Many traders will have found themselves long over the course of the last six weeks. It’s inevitable, given that stocks have been going up, and that fighting the trend is futile. And many private investors – fearful that the low prices are behind them – will have let their emotions get the best of them and decided to chase.

It says a lot that Warren Buffett and Berkshire Hathaway aren’t deploying their cash pile into equities. Aren’t they supposed to be buying when everyone is fearful, critics ask?

But the mood is not one of fear. People believe in a ‘V-shaped recovery’, and that everything is not quite as bad as it seems. Stock market bears have been the subject of derision as global equities rallied, and investor portfolios recovered.

Maybe we aren’t seeing enough fear. There are calls to start opening up the economy and reducing the lockdown (which makes sense) under the guise that everything will be going straight back to normal (which does not make sense).

However, the difference is that the Fed is willing to pump whatever it takes in order to stimulate the economy. With so much cash swirling around, why would you want to be anywhere other than equities in the long run?

So this time, it could be different. The fall was the sharpest fall in history, and even though I still believe that many businesses are overvalued and that the market is due another leg down, many investors don’t want to miss out on a potential second bite of the apple.

Here’s a chart of the FTSE 100. The index has put a lower high and failed to break 6000 before selling off.

The FTSE 250 chart looks similar, and is already well off its highs.

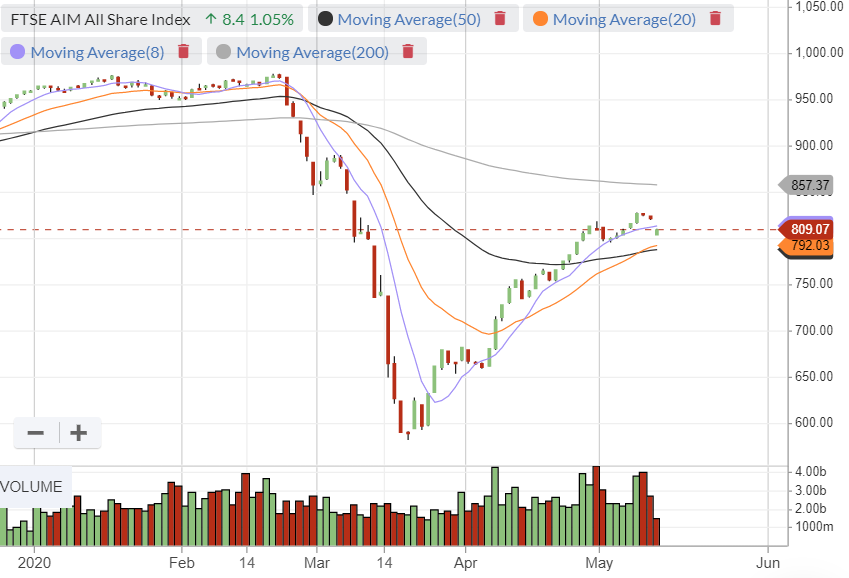

So far, the degenerate cesspit that is AIM hasn’t moved much. It’s likely to though (at least in my opinion) as markets tend to follow the leaders, and many of these stocks are illiquid and can be marked down rather quickly.

This is further exacerbated by the herd mentality of both traders and investors. Many use this as a derogatory term to compare people to sheep – but trend following is following the herd. If…