The Brexit debate over Britain's upcoming "Stay or Go" EU referendum has had some obvious effects in financial markets, not least on sterling, which has weakened markedly against both the US dollar and the euro in recent weeks.

A more surprising casualty of the economic uncertainty thrown up by Brexit is the UK housebuilding sector. Why should this be the case, given that this is an exclusively domestically-oriented industry?

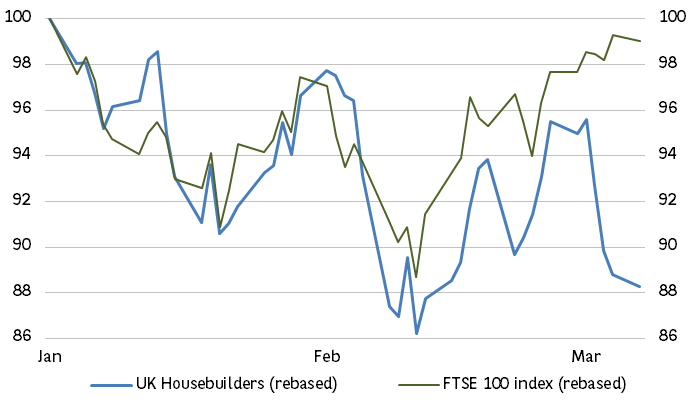

Housebuilders have been left behind over the last month

1. Housebuilders still near 2016 lowsBloomberg

1. Housebuilders still near 2016 lowsBloombergWhile the bellwether FTSE 100 stock market index has recovered nearly all of the ground lost between the start of the year and early February, housebuilders like Barratt Development, Berkeley Group and Bellway have struggled. Over the year to date, the FTSE 100 has lost just 1%, while these housebuilders have lost on average 12% (Ch

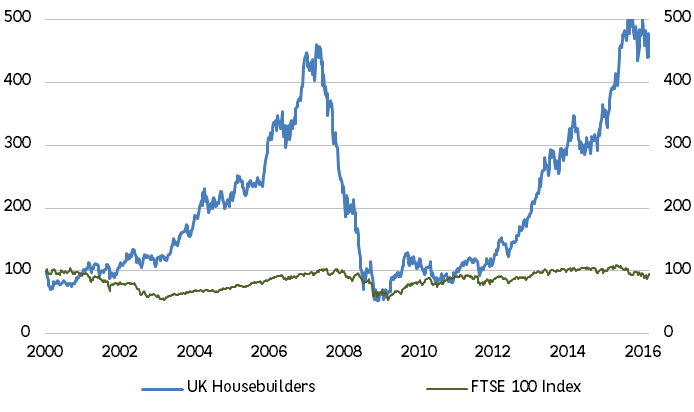

But the long-term is a completely different story

2. Since the year 2000, housebuilders have left the FTSE 100 for deadBloomberg

2. Since the year 2000, housebuilders have left the FTSE 100 for deadBloombergThat is all very short-term. But if we pan out and look at a much longer time frame such as since the year 2000, we get a completely different story.

While housebuilders have enjoyed massive highs and suffered crushing lows over time, the last 16 years have seen house builders gain 340% while the FTSE 100 has gone precisely nowhere (Chart 2).

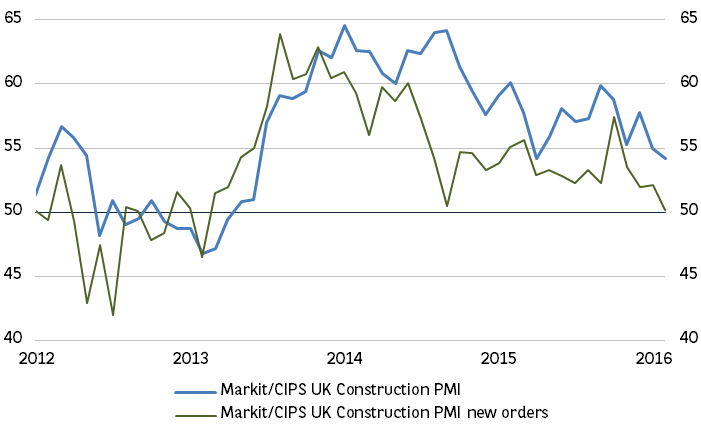

Investors worry about a construction slowdown

A key negative driving housebuilding shares lower is the worry that the UK construction sector is slowing down.

3. UK construction activity growth is slowingMarkit

3. UK construction activity growth is slowingMarkitIt is true that the recent Market/CIPS survey of activity in the sector revealed slowing growth but activity is still growing, albeit at a slower pace than previously. (Chart 3).

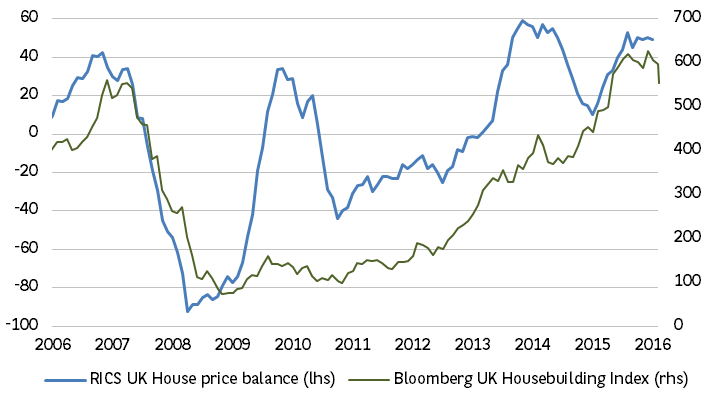

On the other hand, house price trends have remained remarkably robust, judging by the most recent readings from the Royal Institute of Chartered Surveyors' (RICS) monthly housing survey.

Unlock the rest of this article with a 14 day trial

Already have an account?

Login here