Hello and welcome to this week’s edition of the Week Ahead.

US markets have been closed today (Friday), but I can see on the spread betting platforms that the Dow Jones is changing hands at around 44,600, while the S & P is around 6,240, each down c. 0.5% today.

This is after the passage through the House of Representatives of the hotly-contested One Big Beautiful Bill Act (its official title!)

The consequences of this bill are heavy for domestic US politics and for US industry, for example including a range of tax cuts and major new commitments to defence spending, while clean energy tax credits are phased out.

But the consequences of the bill outside of the US - such as the UK - may well turn out to be insignificant.

For example, the bill raises the debt ceiling by $5 trillion (the ceiling was previously set at $36 trillion). In theory, you might imagine that this is negative for the dollar against other currencies. But the debt ceiling has already been raised dozens of times, to the point now where it’s difficult to imagine that it will ever have a practical effect on the ability of the US government to borrow.

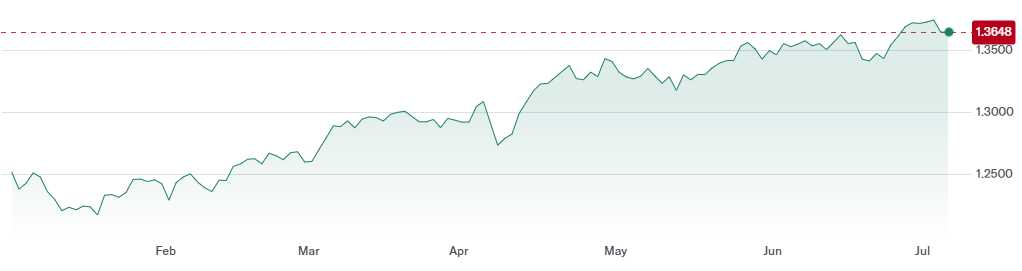

Dollar weakness has been a theme all year, since before the “OBBA” became a political football. Year-to-date, GBP/USD has increased 9% to 1.36.

GBP/USD. Source: finance.yahoo.com

Closer to home, there was some controversy around the position of the Chancellor mid-week. The 10-year gilt yield rose to 4.67%, but has since eased back below 4.6% after Sir Keir Starmer made it clear to the media that she has his “full support”. While the 10-year yield remains a little higher than it was before the controversy, it is well within the range at which it has traded year-to-date (4.4% - 4.9%).

UK 10-Year Gilt. Source: MarketWatch.com

Meanwhile, as we head into the dog days of summer, company news may become a little quieter - this is evident in the schedule below. Have a great weekend!

Economic Calendar

| Date | Time (BST) | Country | Event |

|---|---|---|---|

7 July | 07:00 AM | UK | Halifax House Price Index |

7 July | 10:00 AM | EU | Retail Sales |

7 July | 08:00 PM | US | Consumer Credit (US) |

8 July | 01:00 AM | UK | Retail Sales |

9 July | 12:00 PM |