There are opportunities to make - and lose - a lot of money in this market. Last week I considered some higher risk share prices that have been heavily hit by this lockdown. There are some interesting trades to contemplate but the risks and unknowns are considerable.

For example: what will post-lockdown social distancing policies look like and how prohibitive might they be to visiting shops and bars?

It will surely be a bumpy ride, whichever way the government decides. I continue to monitor these areas of the market, but it must be stressed that not getting involved is always an option - there are plenty of other opportunities to consider where a company’s trading prospects need not depend upon shifting government pandemic policy.

For many, a more appropriate risk/reward balance can be found in looking for growing, high-quality companies with strong trading prospects not adequately reflected in their share prices. This is what I spend the bulk of my time looking for.

This search for high quality companies with strong underlying trading momentum that have compounding potential has led me to a different sector - one that, if anything, stands to benefit from present conditions...

Video games: the perfect lockdown activity?

Video games have eclipsed films and books as the predominant mode of entertainment and this market continues to be driven by attractive long term growth trends. Fortunately the UK punches above its weight in this area.

Investors have a raft of publicly traded companies - all of whom have IPOd in the past ten years or so - from which to look at.

The ones I want to look at are, in order of market cap:

- Keywords Studios (LON:KWS)

- Frontier Developments (LON:FDEV)

- Team17 (LON:TM17)

- Codemasters Group (LON:CDM), and

- Sumo (LON:SUMO)

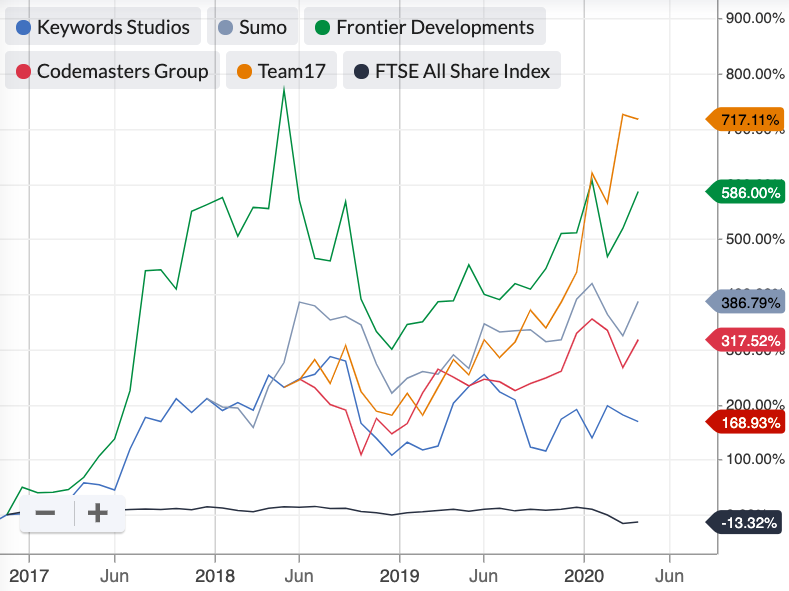

If I’ve missed any obvious candidates out, let me know in a comment. There are probably good overseas companies to look at as well. The stocks listed above have all been tremendous successes for investors so far.

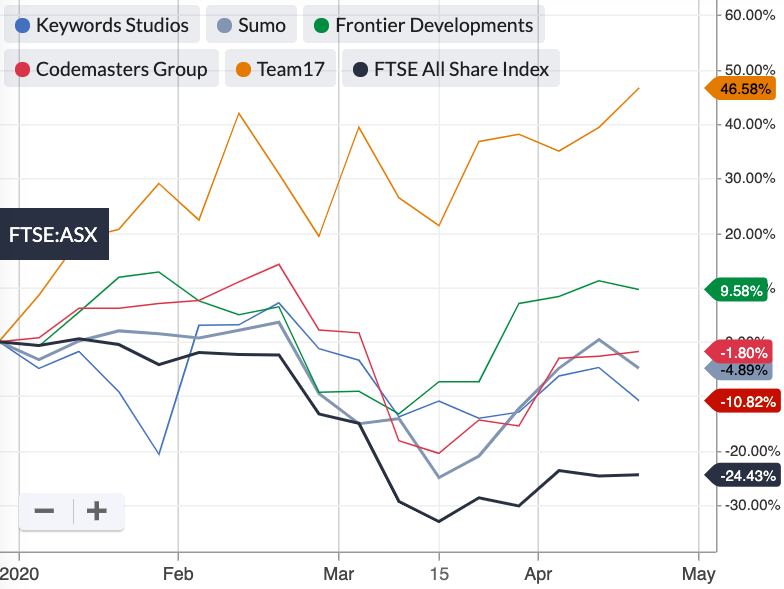

Most of them are high momentum and high quality. In the year-to-date, these stocks continue to show positive relative strength.

TM17 clearly has the strongest share price momentum of the lot right now, up nearly 50% so far in 2020 against an All-Share that is still down…

.jpg)