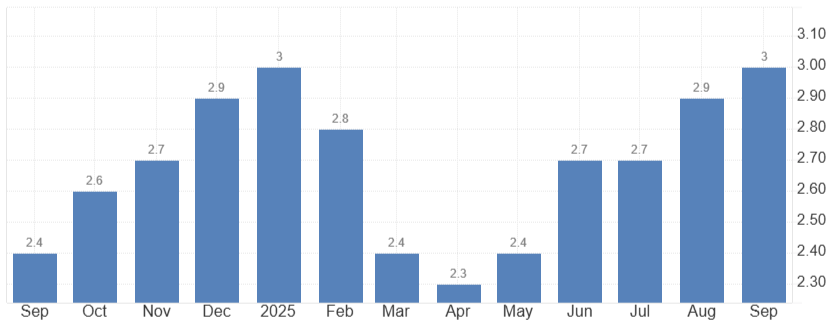

And inflation has been rising recently:

Source: tradingeconomics.com

Rising inflation should be a reason to hike rates, but the Fed is clearly not convinced that this is what the US economy needs at this time.

Which is strange, because the language used by the Fed in relation to the economy is actually more positive now than it was in the previous statement. This statement says that economic activity is “expanding at a moderate pace”, whereas the previous statement said that activity was moderating.

But they remain fundamentally cautious:

Uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment rose in recent months.

The US unemployment rate is 4.3% and while this is still a little higher than it’s been over the past year, I would have always considered this…

.JPG)