I can understand why the value investor is not in favour of stop losses but may even use a fall in price to purchase more. However the investor who uses momentum as a guide for entry would use stop losses.

I read an article recently suggesting that a stop loss between 15 and 20% used in an arbitrary fashion increased returns.

It is laborious to try to back test this on stock ranks as it is very difficult to see what past Stock ranks have been

Does any one use momentum in ranks as a guide for entry and use stop losses for exits? If so how successful has that been and how do you set levels?

Thank you

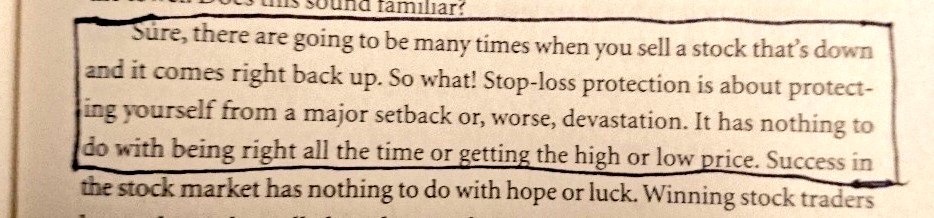

The point of stop losses are to protect your capital. Probably the most important part of investing.

The argument that the drop is temporary or chops you out is neither here nor there. they help you make money in the long run by not loosing it in the short term. The obsession by alot of PI's that they must be right on every stock is a key factor in underperformance.

Mark minervini, bill O'Neil, Stan weinstein all hammer home point if this.

the key message from minervini book.