I suspect the Guru screens are missing some good criteria as they haven’t picked up Volkswagon. Personally I think the screens are brilliant but there’s no substitute for researching a company and looking beyond the numbers.

(Guru) Screens which pay attention to excess Balance sheet leverage would probably eliminate auto companies.

Which is unjust, as the auto Balance Sheets include the Financing Arm debt which is secured (& safe unless residual values collapse).

Removing the Financing Arm debt reveals that auto compnies operate with net cash.

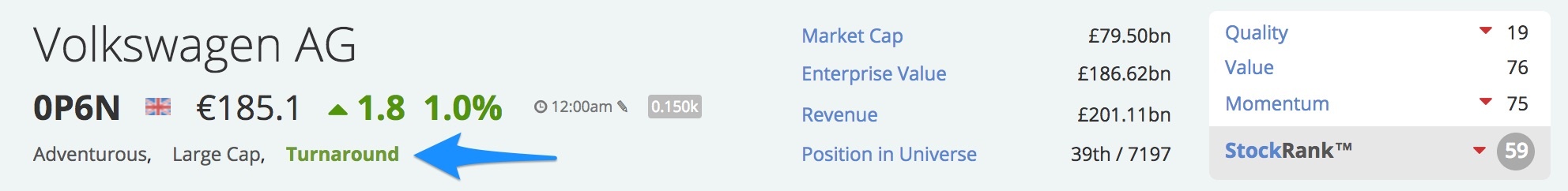

That said, VW is a mature, cyclical company growing it's top line at 0-4% p.a. & with wafer thin operating margins.

No release of value here unless VW IPO's either Porsche or Audi.