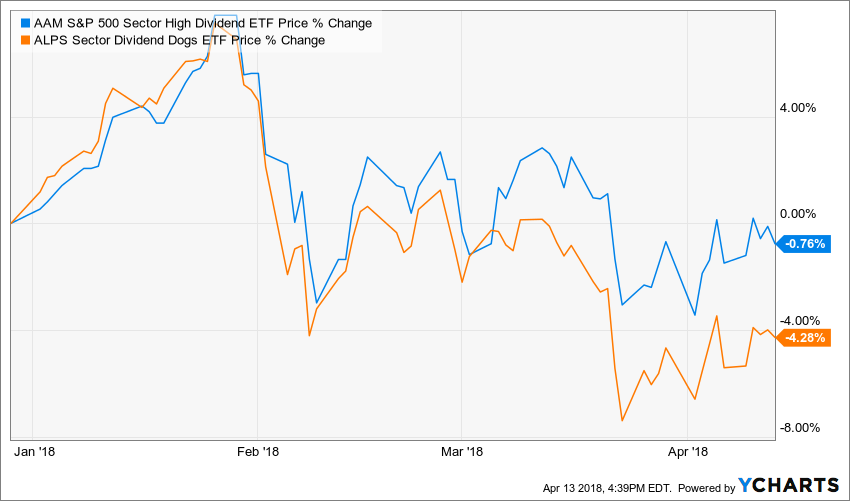

Investors looking for high dividend yield in the large cap universe should consider these two diversified and balanced ETFs:

- ALPS Sector Dividend Dogs ETF

- AAM S&P 500 High Dividend Value ETF

What Makes These ETFs Similar

Both ETFs have a dividend yield focus on stocks in the S&P 500 (SPY).

Both have a similar methodology of selecting up to 5 stocks per sector. Each position is also equally weighted. This creates a balanced sector representation in the fund. This diversification technique has the potential to improve performance when certain sectors are under-performing.

What Makes These ETFs Different

There are a few aspects which makes these ETFs different.

Expense Ratio. The newer AAM S&P 500 High Dividend Value ETF has a lower expense ratio of 0.29% versus 0.40% of the ALPS Sector Dividend Dogs ETF.

Re-constitution and Re-balance Frequency. SDOG makes their stock selections once per year and re-balances back the positions to equal-weight on a quarterly basis. SPDV selects its holdings and rebalances back to equal-weight on a semi-annual basis.

Sector Representation. SPDV includes the newly separated GICS sector of REITs while SDOG does not.

Stock Selection Ranks. SDOG selects stocks based on high dividend yield. SPDV selects stocks based on high dividend yield and high free cash flow yield.

Age. SPDV is a relative new-comer with an inception date of November 28th, 2017. SDOG has a longer history with an inception date of June 29th, 2012.

Who Might These ETFs Be Suited For

If you are looking for a large-cap pure tilt towards dividend yield with a longer track record, then the ALPS Sector Dividend Dogs ETF might be an ETF to consider holding.

AAM S&P 500 High Dividend Value ETF could be more well suited for an investor looking for not only income but also a fund which has a strong free cash flow yield for dividend sustainability. As dividends are paid out of free cash flow, having a strong free cash flow yield could potentially point the fund towards companies which have a higher chance of paying high dividends even in turbulent markets. You can read more about the interaction of free cash flow in dividend analysis with this S&P report.

Although SDOG is a purer yield play, the difference in yield between the two funds is small.…