A ‘strange serenity’ is how I have heard markets in the US described this week - which has concluded with a step up in Donald Trump’s global tariff regime. ‘Punch drunk’ is another description, which seems apt considering it has been four months since ‘liberation day’ - a period of time when the word ’tariff’ has never been far from the business headlines.

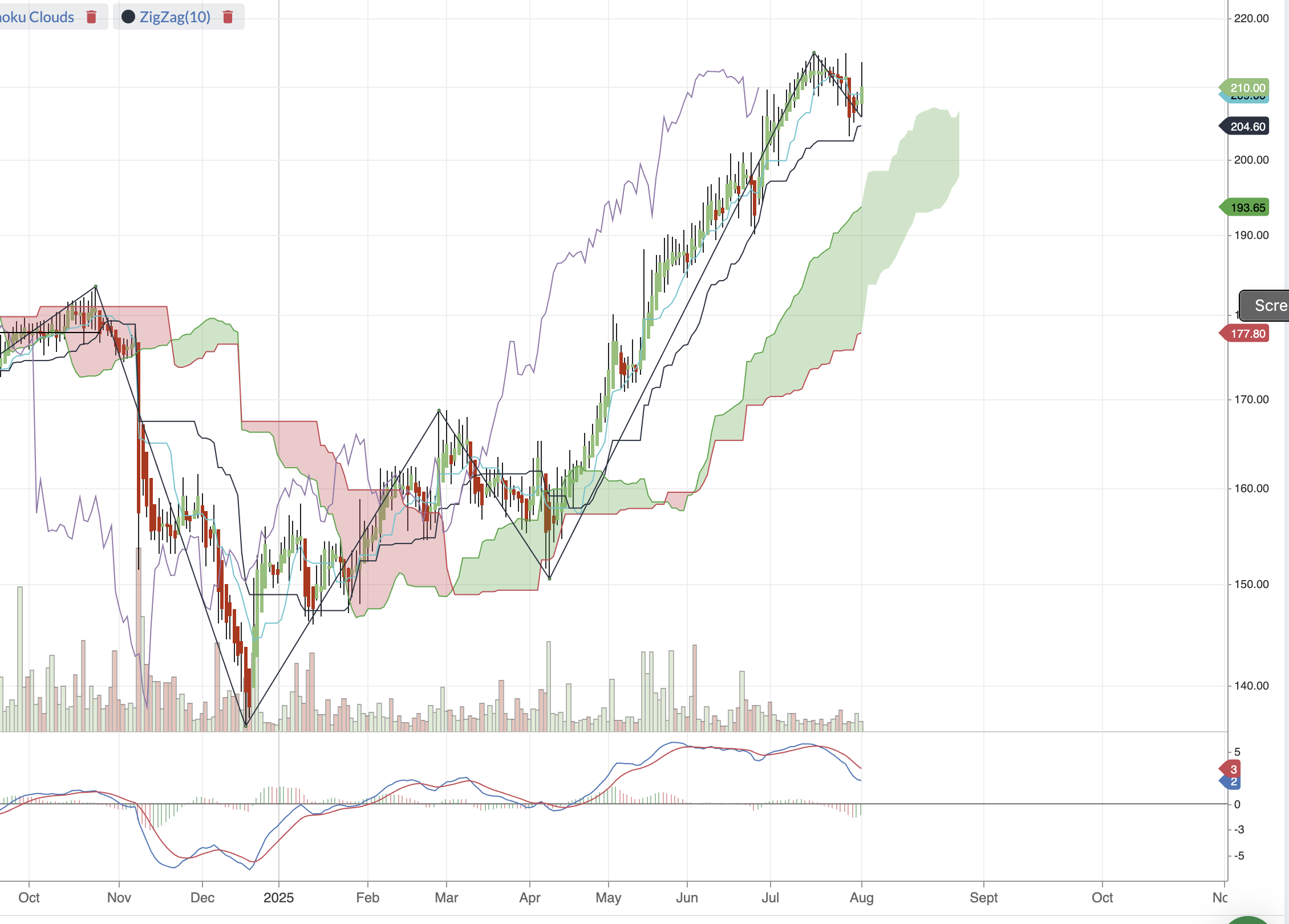

The S&P 500 is down marginally in the last five days, but it hasn’t really faltered compared to the movement that week in April when the president first launched his tariff hand grenade. In fact, the index is up more than 27% from those April lows and is, once again, close to all time highs.

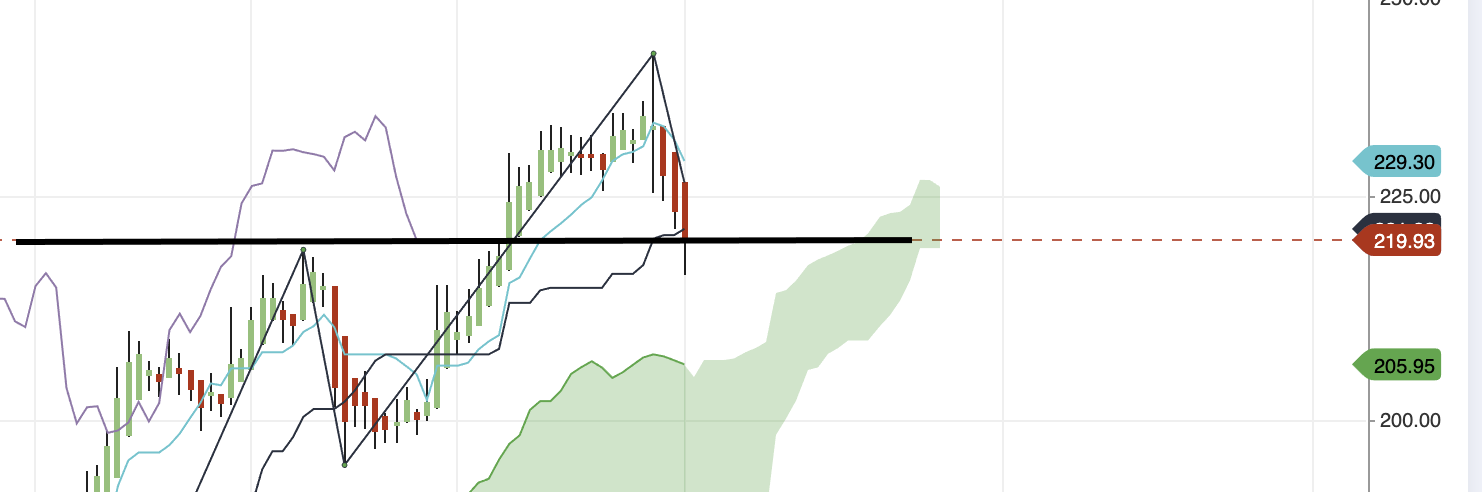

As of this week, we now have two companies with a market capitalisation of over $4trn. NVIDIA (NSQ:NVDA) and Microsoft (NSQ:MSFT) now account for almost 15% of the total market. Throw Apple (NSQ:AAPL) into the list and the three largest companies in the S&P 500 now make up more than a fifth of the total index. That’s not a particularly healthy state of affairs.

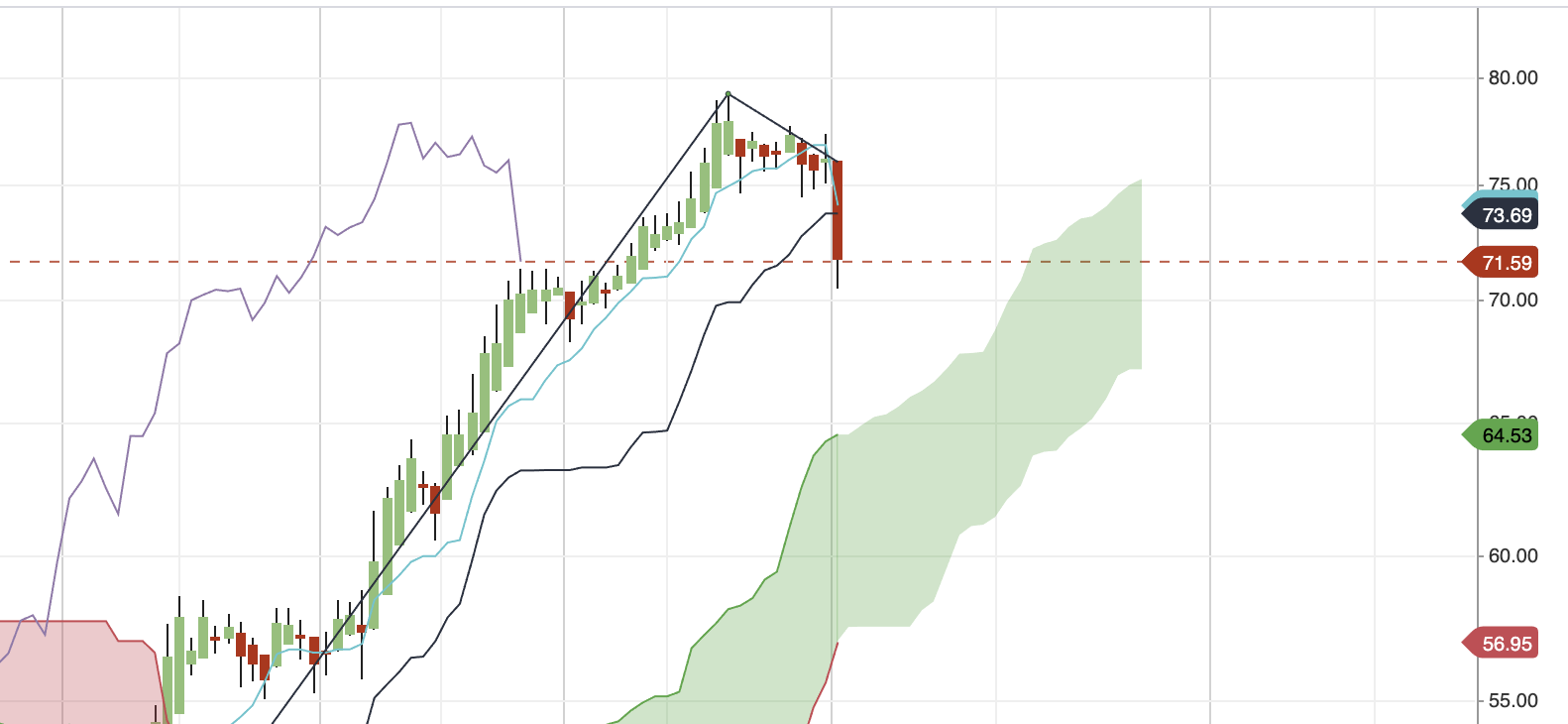

But then it’s hard to argue with the fact that numbers from the US tech giants to have announced results this week have been spectacular. In the three months to June, Microsoft sales were 18% higher at $76.4bn, with operating income rising even faster. Apple revenues rose 10% to a whopping $94bn in the third quarter, with particularly impressive growth coming from the iPhone - which turned 18 at the end of June.

For Apple investors the tariff threat hangs heavier than it does with some of its peers. Despite expectation-beating numbers, investor response was somewhat muted during after-hours trading on Thursday. Amazon shares also faltered in response to a weaker than expected outlook, which is largely tariff-based.

The strange upside to Trump’s mind boggling policies is that it has forced markets (and market watchers) to be far more idiosyncratic. Companies are being analysed for their individual merits far more so than they have been in recent times. That should be a welcome relief for private investors, for whom the seemingly never-ending growth of tracker funds has become hard to compete with.

Closer to home, the FTSE has been similarly nonchalant about wild US policies. The FTSE 100, where the largest and most internationally diverse businesses live,…