Tricorn (LON:TCN) are the future of global tubular solutions. That's according to their last annual report, anyway, but it was eye catching enough to get me interested. Any business on the cutting edge of any solution, let alone tubular ones, has me curious already. I jest slightly, but the next line in their annual reports is slightly more informing; ' the holding company for a group of companies that develop and manufacture pipe solutions to a growing and increasingly international customer base.'. So they make pipes! I have no aversion to small, component, niche industries. Indeed, I think being the king of a niche is an excellent way to freeze out competitors and ensure a good return - though whether that's possible in Tricorn's case remains to be seen. They list three main markets - energy & utilities, transportation, and aerospace. Essentially it's all the sort of stuff that gets used in engines and machinery.

Tricorn (LON:TCN) are the future of global tubular solutions. That's according to their last annual report, anyway, but it was eye catching enough to get me interested. Any business on the cutting edge of any solution, let alone tubular ones, has me curious already. I jest slightly, but the next line in their annual reports is slightly more informing; ' the holding company for a group of companies that develop and manufacture pipe solutions to a growing and increasingly international customer base.'. So they make pipes! I have no aversion to small, component, niche industries. Indeed, I think being the king of a niche is an excellent way to freeze out competitors and ensure a good return - though whether that's possible in Tricorn's case remains to be seen. They list three main markets - energy & utilities, transportation, and aerospace. Essentially it's all the sort of stuff that gets used in engines and machinery.

This makes it sound like an industry with a future. I'm not in the business of making predictions - thank God - but I would hazard a guess that engines and machinery will still be seeing a bit of use going forward. Probably a growth industry but, like Volex, that doesn't really mean that much given all the other factors involved.

Why we're down here

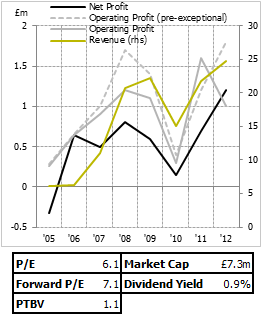

What took Tricorn from being a relatively 'normally' priced small cap to one that looks rather cheap relative to earnings/assets was some bad news last November; the loss of a big contract with Rolls-Royce. That contract accounted for 11% of group revenues - so obviously a huge loss - but, as always, it's the implications between the lines that hurt the most. It raises all sorts of questions about the business as a whole - are they uncompetitive? Are their issues with the products which will lead to further contract losses? There's been no further news since except a tidbit in the interim results (which were actually decent), but clearly investors are worried - the price dropped from above 30p in October to below 20p in November, and currently sits at 22p.

Management, while cognizant of the size of the loss, still confirmed an increase in the dividend in the interims and said they still forecast PBT to be roughly…

.png)