Source: Trifast

Last week, Alex took a look at How Smart Money Targets Turnarounds through the lens of stocks held by the Rockwood Strategic (LON:RKW) investment trust. I’d recommend taking a look if you haven’t already, as it’s full of interesting data-driven insights.

In this week’s Stock Pitch I’m going to follow up on this with a look at one of Rockwood’s larger holdings, Trifast (LON:TRI). The industrial fastenings group was a top 10 holding for Rockwood at the end of 2025, accounting for 4.4% of the trust’s net asset value.

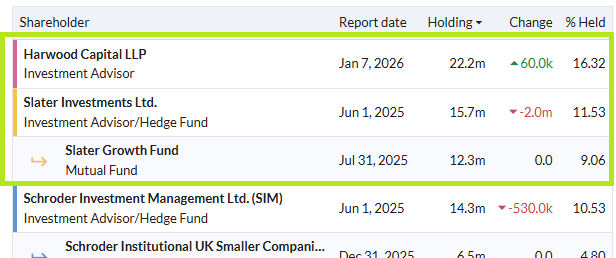

Harwood Capital (Rockwood Strategic’s investment manager) is currently Trifast’s largest shareholder, at over 16%:

Coincidentally, Trifast’s second-largest shareholder is Slater Investments – another well-regarded UK active fund manager. I’ll be covering Slater Investments in more detail next week, so look out for that piece.

The Pitch

Trifast’s product portfolio contains more than 50,000 items, mostly small fastenings such as screws and bolts that are needed by the company’s industrial customers. It’s undeniably a cyclical business, but ultimately I think this is where the opportunity lies.

The company is currently in the middle of a transformation plan aimed at delivering improved profitability and shaping the business for future growth. Management has put in place medium-term targets for a 10% operating margin and 12%+ return on capital employed.

Hitting these targets could see profits double, even with minimal sales growth. In such a scenario, I believe Trifast shares would justify a significantly higher valuation, as it has done during past growth cycles.

The Big Picture

Trifast’s niche focus and global reach means it’s a key supplier to many much larger customers. The group’s focus on improvement and consistency is already delivering results, with value starting to emerge:

Margin progression: the group’s adjusted operating margin rose from 5.1% in FY24 to 6.7% in FY25. Broker forecasts for FY26 were reiterated this week and suggest this figure could rise to 7.5% for the year ending 31 March.

Global growth exposure: Trifast’s operations stretch across the UK, Europe, Asia and North America. In total the group is active in c.65 countries. It operates as a full-service provider to OEMs…