Calling all deep value investors :-)

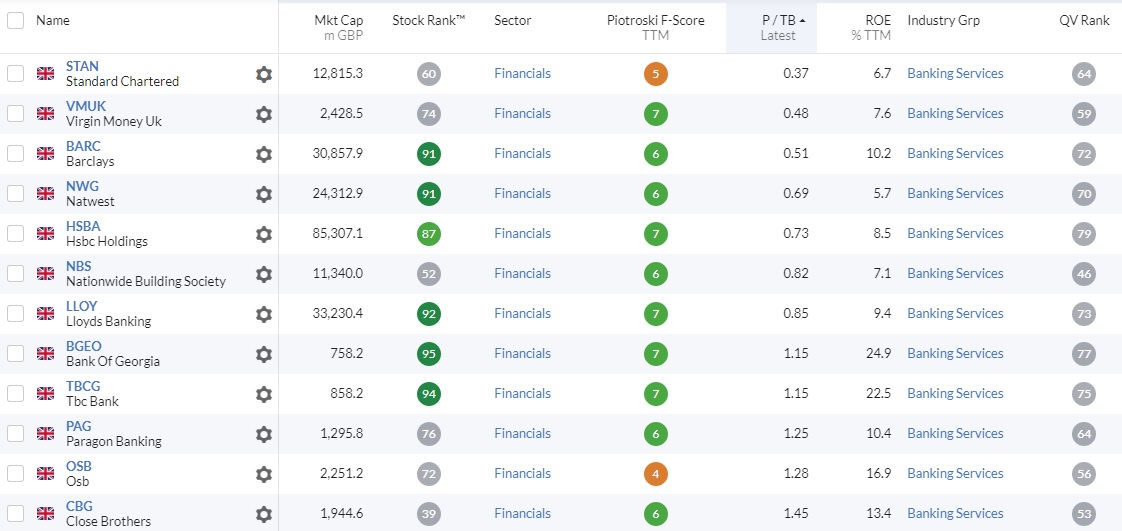

Standard Chartered (LON:STAN) appears to have very healthy value accounting ratios AND good intrinsic/fair values …

What are your thoughts? Would you buy? If not, why not? :-)

Calling all deep value investors :-)

Standard Chartered (LON:STAN) appears to have very healthy value accounting ratios AND good intrinsic/fair values …

What are your thoughts? Would you buy? If not, why not? :-)

I identified Stanchat as good value some 8 years ago and put my money into it. I pulled out and lost money a few years back. so lesson learned, but will I get back in??? At a p/e of 6.6 and price to book of 3.3 and a returning dividend of 4% it look enticing, but the balance sheet tells us that equity and retained earnings have remained static for the last four years. Diluted net income was way down last year, so did they over provision for loan losses? From their interim it appears so, but who knows with this company and that is the problem it's just too hard to analyse accurately.

Run from London with interests in America the Far East and Africa, probably lots of expats in hard to figure diverse markets, with varying compliance standards, just managing this model to function in an ever fast moving market place would be an achievement. It may be easier not to bother to analyse this company and invest in something else. With all the big funds invested owning 39% of this company, I would be surprised if there has been no pressure to sell off regional interests to get the asset value into the share price. Listen up Black Rock & Vanguard!

This has been a useful exercise for me as it has made me justify further investment. My inclination is to wait for the next accounts but this may miss any upturn. Decision: sell Sept put options to get some income, at a strike of £4.00 , with stop los and watch carefully on the basis that, at this price, the share is unlikely to drop much further too quickly and most likely maintain or increase its current price.

Looks very attractive on a Price / Tangible Book Value of just 0.37x.

However it has one of the lowest ROE's amongst its peers, at 6.7%.

I would need to identify the ways in which the management will drive the ROE upwards - without this, the stock will likely remain a Value Trap.