The global consumer staples group Unilever is now the fourth largest company in the FTSE 100. Unlike some of its FTSE 100 peers, such as BP and HSBC, it has been a reliable dividend machine. Volume growth has slowed down recently but Unilever's exposure to emerging markets bodes well for the long-term.

The chances are that you have used a Unilever product today with the company having 11 of the top 50 global fast moving consumer goods brands.These include Lynx/Sure deodorant, Simple shampoo, Dove and Persil.

Unilever has 11 of the top 50 fast moving consumer good brands

The largest division is Personal Care at 39% of fourth quarter revenue while Food came in at 27%. The two smaller divisions are Home Care at 19% and then Refreshment at 14% (the home of Ben & Jerry ice creams).

Unilever is aiming to increase its exposure to the premium segments of the consumer space. Acquisitions are being targeted in Personal Care and in the Food division new growth opportunities are being pursued.

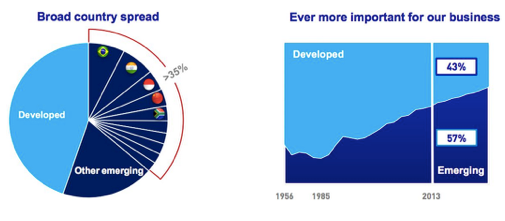

A notable feature of Unilever is that 57% of revenue in 2014 coming from emerging markets. This makes the shares a good way to benefit from the growth of the middle class in countries like Brazil, India, Indonesia and China.

Unilever by revenue by market and long-term trend

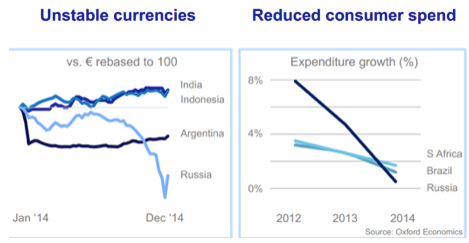

However, a slowdown in emerging market saw fourth quarter volume fall by 0.4% but in the whole of 2014 volume increased by 1%. This compares to volume growth of 2.5% in 2013, 3.4% in 2012 and 1.6% in 2011.

Unilever did increase its market share in 2014, despite increasing prices by 1.9%, and as such underlying revenue grew by 2.9%. It was also notable that the core operating margin rose by 0.4%, at current exchange rates, to 14.5%.

A tough environment in many markets

The group saw reported revenue fall 2.7% in 2014 to €48.4bn as a 4.6% foreign exchange headwind offset 2.9% underlying revenue growth. It was impressive, therefore, that Unilever managed to increase core EPS by 2% to €1.61.

An attraction for investors in Unilever is the dividend which was €1.14 in 2014 and has grown at…