As is usually the case, news of the placing was announced when the share price was very high - around 104p. A placing of £36million in total at 90p which is large for a company with a market cap. of £85m. Institutions had been sounded out for £34m - a positive and impressive sign that they back VLG plans, and £2 million available to retail holders. Directors were not participating but in fact selling around two thirds of their shares - not a positive sign but then again they had barely sold any shares since VLG was founded in 2010.

Three acquisitions were outlined. The first 'Vulcan' is a quite advanced for about £5 million. Two other acquisitions were outlined for £5million and £15-c£20 million but these seem very early stage from the RNS. They all sounded excellent fits for VLG both in terms of production and sales channels. Acquisitions usually take longer than expected so if Vulcan completes before the end of 2020 that would be very quick. The other two appear some way off, possibly not complete in 2021. On the day the RNS appeared Cenkos published a research note for 2021 including figures with these acquisitions which I consider rather misleading. They may take a long time and as with any potential acquisition, may not happen at all. Whatever happens it will take a considerable time for VLG to deploy this cash which will sit on the balance sheet for the time being.

I like VLG medium and long term plan to grow organically and via acquisition. The site in Italy is large and they have scope to buy additional property where the factory is.

In the near term what positive news can boost the share price from here?

1. Vulcan completing soon and this seems likely.

2. Positive news from the Cardiff University study would mean that VLG sell some more mouthwash but how long will the fight against Covid last? The charismatic and down to earth government advisor, Johnathan Van Tam's football analogy is that we are now 70 minutes into the football match - so we are on the last leg. Is a positive test result really going to make much difference to an enlarged VLG?

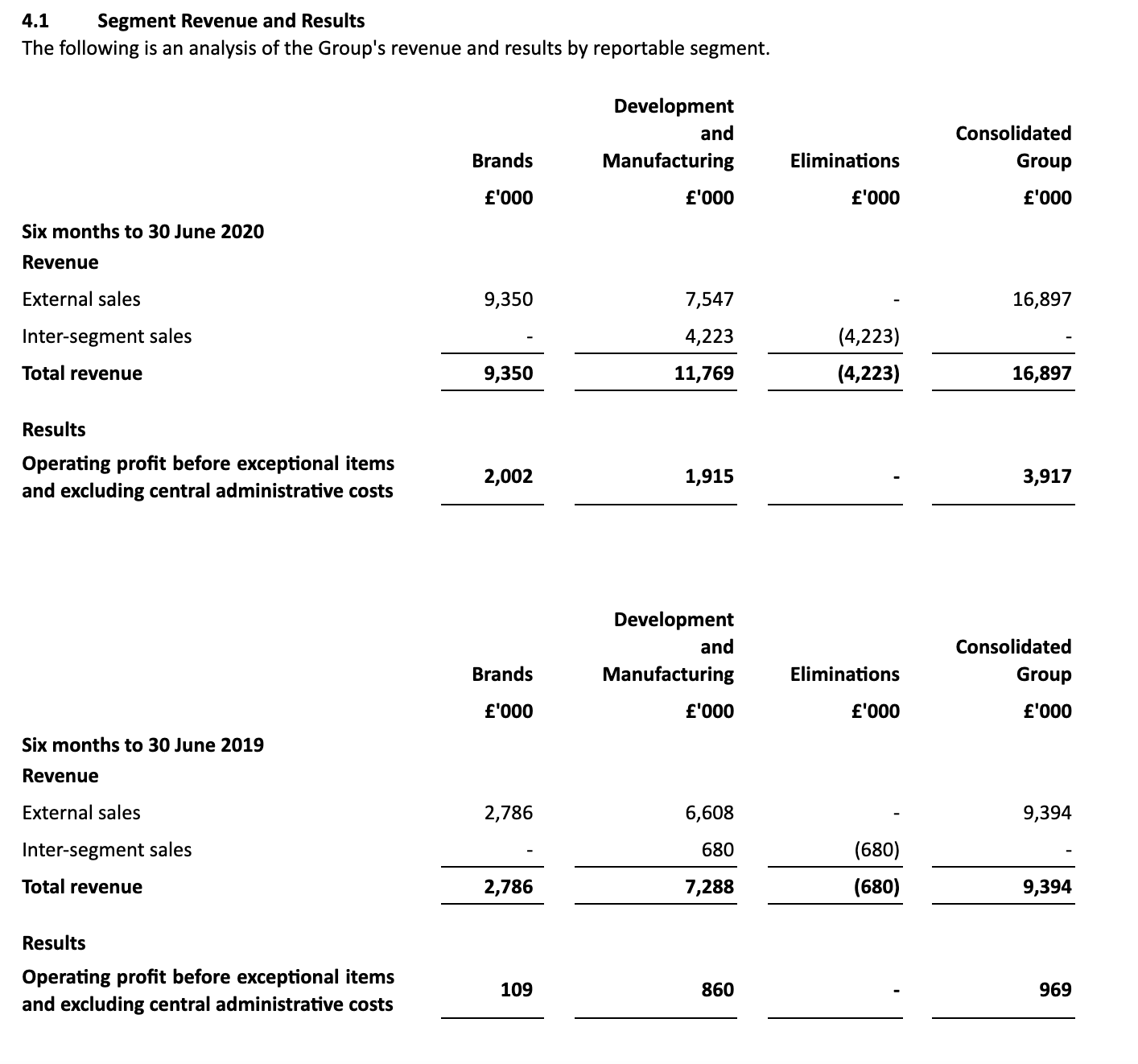

3. FY results due in the second half of January. VLG guides the market for £30m rev and £6m EBIDTA. H1 rev was £17.9m so an additional £12.1m. Several commentators including Simon Thompson…