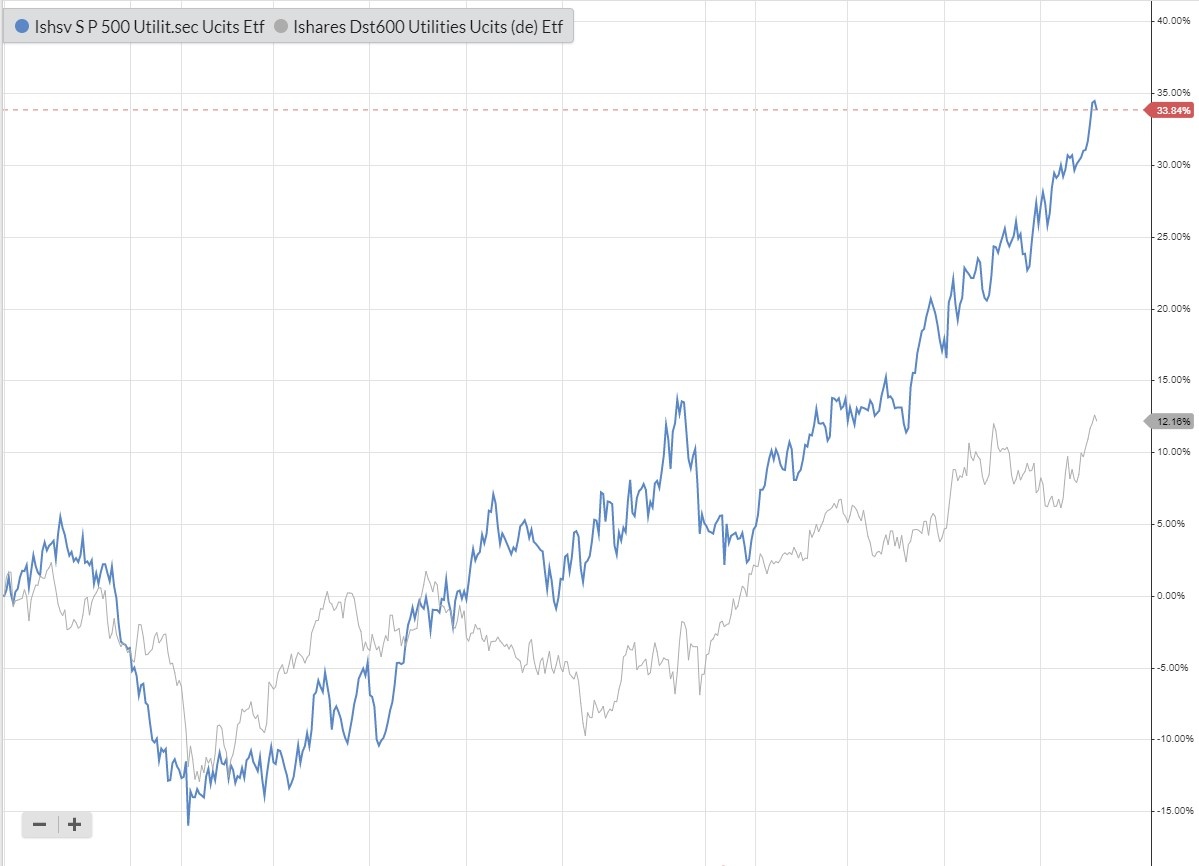

The popularity of index trackers is growing. Passively managed funds outperform actively managed funds about 75% of the time and they have much lower charges - some as low as 0.07% per annum. In times of uncertainty, institutional investors often shift their money to utilities which are perceived as safer than most other alternatives - after all people use the same amount of electricity and water during recessions as they do during boom times. For this reason it makes sense to switch from total index trackers such as VANGUARD S&P 500 UCITS ETF (LON:VUSA) to a utilities sector tracker such as ISHSV S P 500 UTILIT.SEC UCITS ETF (LON:IUSU). Over the last year VUSA has grown by 6% whilst IUSU has grown by 28%. Over the last month, IUSU has surged whilst VUSA has remained static. These figures can be used as an indication that US investors are bracing themselves for a substantial market correction if not a crash.

I hold ISHSV S P 500 UTILIT.SEC UCITS ETF (LON:IUSU).

Euro utilities are behind the curve: