US markets had a slightly rough day yesterday, with DJIA, S&P500 and Nasdaq all down between the range of 0.4 and 0.55 per cent. On the other hand, a few stocks are holding on with a strong grip and would not let go, while some are gearing up to rise. Overall they seem to be stronger than the rest of the market.

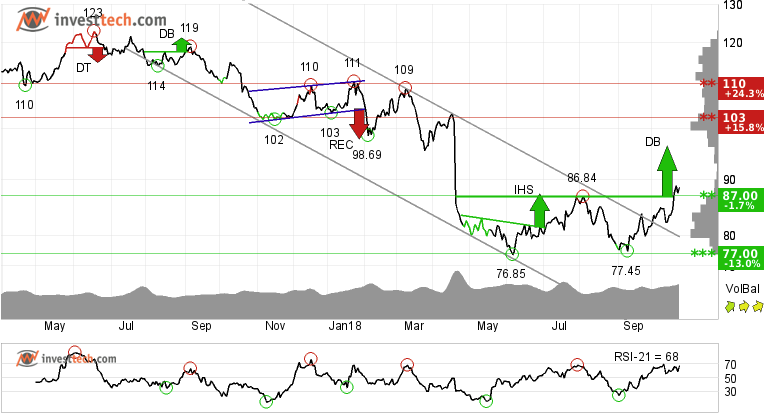

Philip Morris International Inc. , Close: 88.50

Philip Morris International Inc. reported its Q3 numbers on 18/10/2018.

The stock has broken out of the falling trend in the medium term, which indicates a slower falling rate in the beginning.

A buy signal is initiated by the means of a positive break out from a double bottom formation and through the resistance around 87.00 dollars, both in the medium and long term charts. A trend change may be expected here and further rise to 97.00 dollars or more is signaled.

Recently volume has been higher with the rising prices and lower with price corrections. This is a positive sign. Additionally, the momentum indicator RSI is rising and trying to catch up with the rising price. Another sign of strength.

Next resistance is at 103.00 or 16 % higher than yesterday's close, while support is between 87.00 and 82.00 dollars.

The stock is overall assessed as technically positive for the medium to long term.

Investtech's outlook (one to six weeks): Positive

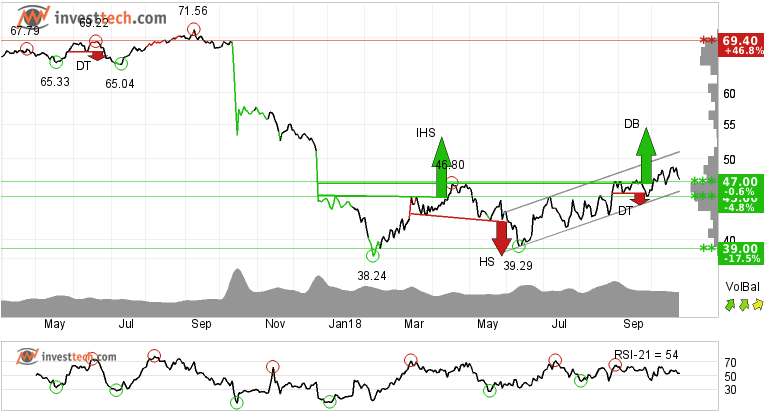

Pacific Gas & Electric Co., Close: 47.29

Pacific Gas & Electric Co. shows strong development within a rising trend channel in the medium term. This signals increasing optimism among investors. The stock has given a buy signal from a double bottom formation as the price broke up through resistance at 46.80 both in the medium and long term. Further rise to 54.56 or more is signaled.

Upside potential in the stock is big as the next level of resistance is around 60.00 dollars (or about 29 %) and 69.00 dollars which is equivalent to 47 % higher from last close.

The stock is currently testing support at dollar 47.00. This could give a positive reaction if buyers decide to jump into the stock and give it a positive energy.

There is support around 45.00 which can be used as a potential stop loss. A close below this level may lead…