Timeweave (LON:TMW) are an interesting company primarily, to me, for one main reason - it's cheap on an earnings basis while holding nearly 70% of its market cap in cash. Since cash is a non-productive asset, sitting there on the balance sheet and not earning anything, implicit in the two factors above is that the productive bit of the business is really productive on a returns basis. That leads neatly to the two big questions I want to ask myself of the business. Firstly: why are they holding so much cash, and are they going to do anything with it? Secondly, how is this business earning such supernormal returns? And thirdly - I know I said there was only two but this one ties them together like the proverbial bow tie - can that huge wad of cash be invested to earn anything like the return the rest of the business is? If so, the signs are good!

Timeweave (LON:TMW) are an interesting company primarily, to me, for one main reason - it's cheap on an earnings basis while holding nearly 70% of its market cap in cash. Since cash is a non-productive asset, sitting there on the balance sheet and not earning anything, implicit in the two factors above is that the productive bit of the business is really productive on a returns basis. That leads neatly to the two big questions I want to ask myself of the business. Firstly: why are they holding so much cash, and are they going to do anything with it? Secondly, how is this business earning such supernormal returns? And thirdly - I know I said there was only two but this one ties them together like the proverbial bow tie - can that huge wad of cash be invested to earn anything like the return the rest of the business is? If so, the signs are good!

If that's piqued your interest, there's good news and bad news. The good news is that there is some validation that your hunch might be correct - the bad news is that there's no real opportunity to stick your money on the line. Timeweave is in the process of being taken over in a deal which, according to the independent directors, 'fails to reflect fully the value of Timeweave, its prospects and its strengths'. Though, let's be honest; they would say that. Given it all, though, the figure does seem bizarrely low. Mayfair has paid 22p a share - £50m, basically, for a holding company which contains £33m cash. Given a post-exceptional profit of £5.2m last year, a figure of £17m for the operating business doesn't seem particularly demanding. That 'ex-cash' figure is tweaked around by how much you reckon is 'excess' and how much is part of 'working capital' - probably at least some - but the principle is the same.

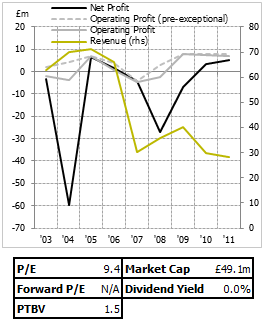

Before I get too carried away, though, it should be noted that the company doesn't exactly have a glowing history of profitability. A number of discontinued operations and write-downs swamp the profit figures for the company over the last 10 years, and the following chunk from the last annual report made for entertaining reading:

In December 2007, the Company raised £11.1m gross from shareholders via a rights…

.png)