Hi, and welcome to The Week Ahead, your destination for what's coming up this week in large cap and international stocks.

This week is the calm before the storm, with Q1 reporting season for most global stocks starting next week. However, we are still getting a few US companies that are managing to update us on how their 2024 has started.

Coming up this week…

Date |

Big UK earnings |

US company reporting |

EU company reporting |

Economic announcements |

Monday - 15 Apr |

Mitie (TS) |

Goldman Sachs (Q1) |

US Retail Sales |

|

Tuesday - 16 Apr |

B&M (TS) |

Bank of America (Q1) |

LVMH (Q1) |

US Housing Starts |

Wednesday - 17 Apr |

Saga (Finals) |

US Bancorp (Q1) |

UK CPI |

|

Thursday - 18 Apr |

Centamin (Q1) |

Netflix (Q1) |

Danone (Q1) |

US Jobless Initial Claims |

Friday - 19 Apr |

American Express (Q1) |

Sodexo (Q1) |

UK Retail Sales |

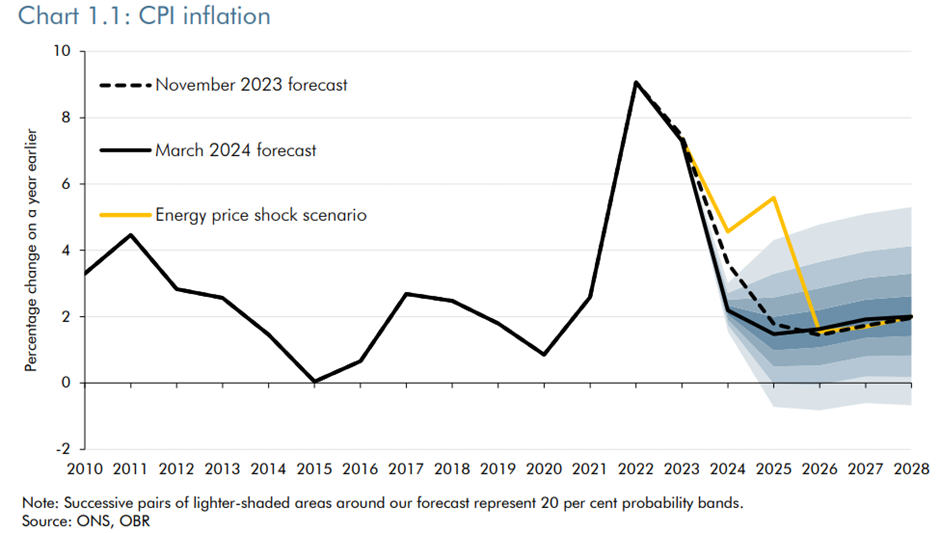

Inflation

The eyes of many UK investors will be on the UK CPI figures released on Wednesday. Last week, US CPI data came in surprisingly hot at 0.4% for March. This gives a 3.5% year-on-year rise, the biggest gain in six months. Some economists had argued that recent strength had been due to businesses raising prices at the start of the year. The rise in March puts pay to this idea, and in response, markets moved to price in the first cut in interest rates in September instead of May. Given that US equity markets had been strong recently in anticipation of a near-term cut, they reacted negatively to the news.

Here's the March UK CPI fan chart from the OBR: