From the latest Barclaycard spending report for May, we finally get some welcome news for UK consumer spending:

Consumer spending grew 5.1 per cent year-on-year in May, the highest level seen since April 2017

In-store spending rose by 2.6 per cent as good weather encouraged shoppers to head out and about

Non-essential expenditure increased 4.6 per cent, its highest level of growth in more than a year, as garden centres, clothing and pubs performed strongly

OK, so we should not get too bullish as clearly, the better weather over the last month or so has been a real boon to pubs and clothes shops.

But still, this has got to be good news especially for online clothing retailers (ASOS (LON:ASC), Boohoo.Com (LON:BOO), QUIZ (LON:QUIZ), Next (LON:NXT) ) and pubs and restaurants (EI (LON:EIG), Revolution Bars (LON:RBG) ).

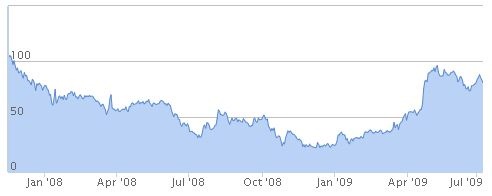

Looking at the way that non-food retail (F3RETG in the chart below) has underperformed relative to the broader UK stock market (NMX) since 2015, this unloved sector might finally be due a bout of outperformance!

And remember, pubs should hopefully get an extra boost from the World Cup, as long as England doesn't get knocked out at the group stages!). Remember, the longer that England stay in the tournament, the better for the likes of ITV (LON:ITV) on their advertising revenues...

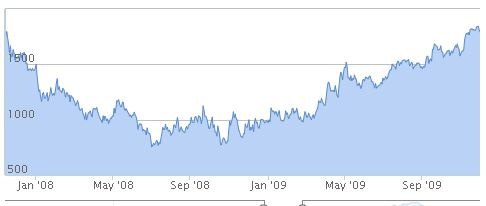

Note in the chart below how ITV looks to be breaking out of the 2-year downtrend, with a gap at around 218p that could be filled by the next upmove.

DIY stores have had a very good May too apparently, with May spending +7.3% y/y, so perhaps better news for Kingfisher (LON:KGF) too.

Finally, amusement parks are seeing a strong pick up in demand, so this better weather story might be a good boost for Merlin Entertainments (LON:MERL) too. This plays into the trend in favour of spending on "experiences", which…