Cyprium Metals (ASX:CYM)

Plan to restart Nifty copper mine.

Wating on FID and further funding announcements in FY24.

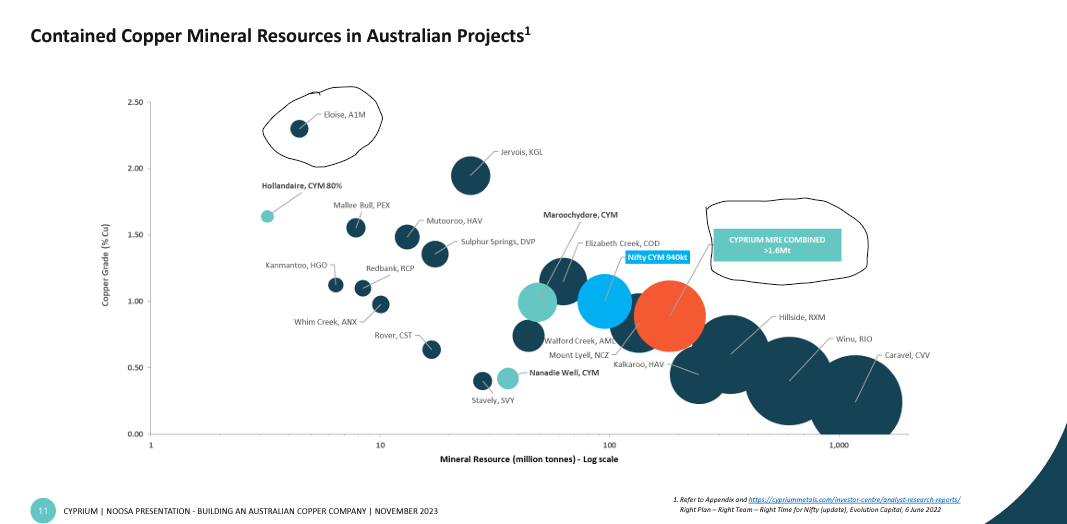

MER +1.6mt copper over 3 projects with further exploration upside.

Expecting first cash flows within 2-years.

Have debt on the books and just raised equity taking shares outstanding to 1.5bn. Will need to raise more funds to restart mine to start generating cash flow to pay back debt. Plenty of interest in the last cap raise indicating plenty of enthusiasms for the project and raising the remaining funds should not be an issue. Next 12-18 months is where the rubber hits the road (make or break).

AIC Mines (ASX:A1M)

High cost, high grade producer

Need a high copper price to be profitable and stay afloat.

Exploration upside

Will plough any profits and free cash flow back into the ground to increase production and resource size. They need to do this to lower their cost of production and become more profitable. Taking a leaf out of Twiggy Forester's book, as he did the same with Fortescue (ASX:FMG) in the early years.

A1M at this point in time has a much smaller but higher grade deposit and is already producing with plans to expand. CYM is still 1-2 years away from production but has much more copper in the ground and all things being equal should be the lower cost producer.

If you had to choose between the two, who would it be?