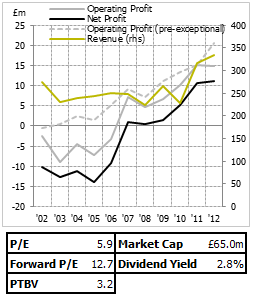

Note: for the graph to the right, I've taken their reported figures (now in USD) and restated them in GBP as their previous results were. The graph is in GBP. The results are now in USD.

Volex (LON:VLX) are a company I haven't heard about or looked at before. This is nice. Given that the market is going up, it strikes me that there are more potential stocks leaving interesting territory than entering it - and by interesting I mean cheap - and there's a whole lot of chaff I don't want to sift through to get to something potentially interesting; speculative mining shares and financially engineered contraptions seem to litter the place. I only have to look at the share price chart to see where I want to begin here, though; three huge jumps in price jump out at me, and I think understanding those should help me understand the business.

Volex (LON:VLX) are a company I haven't heard about or looked at before. This is nice. Given that the market is going up, it strikes me that there are more potential stocks leaving interesting territory than entering it - and by interesting I mean cheap - and there's a whole lot of chaff I don't want to sift through to get to something potentially interesting; speculative mining shares and financially engineered contraptions seem to litter the place. I only have to look at the share price chart to see where I want to begin here, though; three huge jumps in price jump out at me, and I think understanding those should help me understand the business.

What they actually do, to begin with; at the most basic level, they make cables and wiers for data/power transmission. Can we call this a growth market? I guess we can; electronics is probably the growth market of the last half century, so it makes sense that the building blocks of the electronics we all hold dear are also vital. Commoditisation is a worry, of course, but perhaps this is somewhat tempered by the rate of progress; this isn't like tires, milk or bread. Fibre optic cables, as an example, seem like the next big thing - and improving the components seems to go hand in hand with improving the experience for the end-user. If products are constantly evolving, there's a premium for those who can keep up. Volex try very hard to sound like a cutting edge and integrated company - they highlight the precision nature, and the fact service and reliability is vital given the value of the end products.

The two recent bumps

Looking at the share price chart, there's obviously been some action taking it down into cheap-looking territory - and it doesn't take a genius to guess that those big downward plunges in the last year were profit warnings. Indeed, the company; which, judging by the chart above, has been on a steadily rising trajectory, rather disappointed the market by noting in September that:

In light of…

.png)