Polar Capital: A Good Time To Warm Up

Polar Capital (LON:POLR) is an asset manager, managing a selection of investment trusts (like the Polar Capital Technology Trust, PCT; and the Polar Capital Global Financials Trust, PCFT). They also manage a number of unit trusts and hedge funds, with their Assets Under Management (AUM) up to $13.6bn as of the end of June this year.

Why I Like Asset Managers

I like asset managers for a number of reasons:

- Firstly, their business model tends to be asset-like, but highly profitable.

- Secondly, as a result of this they are often serial dividend payers and growers, and

- Thirdly, they also tend to hold net cash on their balance sheets, a good buffer to have against periodic stock market and economic downturns.

They Should Benefit from Financial Repression

We remain mired in a strange economic scenario, where global economic growth is struggling and requires a very helping hand from central banks around the world, in the form of Zero Interest Rate Policies (ZIRPs) and Quantitaive Easing (QE) programs. While these ultra-low interest rates have been manna from heaven from borrowers, they have been dreadful news for savers, with UK deposit savings rates falling year on year (Figure 1).

1. UK Deposit Rates Hit a New Historic Low

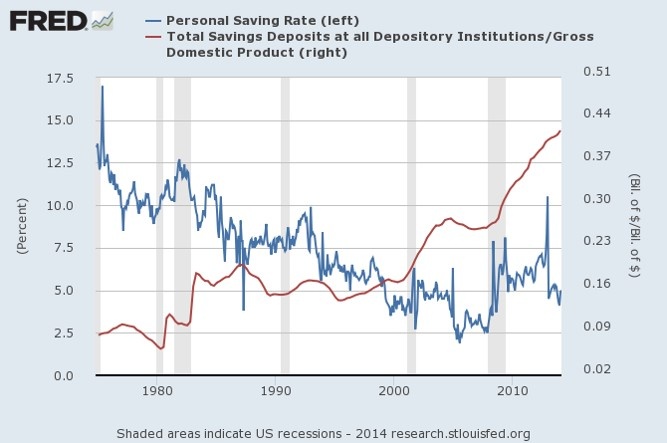

And yet, scarred no doubt by 2 stock market crashes since the year 2000, the average UK household has preferred to keep a large amount of savings in the form of cash, rather than any other higher-yielding investments like stocks and shares. This is a global trend; In the US and Germany, for example, cash held on deposit by households continues to hit new highs at over 0.4% of GDP (red line and right-hand scale on Figure 2), in spite of the five-year old stock market rally and the US S&P 500 index recently breaching the 2000 level.

2. US Savers Keep Record Amounts in Cash

As these ultra-low interest rates on cash deposits remain, there will be added pressure over time on households to find better yields elsewhere, in other asset classes like stocks and bonds.

Right Now, Stocks Yield the Most

The Hunt for Yield should push investors towards stocks, given the already-depressed yields now available on government bonds; note that you now have to pay the…