Unilever generates 57% of revenue from emerging markets and is therefore exposed to countries like Brazil and Russia. However, underlying sales growth in the third quarter came in at an impressive 5.7%. The sales strength was broad based with all the geographic regions and product divisions seeing gains.

Media headlines suggest a general emerging market slump but some countries are seeing conditions improve. The rate of economic growth in India, for example, is expected to pick up in 2016 as consumer spending picks up.

Developed countries, meanwhile, have seen inflation fall back which has boosted consumer disposable income. The economic backdrop is therefore mixed but Unilever has nevertheless seen its sales momentum pick up.

Source: Unilever investor presentation

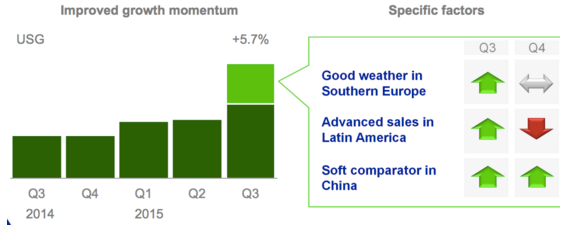

Unilever’s underlying sales growth (USG) – revenue excluding currency changes and any acquisitions or disposals – came in at 2.9% in 2014. It remained at 2.9% in H1 2015 but in the third quarter of 2015 the figure rose to 5.7%.

Unilever attributes the gain to good weather in Southern Europe, advanced sales in Latin America and a soft comparator in China. Newspaper hacks attributed the performance boost to “selling more ice cream in the sunny weather”.

Source: Unilever investor presentation

Third quarter strength was broadly based with European underlying sales growth (USG) at 2% in Q3 versus 0.2% in the first nine months of 2015. North America saw 3% USG in Q3 versus 0.4% in the first nine months of the year.

In Latin America Q3 underlying sales growth came in at 15.1% versus 12.5% in the first nine months of 2015. Lastly, in the Asia/AMET/RUB countries the Q3 USG came in at 5.3% versus 4% for the first nine months of 2015.

Despite the talk of a slowdown it was the emerging market that drove Unilever’s performance in Q3 with 8.4% underlying sales growth. This compares to only 2.1% underlying sales in developed markets.

As such despite ongoing issues in countries like Russia, Brazil, China the performance of Unilever has improved in all of its four regions. This suggests that demand remains resilient for products like deodorant and soap.

Divisional performance

The main product area at Unilever is Personal Care which generated 38% of revenue in Q3. Personal Care saw volume growth came in at 4.8% in Q3…