Synectics (LON:SNX) 143.4p to buy 6% up today

After a rough couple of years this looks to have turned the corner now. Cash positive, profit making again with the last update saying it was beating forecasts. China opening up will give the company a good boost. NAV of 215p and broker target of 315p. Recently broke above the 50 and then the 200 Ema, the 2 Ema's have just crossed to form a golden cross. Has also broke out of the downward trend channel. After the recent rise it may retrace to about 123p which would give a good buying in position for the potential of a multi bagger.

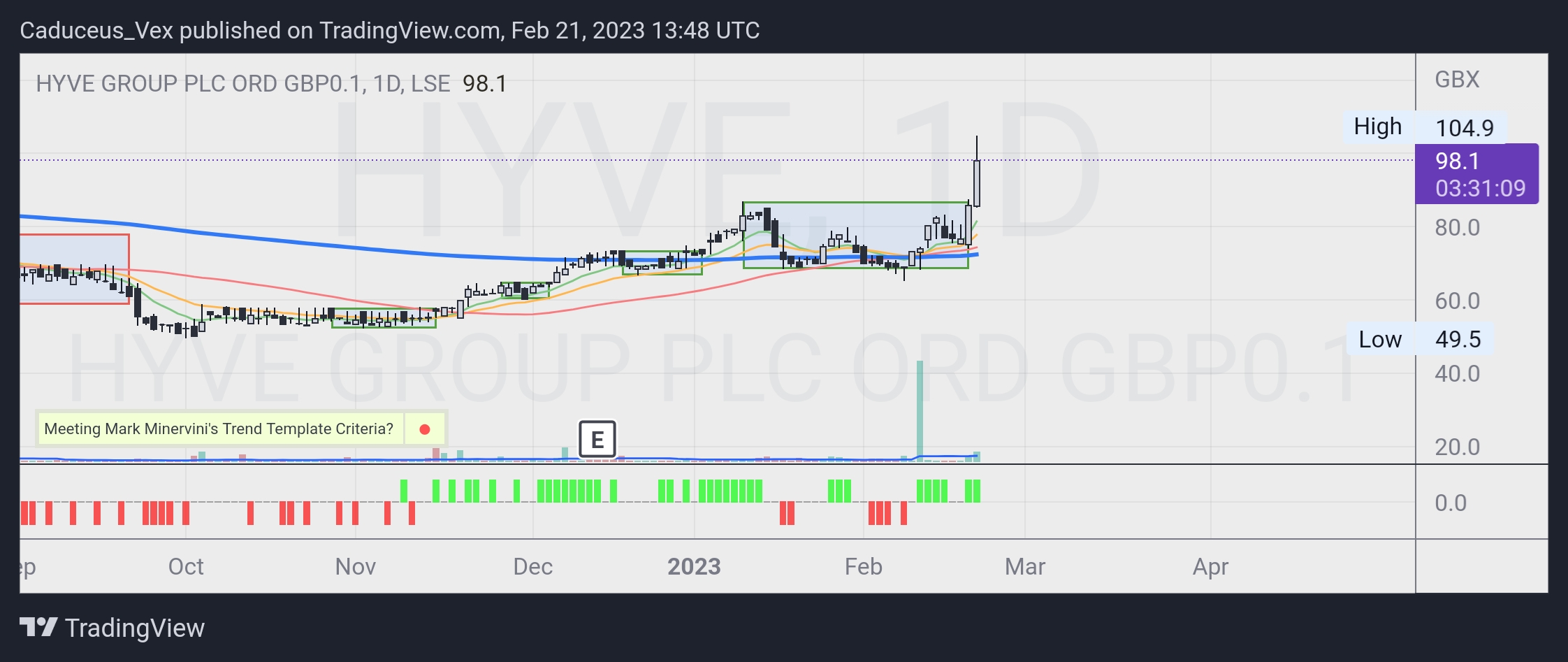

Hyve (LON:HYVE) 71.4p to buy 2.9% up today

This company has been around for 20 years and has had a radical change in the last few years. Suffered due to lockdowns and the the Russian war, it has gone from holding 90% of it's trade shows in emerging markets to 95% now in advance economies, making it less risky. The downside would be it's debt of £71m but this was on the lower side of it's estimates last results and it has now secured it's refinancing. It has sold it's exposure to Russia but i'd say you can forget about the company receiving money back in the future for this. China opening up should help this company.

Set to become profitable this year with just shy of £9m profit forecast. This has a forecast of £20m profit on 2024. With analysts forecasting a 98% increase in the sp, I would guess an easy 20% to be made in the shorter term.

It broke out of the 50 Ema and 200 Ema in December and has recently retraced back to the 200 Ema and a support line. Golden cross is about to happen providing it holds this level. Having broke out of the downward trend in December this looks like a good position to buy into now.