Given the 20th Jan inauguration of Donald Trump to the White House, there’s unsurprisingly been a great deal of 'chop' across markets this month. With bond yields firstly rising on the back of inflation fears - then dissipating slightly due to softer than expected CPI data and no trade tariffs (re China, EU, Canada & Mexico) YET mandated by the US President.

Elsewhere there’s been a mountain of Xmas trading updates, alongside encouraging government plans to deregulate some industries and boost growth (eg Financials, Crypto, car finance, sacking UK CMA head, etc).

What other sectors might benefit next – eg North Sea Oil & Gas, Vet services, etc?

Indeed to me, this latter initiative to ‘burn excessive red tape’, is a breath of fresh air, and should at least help corporates recover some of the belligerent Employer NI tax hikes imposed in the October Budget.

Albeit equally, this could undermine some firms' business models whose revenues depend on tightening regulation – eg #LTG’s Affirmity division whose US clients will no longer have to comply an Executive Order that Presidential Trump rescinded last week.

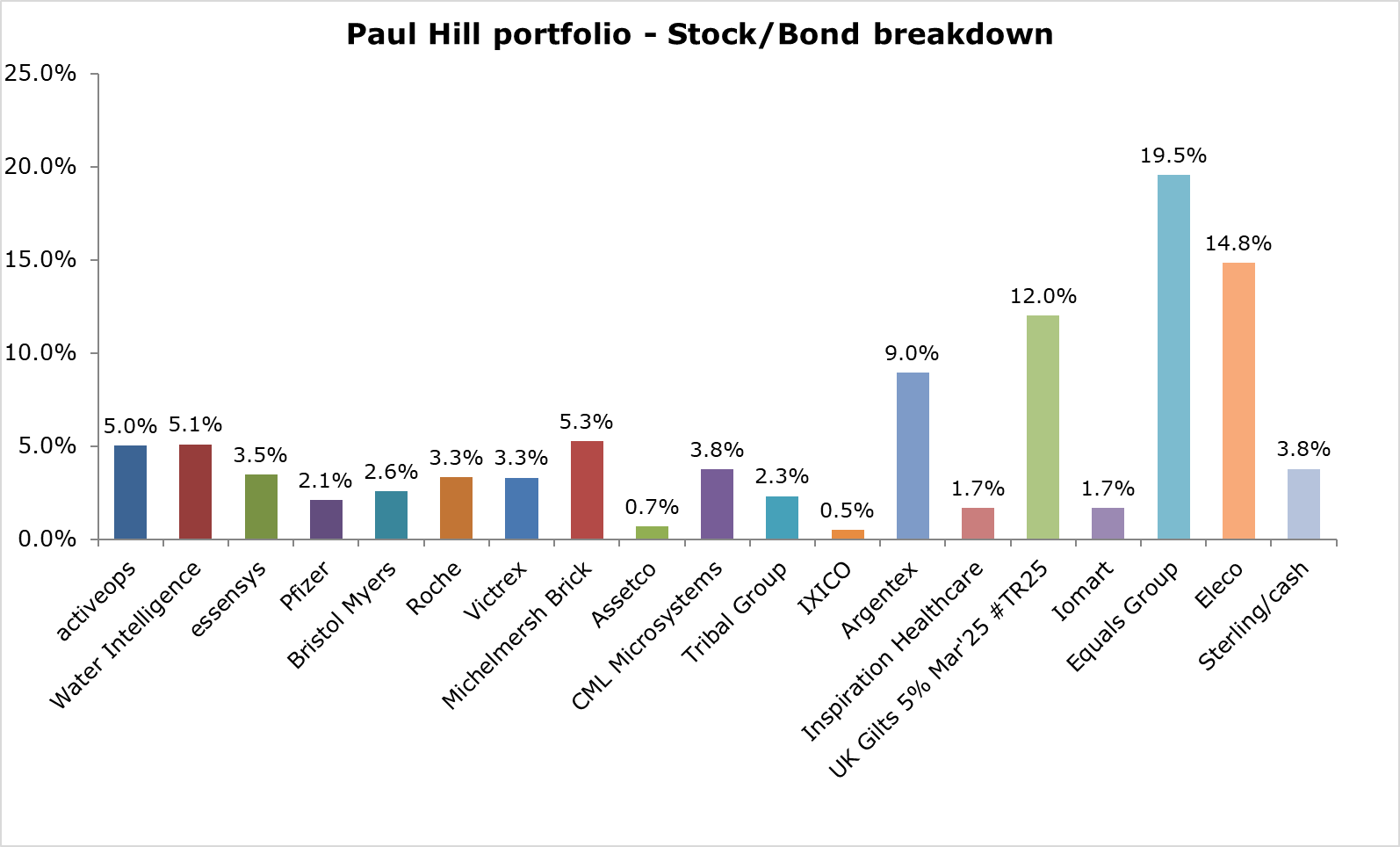

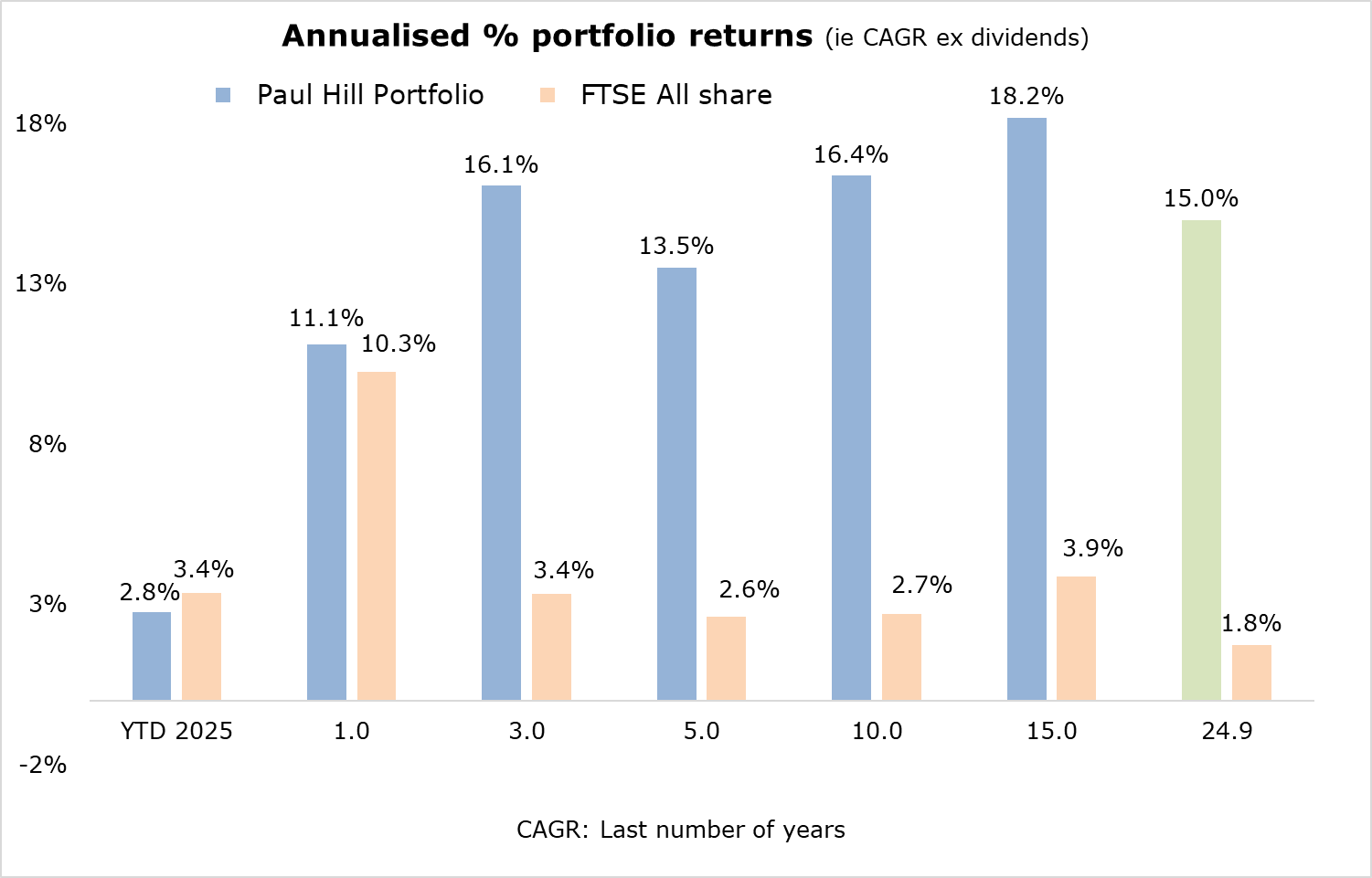

Anyway in terms of my own portfolio (see below) nothing has really changed. +2.8% YTD returns are broadly in line with the FTSE All share index (+3.4%) - so still all to play for. Fingers crossed.

Good luck everyone.