Travis Perkins is Britain's largest builders' merchant and is benefiting from a recovery in market activity. General election uncertainty hit the sector in April but the market is now set to pickup. Travis Perkins is therefore well placed to see further sales momentum and improve its return on capital.

One way to gauge the strength of a economy is to count the number of construction cranes in major cities. In the UK another test is to count the number of green Travis Perkins trucks whizzing along to building sites.

Travis Perkins plc is the largest supplier of building materials in the UK and has a “unique breadth". This includes consumer brands like Wickes and general merchanting brands like Travis Perkins and Benchmarx Kitchens and Joinery.

Travis Perkins can supply it all: division brands, sales & market share

Source: Travis Perkins investor presentation

The most important division is General Merchanting which generated £183m adjusted EBITA in 2014 – 47.6% of the group total. This area has the highest EBITA margin at 9.85 and achieves a lease adjusted ROCE of 16%.

The Consumer division generated £77m of adjusted EBITA in 2014 with a margin of 6% and a lease adjusted ROCE of 7%. Contracts came in at £72m of adjusted EBITA in 2014 with a 6.7% margin and a 13% lease adjusted return on capital.

Plumbing & Heating division came in at £65m EBITA at a 4.8% margin and a 9% lease adjusted return on capital. Clearly the three smaller divisions have some way to go to catch-up with the returns on General Merchanting.

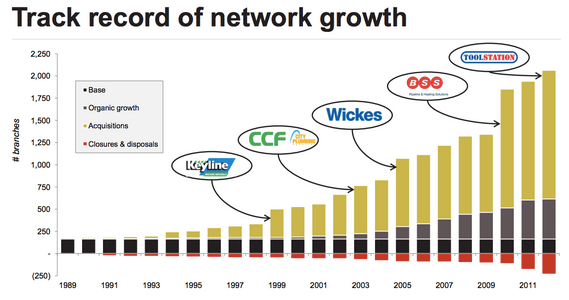

Travis Perkins' strategy is to exploit its “scale advantage", develop new customer propositions and expand its network. Organic growth and acquisitions saw the branch network increase from around 200 in 1989 to nearly 2,000 in 2013.

Source: Travis Perkins investor presentation

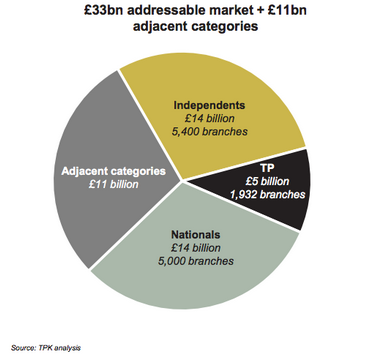

At a Capital Markets day in December 2013 the group estimated the addressable market at £33bn (£26bn in trade and £7bn in retail). The builders' merchant sector is fragmented with over 3,000 independent firms with 5,400 branches.

There is also scope to move into £11bn of adjacent market categories with acquisitions previously having been the key drive of growth. The last major purchase was Toolstation while Wickes was bought in 2005.

Market view: Significant structural opportunities for growth

Source: Capital Markets day presentation

In terms of guidance and Travis Perkins is aiming…