When Warren Buffett raised his stake in Tesco in 2012, little did he know that he was breaking one of his own investment rules. He’d initially taken a position in the UK retail giant some years earlier. After a profit warning and news of increasingly fierce competition, Buffett chose to buy more shares as price started to slide. It was an error that eventually forced him to take a £287 million loss on what had turned out to be a classic Value Trap.

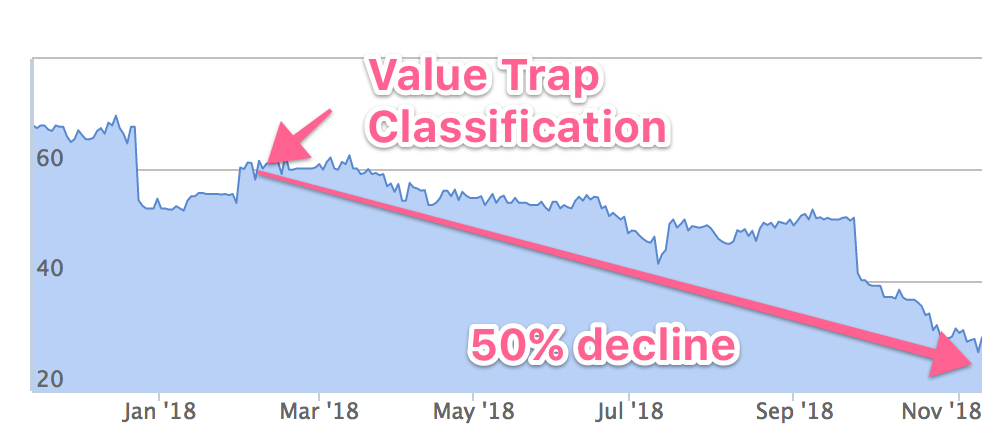

With Tesco, Buffett showed that Value Traps can open up in front of even the smartest investors. Yet these disappointments are a particular risk for investors looking for a bargain. The bargain hunter’s favoured territory is the deepest, darkest corner of the market. It’s here that unloved, broken and misunderstood companies languish. In amongst them lie the turnarounds and contrarian plays that can deliver stellar returns if they rehabilitate. But also lurking are the “value traps” - stricken stocks that may either never bounce back or make you bear too much opportunity cost to make it worth the wait.

Deep value - the domain of the value trap

‘Deep value’ is an investing approach that was born in the writing of Benjamin Graham. Chastened by the losses of the 1929 stock market crash, Graham hatched a completely new brand of security analysis. He shunned the expensive ‘glamour’ stocks of the day in favour of unpopular shares that sold below their 'intrinsic value'. Importantly, he insisted that these potential dogs were priced so cheaply that there was a healthy ‘margin of safety’ in the price. With a well diversified portfolio, he reasoned that he could absorb a number of inevitable losers but ride out profitably on a wave of winners.

Graham’s value strategies have earned him a great deal of respect. But one of the risks of taking his approach is becoming overexposed to stocks that are risky and perhaps on the brink of bankruptcy.

Seth Klarman is one of the best known modern day investors to have modelled an approach on Ben Graham’s ethos. He’s become a billionaire through his stewardship of Baupost Group and even wrote a book called Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor.

In his 2012 letter to investors, Klarman pinpointed the subtle risk of falling into a Value Trap. He wrote that a…