IPD (ASX:IPG) is a distributor of electrical equipment in Australia.

IPG consists of two core divisions - distribution of products (+90% of profits) and the provision of services.

The electrification of everything is a very strong narrative leading into 2023 and beyond. Supported by both the government and its citizens, IPG is on the frontline of critical work given the need to not only draw more from the grid, but to also do so more efficiently.

The replacement cycle which is currently underway is likely to continue and IPG should be beneficiaries of that.

`

Beyond servicing the renewable energy sector and Industrial communications, the company has an agreement with global electrics supplier ABB to sell EV infrastructure on behalf of them in Australia and New Zealand.

This offers an exciting opportunity for IPG given the expected uptake of EVs into the future and the urgent need to upgrade EV infrastructure. The company refers to this time as a "once in a lifetime opportunity" for them, and its difficult to disagree with that sentiment. The sale of EVs have jumped in Australia but still only account for around 3% of all new sales. This significantly lags the rest of much of the developed world. This gives the company runway for growth in a sector with very little in the way of direct competitors.

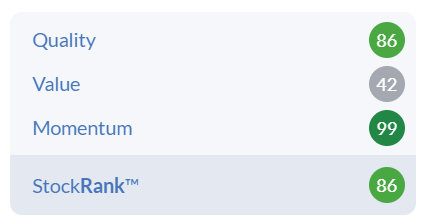

StockRank ™ score

The company only listed in late 2021, and it has maintained a StockRank TM above 80 for the entire time.

Looking at the current overall score of 86, this is slightly down on September 2022 figure when it most recently crossed back above 90.

However the score has since pulled back due mainly to the erosion of Value as the price has gone up. This is no better exemplified by the Momentum score of 99.

Pleasingly the company has been beating proforma expectations, 27% on the revenue line and 59.5% on the NPAT. This is the sort of return you would want to see from a new listing and its unsurprising that the early adopters have seen such a strong run.