There have been some exciting updates from promising companies over the past few days. Judges Scientific has made an acquisition, Codemasters agreed a promising licence with the World Rally Championship, and Quartix has updated on trading.

Judges Scientific (LON:JDG)

- QM Rank: 96

- Share price: 5,560p

- Market cap: £355m

(I have an interest in this company)

Judges Scientific (LON:JDG) is an AIM-listed company specialising in the design and production of scientific instruments. It acquires top-quality businesses with established reputations in worldwide markets.

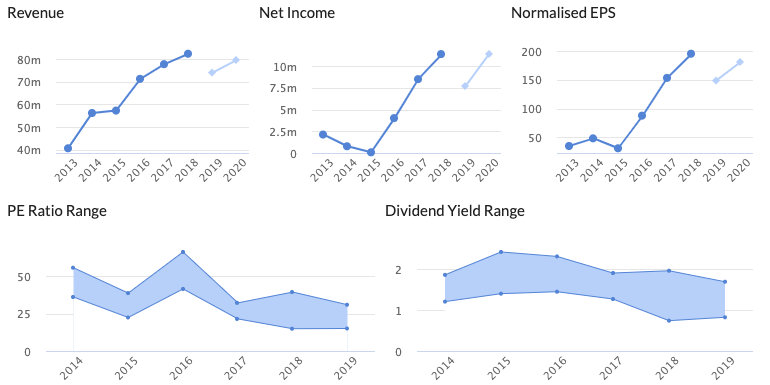

JDG is a great company. One small catch: it is always expensive, as you can see from the PE ratio range in the graphics below:

A lot depends on your view of the long term potential at Judges.

Some wonder whether there is a natural ceiling to Judges acquisition-dependent growth model. This view is justified - the group’s CEO himself has warned that deals above the £1m EBIT level become much more competitive. If Judges has to pay more for larger acquisitions, that will act as a serious drag on long term returns.

But Cicurel is a canny and experienced operator - and such operators know that if you want to impress, you should underpromise and overdeliver.

My hunch is that all this talk about running out of deals is Cicurel et al trying to manage shareholder expectations - understandable for a company whose share price typically trades at a steep premium.

If you flick through the reports, management regularly cites a large and fragmented global opportunity.

Recent trading

Since I last looked at the group, JDG has released FY19 Final Results. To recap:

- Revenues +5.9% to a record £82.5m (5.6% organic growth);

- Adjusted operating profit +18% to £17.4m;

- Adjusted basic EPS +21% to 222.5p for an adjusted FY19 PE ratio of c25x;

- Final dividend of 35p, totalling 50p for the year, an increase of 25% (this excludes the special dividend of £2 paid on 10 December 2019); this is an FY19 yield of 0.9% (4.5% including the special dividend)

- Organic order book at 13.2 weeks (1 January 2019: 14.4 weeks); total order book 13.6 weeks;

This order book has since come down a bit though. The group’s AGM Update shows organic order intake as of 15 May was down 18.5% year-on-year “caused by the closure of universities, the cancellation of scientific conferences and our inability to travel.”

Not ideal, but this kind…

.jpg)