As a financial journalist covering hundreds of FTSE companies’ financial results every earnings season, I listened in to a lot of investor earnings calls. The larger companies sometimes hosted a separate call for journalists, but I always liked to attend the investor briefings - juicier questions were asked.

But those questions tended to follow a similar pattern:

Host: “The first question comes from Mr X at Morgan Stanley.”

Mr X, Morgan Stanley: “Thank you for your presentation Mr CEO, I’d like a few more details about your cash flow in the coming year. What projects can you see absorbing significant capital?”

-

Host: “Thank you Mr X, we’ll now go to Mr Y at Barclays”

Mr Y, Barclays: “Thank you, I would like to address my question to Mr CFO. Do you anticipate positive operating cash outflows in the coming year?”

-

Host: Thank you Mr Y, we’ll now go to Mr Z at JP Morgan

Mr Z, JP Morgan: “I appreciate you taking the time Messrs CEO and CFO, is there any more detail you can provide us about your capital expenditure plans in the coming year and when the investment will begin to generate operating cash flows”

-

And so on. Down through HSBC, Goldman Sachs, Merrill Lynch and Credit Suisse. Big investment banks get to ask their questions first, they get the most exposure to management and consequently, they have the highest potential to gain an understanding of the way the companies they report on work.

It’s a deal which works just as well for the companies as it does for the banks. When the time comes for a company to raise money, the bankers who have had their questions answered and have gained an understanding of the company’s plans and outlook are more likely to help sponsor the fundraising.

Meanwhile, the research notes that these banks produce are a much sought-after source of knowledge, sentiment and truth in the markets. Encouraged by disclaimers and regulation, which insist that institutional research is independent, private investors can’t be blamed for believing that the analysts at the big banks know how to pick stocks best.

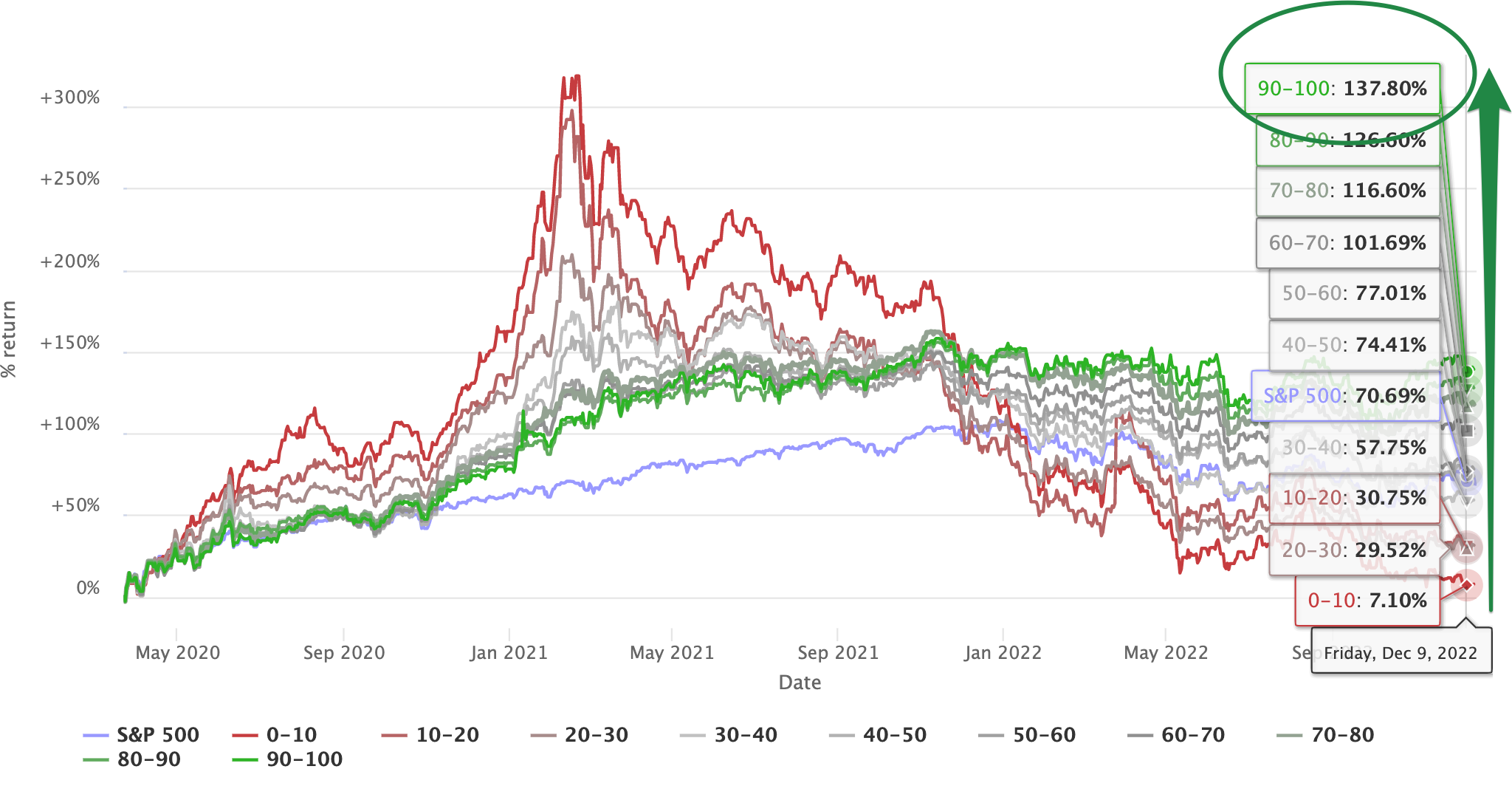

The following chart might therefore come as something of a surprise:

It shows that stocks with the highest forecast EPS growth and most ambitious price targets set by brokers have the lowest StockRanks. By contrast, Stockopedia’s highest ranked…