Last week, we looked at volatility in the market and how a rising market lifts all boats in the harbour. It makes one feel like a good trader in the market rather than being a trader in a good market.

Hopefully, readers of this column have fared better due to this warning, as I wrote that we should not forget about risk management and stop losses, and that we should ensure we have exit plans for our positions. Many of my stops kicked in over the course of this week, and I’m now looking for shorts.

This week has no doubt seen many new traders become long term investors, and many investors who feared they were missing out now nursing large losses. Emotions are the trader’s greatest enemy. They deliberately play tricks on us; they lure us into temptation and seduce us into moving our stops just that little bit wider.

Having clearly defined exit plans and strategies is something I believe that can improve a trader’s P&L instantly.

Looking at last week’s mentions, all of these ran up nicely into profit – yet less than a week later all of these stocks have now given back their gains and more. Stocks require vigilance.

One way to hedge a falling market is to buy the L&G FTSE 100 Super Short Strategy Daily 2x UCITS ETF. That’s a mouthful, but luckily its EPIC code is much more palatable: £SUK2.

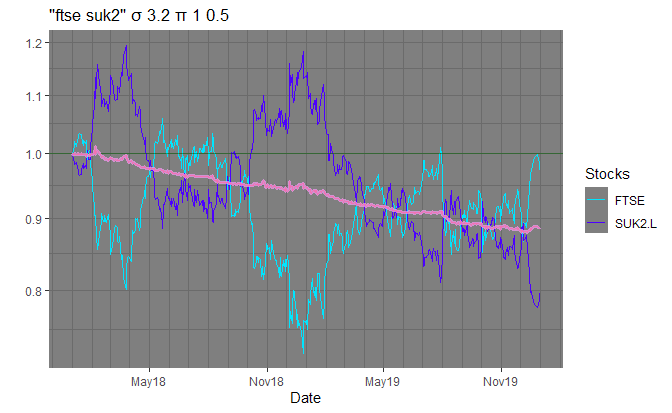

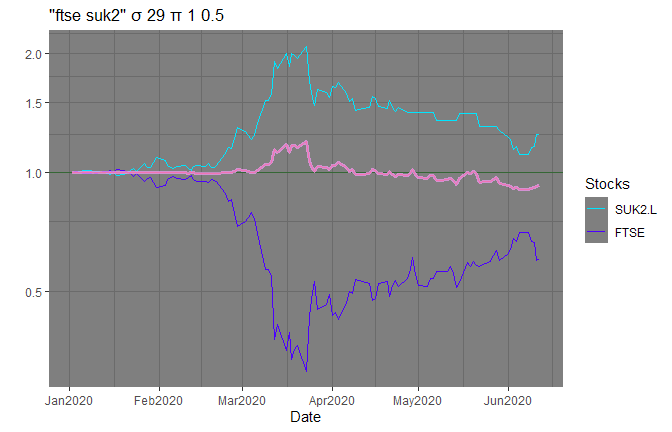

What SUK2 does is act as a levered short play on the FTSE 100. However, this is available to buy in ISAs. As the FTSE 100 itself is a derivative of the top 100 UK listed companies, SUK2 is a tradable asset, which means that the price is not necessarily correlated to the FTSE 100 but to the opinion of people buying it, which makes it a derivative of a derivative.

If you want direct exposure to the FTSE 100 then it makes sense to open a spread bet short, but if you are bearish and wish to hedge your existing holdings as an investor, you can buy SUK2 and there are no interest fees as it is a stock. The correlation is not perfect, but SUK2 does provide good returns in falling markets.

Here is a chart of SUK2. I bought on Tuesday, when I was stopped out of many positions…