By now, you must have either read about the Uranium opportunity of been deliberately avoiding doing so.

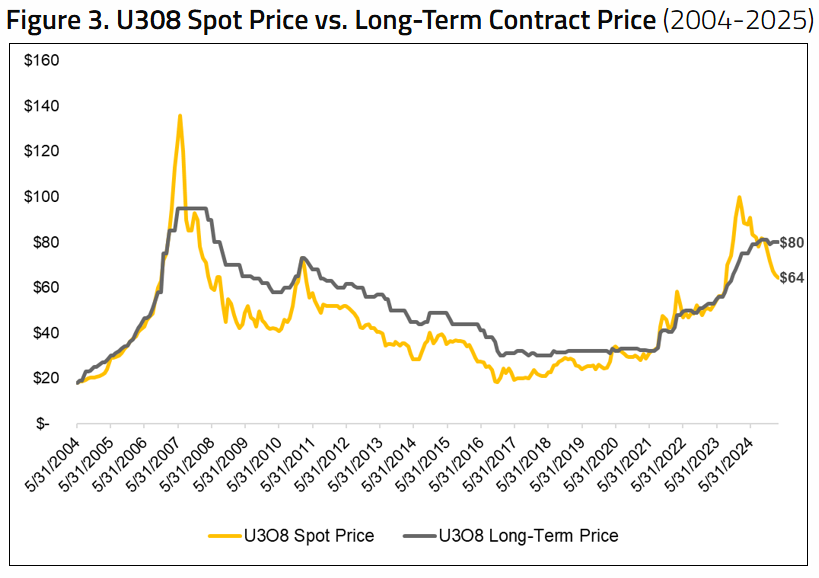

In short, it is a unique commodity, in that you can only use it if you spend tens of billions on building a nuclear power plant. At which point, you aren't going to chose not to use the plant because the fuel cost has risen. For 15 years nuclear has been out of favour, and so nobody opened new mines. Now it is roaring back into favour, there is a shortage of the yellow stuff, and price has been on a tear, and sensitivity to price is non-existent: the cost of uranium is generally reckoned to be about 10% of the operating cost of a nuclear power plant.

There are 2 LSE listed ways to play this: Yellow Cake (LON:YCA) is an investment company that simply owns uranium. It should simply track the price of the commodity, though currently trades at a 12-15% discount to NAV. There is also the chance there that somebody tries to buy uranium directly from them. It's a weird market with a structural shortage, so who knows. I would not be surprised if YCA ended up selling uranium at a premium.

Yellow Cake (LON:YCA) has been an outstanding performer, but my post is about its under-performing relative, Geiger Counter (LON:GCL) . GCL is an investment trust that invests in companies in the Uranium mining space. As with most commodities, the miners have lagged far behind the metal they produce recently, though last week there were very big moves. If you want to know why, there are lots of reasons.

The interesting thing about GCL is that it is small, and a few years ago the board decided they wanted to grow the share capital. But as it usually traded as a discount, how to do this? They decided to issue subscription shares. These are rights granted to existing shareholders to buy shares at NAV on a date 12 months ago. Last year, they were worthless. However, as uranium has been on a tear, the NAV of GCL has risen from sub 40p last April to over 70p now. There are 2 NAVs, by the way: diluted and non-diluted.

Now, here is the important bit. On Friday the diluted NAV was 65p and the non-diluted 71p (edit: on 31 Jan the figures were…