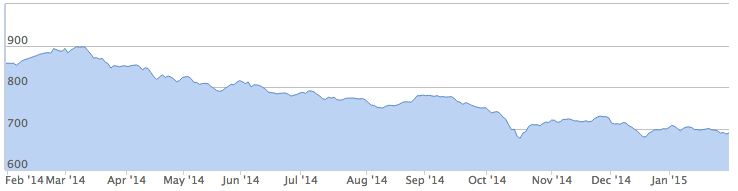

Greece was a focal point for investors once again this week. News of the election win by the far-left Syriza party led by Alexis Tsipras caused the Athens stock market to tumble. It also reignited debate over whether the country will eventually leave the euro. But according to nobel prize winning economist Robert Shiller, it suggests that Greek stocks could be a “spectacular investment".

Famed for his work on how emotions drive investment decisions, he was quoted as saying this week: “You can't free yourself from the prison of the zeitgeist unless you become a smart beta person and start mechanically doing investments that don't sound right."

Famed for his work on how emotions drive investment decisions, he was quoted as saying this week: “You can't free yourself from the prison of the zeitgeist unless you become a smart beta person and start mechanically doing investments that don't sound right."

Tempted to follow Shiller's advice? Stockopedia's Europe and Global subscribers can view our “Greek tragedy or olive and kicking?" screen here.

A matter of factor...

At Stockopedia our philosophy is grounded in some of the most persistent drivers of long-term market returns. These are powerful factors that are generally ignored, misunderstood or (because of our emotional biases) pretty difficult to stomach. But factor investing has risen in popularity and it's a subject picked up this week by John Authers in the FT.

An Apple a day....

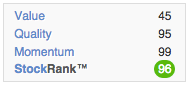

US tech giant Apple announced the biggest quarterly earnings performance of any company ever, this week. It made around $8.3 million dollars per hour in profit during its fourth quarter, helped by massive demand in China. Interestingly, Apple is still one of those companies that some analysts fear is just around the corner from catastrophe - which is ludicrous, according Ben Thompson at Stratechery. With a StockRank of 96, it's still ranking as one of the highest Quality, Value & Momentum stocks globally.

US tech giant Apple announced the biggest quarterly earnings performance of any company ever, this week. It made around $8.3 million dollars per hour in profit during its fourth quarter, helped by massive demand in China. Interestingly, Apple is still one of those companies that some analysts fear is just around the corner from catastrophe - which is ludicrous, according Ben Thompson at Stratechery. With a StockRank of 96, it's still ranking as one of the highest Quality, Value & Momentum stocks globally.

Warren Buffett's well publicised confidence in the spending power of US consumers led him to buy the country's fifth-largest chain of auto dealerships last year. With US motor sales roaring ahead, we lifted the hood on some of America's largest stock market quoted auto dealership networks to see how they stack up.

Elsewhere, Richard Beddard at Interactive Investor had a look at the high quality but rather pricey software stock Sage, as well as ITE and Treatt. And John Kingham at UKValueInvestor.com, took a long look at Unilever's slowing dividend growth… and came away unconvinced.