A rather boring week for index investors. Despite some volatility during the week, the major indices are largely flat. However, the spot gold price has broken out to new all-time highs during the week, resurrecting investor interest in all things shiny:

Here's what we can look forward to next week:

Economic Calendar

Monday 8th Sep |

||

07:00 |

Germany |

Balance of Trade Industrial Production |

15:30 |

United States |

Consumer Credit |

Tuesday 9th Sep |

||

Wednesday 10th Sep |

||

02:30 |

China |

Inflation Rate |

12:00 13:30 15:00 15:30 |

United States |

MBA Mortgage Applications Producer Price Index Wholesale Inventories Crude Oil Stocks |

Thursday 11th Sep |

||

00:01 |

UK |

RICS Housing Market Survey |

13:15 |

Euro Area |

ECB Rate Decision |

13:30 |

Germany |

Current Account |

13:30 |

United States |

Inflation CPI Initial Jobless Claims Continuing Claims |

19:00 |

United States |

Budget Statement |

Friday 12th Sep |

||

06:00 |

Germany |

CPI Inflation |

07:00 |

UK |

GDP Index of Services Industrial Production Balance of Trade Manufacturing Production |

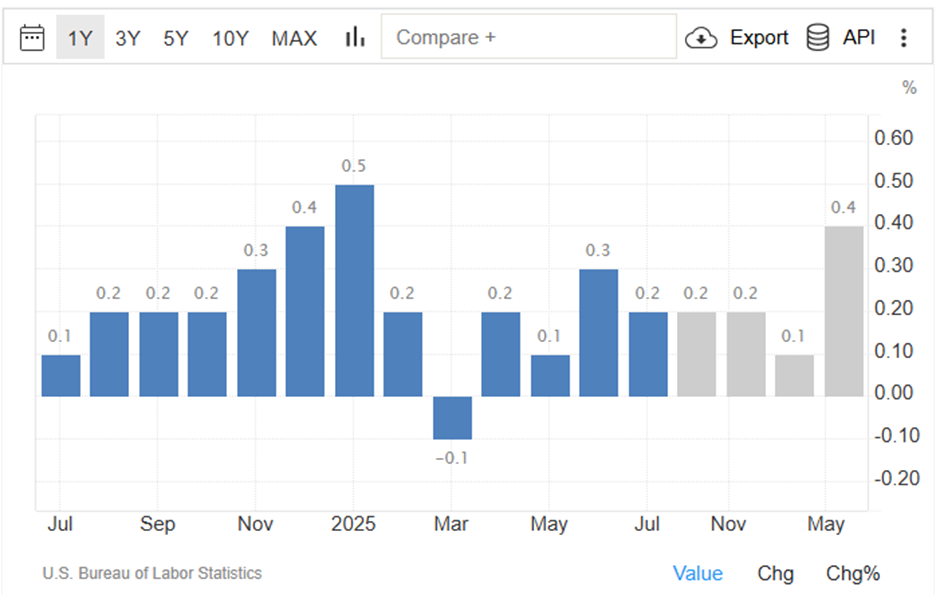

Inflation figures for China and the US will dominate this week's economic news. In the US, inflation is forecast to be flat:

[Graph: Trading economics]

However, the tariff impact is a big unknown here. If this comes in unexpectedly hot due to tariff price rises working their way through the supply chain, this may impact the ability for the Fed to cut interest rates.

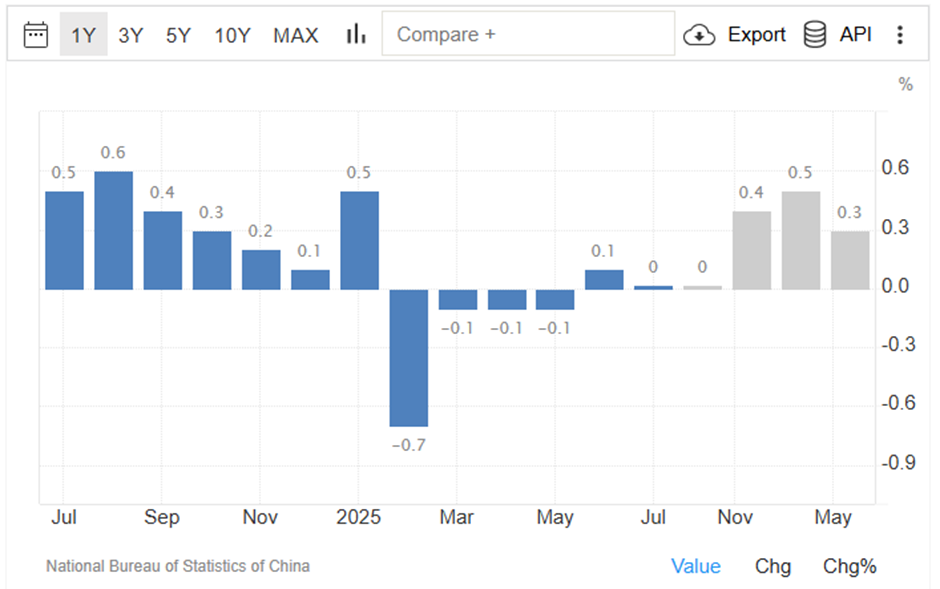

In China, we have the opposite problem. Inflation figures have been weak for much of 2025. Forecasts are for inflation to be flat, before rising to more normal levels at the end of the year:

[Graph: Trading economics]

The risk here is deflation, and again, tariffs are a worry. If these push China into a deflationary spiral, it would be detrimental to global GDP growth.

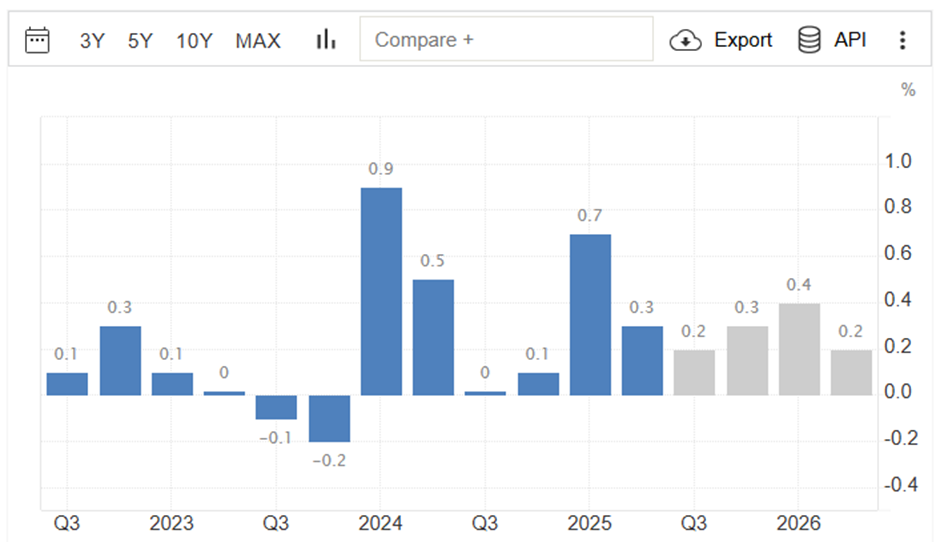

In the UK, we get GDP figures on Friday with figures for July 2025. The forecast for Q3 is relatively weak at just 0.2%, down from 0.3% in Q2:

[Graph: Trading economics]

The July figures will indicate how likely this is, given the…