With Donald Trump destined to return to the White House in 2025 and Republicans on track to take the US senate, global markets have responded with a surprising jubilance.

Early gains in Asia (not China) were matched across Europe, with the FTSE All Share climbing almost 2% by 10am. The US futures markets are also buoyant - although that’s less of a surprise.

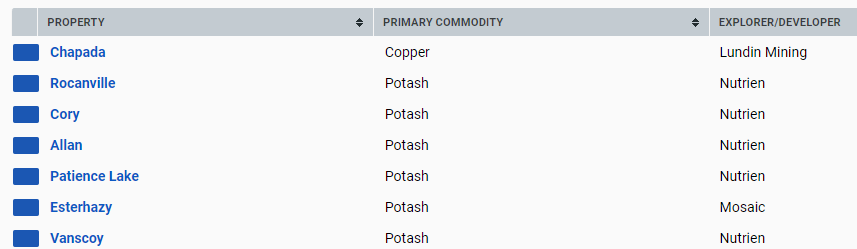

Top risers across Europe this morning

This morning has also seen a surge in the price of Bitcoin to new highs, a strengthening of the value of the dollar against foreign currencies and an upward swing in the 10-year US yield curve.

Why the market response?

Some of this morning’s responses are grounded in the reality of what a Trump presidency will mean for global markets. A commitment to the use of cryptocurrencies, for example, goes some way to explaining bitcoin’s surge. Trump’s protectionist policies around US companies and a commitment to making it harder for the US to trade with China are the driving force behind the strong US futures markets (for both US large and small caps) and a decline in Chinese stocks.

And a rising US treasury yield is a direct response to Trump’s intention to increase the US deficit. His agenda involves material cuts to US taxes, which will decrease US government revenue. But there is no intention to taper spending, so borrowing is bound to increase.

But as for the response of other global markets, those are harder to explain. For a start, Trump’s policy is likely to be inflationary, which isn’t a great environment for any business attempting to sell to consumers. The fallout from rising yields in the US could also cross the Atlantic in time for the Bank of England interest rate decision, scheduled for tomorrow. If rates are not cut in line with expectations, UK markets are likely to react poorly.

It’s also surprising that UK large caps (which make substantial portions of their revenue in the US) are on the rise. Trump has already suggested tariffs of between 10% and 20% on goods sold in the US by non-domestic companies. The likes of Smith & Nephew, Bunzl and Ashtead (which make more than 50% of their revenue in the US market) could see some unpleasant additional…