Why no coverage of thi massive opportunitiy

Why so little mention of foreign stocks

Anyone noticed a commodities super cycle bull market in progress

Why no coverage of thi massive opportunitiy

Why so little mention of foreign stocks

Anyone noticed a commodities super cycle bull market in progress

Yes that’s probably true but is it worth Stockopedia employing a resources expert for a relatively small proportion of members? Many investors don’t deal in that sector at all. They have been calls for more coverage of mid and large caps, I would have thought there was more demand for those stocks than resources. If the membership fee goes up to cover resource stocks, you will probably lose members.

Foreign stocks were cover by Roland but there was little interest and there are huge number of stocks, part of the problem was some stocks could not be traded, such as parts of Europe, Asia and Australia, by many members.

I do have the US region but doubt I will renew it, I may try Europe again.

There was also a member that did a series on European stocks but that ceased a few years ago.

Surely the goal of all investors is to maximise returns

Not really. Firstly there’s the concept of risk-adjusted returns. And a good number of investors stick to the sectors they understand rather than jumping from sector to sector with macro changes. Many more prefer to invest exclusively in defensive stocks, ie those whose growth is both dependable and non-cyclical.

Resource stocks fit neither model. And as their performance is all about the underlying commodities it seems the gains are had before the profits ever have to be counted. Or at least before they turn back down. You’re not playing some nil sum game where a particular miner wins in competition with its rivals. So just buy the relevant ETF as the logical response to a macro opportunity and get out before the market turns.

I do wonder why retail stocks like Boohoo are discussed ad nauseam and the resource sector largely ignored

If you want resource stocks discussed put together a post that will encourage discussion. IIRC Stocko used to be the place where oilies were mostly discussed. Now its different. It can be that way again if that's what people would like.

I think the extent of subscriber interest in different sectors and different classes of stock is something that is open to question. I haven't seen any evidence on this, one way or the other. I think it's also impossible to obtain data on Stockopedia members' investment behaviour, simply because member folios include watchlists and test portfolios in addition to actual investments. And there is no way of knowing to what extent individuals are updating their folios in any case (my own is two years out-of-date).

We each have our own opinions and preferences about investment ... and we each, probably, tend to assume that others think the same way as we do. So this debate is very subjective. We are each paying a subscription that, in part, goes to support the provision of expert analysis and opinion. If your primary interest is in small caps (excluding resource small caps), that probably feels like a good deal. If your main interest is different ... well, not so much.

I'd like to see Stocko carry out and share some research on members' priorities and preferences so that we could have a more informed discussion.

Some good points. I think Stockopedia could do a survey of what members would like to see more coverage of. I invest in various stocks, inc. small caps, mid caps and large caps, also resources, I avoid certain thinks such as tobacco and gambling. I also have foreign stocks mostly US but some European ones. But I’m probably not your average member on here. I’m not keen on subscriptions going up. I think the membership has changed quite a bit in the last few years, I admit I very nearly did not renew last time because of the new site, I prefer the old one but thought I would give it a chance. I agree about folios, most of mine don’t reflect my holdings as most are watchlists or NAPS, I’ve had debates with Stocko about community holdings being inaccurate. I think in the past there were problems with small energy stocks being ramped, we don’t want Stockopedia to turn into something like certain BBs.

So it's just the thrill of the ride for you BnB ? :)

To an extent yes, in defiance of your understandable scepticism. But then I'm not trying to build a pension pot or secure my future so it's very reasonable for my motives to be different. I achieved financial security when I floated my start-up back in the last century, and compounded those gains with the more recent private sale of of a sizeable enterprise I subsequently founded.

So I'm very used to owning companies with all the pressures, frustrations and rewards that status entails. And share ownership nowadays (in my dotage!) is a proxy for the thrill of entrepreneurship. I buy a piece of companies whose products, management and operating performance I admire in sectors that I understand and believe to be aligned with secular growth themes like DX or electrification. I rarely trade and maximising returns never comes into it, even if profit remains a fervent hope,

Nice place to be BnB, congrats on your past successes (no doubt the products of some extremely hard work!)

Many thanks. Hard work for sure, some good fortune, but mostly due to having great partners and colleagues along the way.

Congratulations BnB. From my own experience sacrifice, hard work, developing high performing teams and luck are all the ingredients of a successful business. However I believe out of modesty you have omitted the most important ingredient which is leadership. I have built and sold one business but the fact you have done it twice suggests you are both a great leader and an entrepreneur.

I agree with you BnB that share ownership is indeed a proxy for the thrill of growing a business but unlike you I have to return a profit.

Have Geiger Counter (LON:GCL) and Yellow Cake (LON:YCA) on the current hype.

Research needed and probably impossible due to its dual use as a weapon (as is energy lol).

But good to start the discussion and less of some restaurant somewhere and some cheap non ESG fashionable returnable clothing rubbish. ASOS / BOOHOO = how to lose money in the market.

Maybe Stock Reports for resource/commodity/mining stocks could take in to account political and geographical risk so that the stock ranking is a function of QUALITY, VALUE, MOMENTUM, POLITICAL, GEOGRAPHICAL. I appreciate geopolitical risk is to some degree subjective but with adequate research in to the stability of the business environment this could provide a meaningful metric.

Thanks. Congratulations on your own success. Most new businesses fail within a short period. This sums up the early challenges reasonably well for those quick enough to get the limited free views. Although you, like me, may have risked more of your own money:

Ditto, ride the bull market so to speak.

In the public eye, commodities and natural resources are as popular as a certain Mr Epstein these days. Nothing but doom and bad news hurled at the entire resources sector by the press and political agendas.

There has been massive under investment, in the very source of the vast global improvement in living standards.

The main reason the “renewable” energy tech has got cheaper over the past 10 year is because of the fall in energy costs which is the largest component input of what makes every “renewable” technology possible.

That trade is about to reverse.

Now due to lack of investment in Oil and Gas, the curtain hiding the wizard has been pulled back.

A lot of the multi baggers in the resource sectors are on overseas markets and should we now go through a O&G drilling boom then these will do well. Look at the long term charts for Transocean (400% gain in 12 months) Nabours Drilling (+400%) etc.

O&G Service companies and Silica Sand used in fracking is already in short supply. (SLCA:NYSE) and doing well. All rising fast

Uranium will be a fabulous long term hold. When the oil finally runs out, Nuclear is the only saviour......

I'm expecting this to be a long cycle. You could ride it (sorry about the pun!) by simply investing in ETFs and the like. But I think there's scope to beat the average by investing in a more carefully selected, albeit diversified, portfolio of resource/energy stocks.

There's a role for Stocko to play here in providing expert commentary for PIs. But it doesn't seem to be interested.

Agree this will be a long cycle.

After using stocko for a couple of years, the ranking system does a good job of sorting and highlighting companies with good track records and good metrics and highlighting them. Especially for non accountants, like me.

However I do not think their system can pick out macro trends like this.

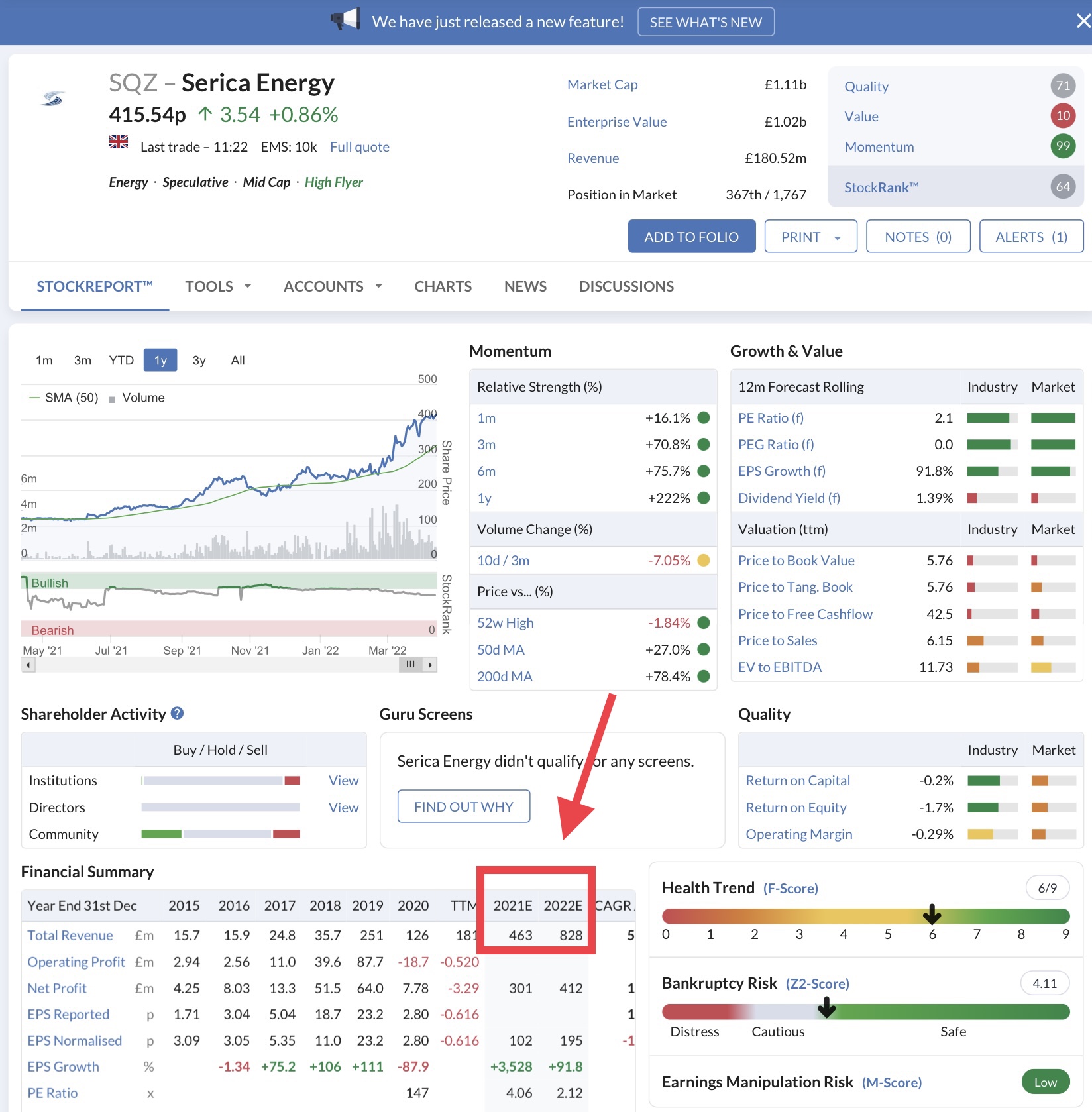

Even my Fav UK share, Serica Energy,. Comes up as “Poor Value”

Serica is producing cash as a rate almost unheard of before. It’s share price has risen but the poor Stocko ranking for value is based on the predicted 2021 revenue which a few months ago was about 460m.

Results day in a week or so....!

Even the ‘22 year forecast will likely be very low.

Based on current O%G prices its revenue could be about 170m a month ( before hedging).

There is no way Stockopedia could know or account for this.

Most commodities are about to experience an eviscerating bust...so position careful. Nothing comes off of allocation gently.

I might buy some after that as we see growth resume and if we also get a classic credit/investment cycle kicking in to end our demi-depression in West since 2008 (financial economy boom, but real economy paralysed).

I think its fine that no once does an official commodity linked stock segment on Stocko. After all, Stocko is a fundamental data driven stock selection tool that seeks to standardise a bunch of metrics for cross sectional comparison and analysis. How do commodity stocks fit into this? With the big ones you need to be aware of mega macro cyclicality and invest contra data often. With the small ones they often look like dirt and there's an occasional diamond that people get to shout about...but most owned it in a lottery way, and you didn't get it right 'fundamentally' unless you hold through to profitable production.

Commodity stock chat tends to be even more spivvy than small cap (no profit) growth hype.

Hi Roodini

If you (and others) have not already seen it. there is a good and detailed thread on Serica Energy (LON:SQZ) by Keelan Cooper well worth a read.

It's here .....

https://www.stockopedia.com/co...

Regards

Howard