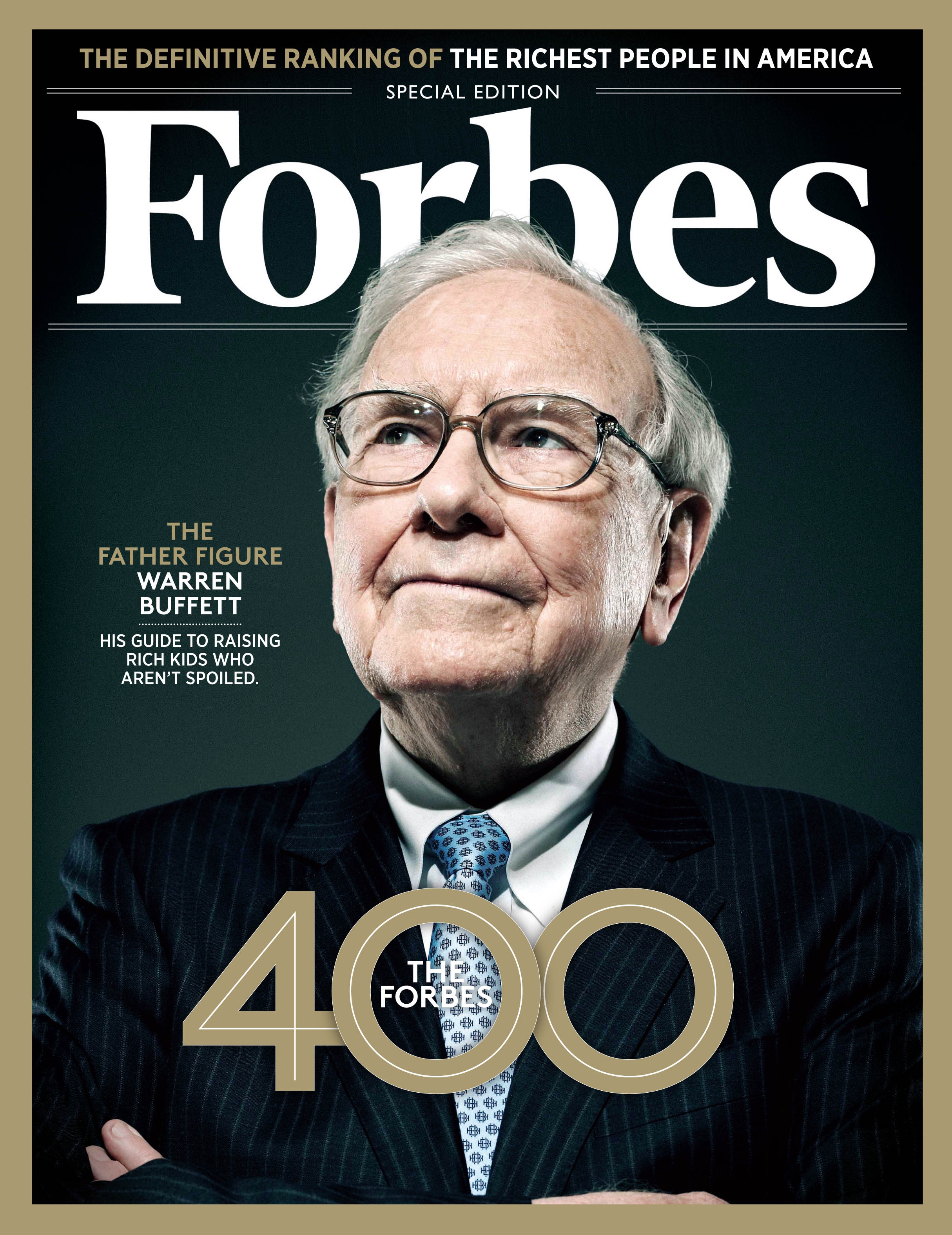

Warren Buffett's annual letter to Berkshire Hathaway shareholders tends to be hotly anticipated by investors everywhere. Apparently, it will arrive later this month together with two extra letters, one from Buffett and one from his business partner Charlie Munger, on their vision for Berkshire in the years ahead. Stephen Foley in the FT wrote an interesting preview of what we might expect, plus there's a great piece by Seth Klarman on the lessons that Buffett has taught us.

Warren Buffett's annual letter to Berkshire Hathaway shareholders tends to be hotly anticipated by investors everywhere. Apparently, it will arrive later this month together with two extra letters, one from Buffett and one from his business partner Charlie Munger, on their vision for Berkshire in the years ahead. Stephen Foley in the FT wrote an interesting preview of what we might expect, plus there's a great piece by Seth Klarman on the lessons that Buffett has taught us.

Topping Klarman's list of lessons is: “Value investing works. Buy bargains." And with that in mind, this week we had a look at how to build a deep value investing strategy. Also on the site, our CEO Ed Croft provoked a lot of discussion with his article on Michael Mauboussin's latest research about whether to buy, sell or hold after a large price drop.

Webinar alert!

Just a quick reminder that Ed will be holding a 45 minute webinar and 15 minute Q&A about some new site feature releases related to the StockRanks. We're launching an entirely new tab at the top of the site that is dedicated 100% to the StockRanks. The webinar is set for Tuesday 10th February at 12.30pm. Spaces are limited so please do book your seat early.

Stick to the factors…

Last week we mentioned that John Authers had picked up on the growing popularity of factor investing - something that we eulogise here at Stockopedia. This week there was a great article by Ben Carlson at A Wealth of Common Sense about whether this growing popularity will eventually damage returns. There's a lot of quotable stuff in there, but we liked this:

“Everyone now knows that buying cheap or high quality stocks works if you're patient. Most people aren't patient. Therein lies your edge as an investor."

This article from systematic fund investor Euclidean on why value investing is so difficult, says pretty much the same thing. And on this note we are reminded of James Montier's classic “Ode to Quant" ended with the following two reasons why the majority of the investment industry isn't about to switch to factor based investing processes:

“Firstly, the fear of technological unemployment. If, say, 18 out of every 20 analysts and fund managers could be replaced by a computer, the…