Trying to describe a passive, index or tracker fund is a lot harder than it might seem. Take a look at some excerpts from descriptions, by the managers, of a number of funds that are widely regarded as falling into this category.

“… closely matching the performance of the FT-SE Actuaries All-Share Index. The Authorised Corporate Director (ACD) will aim to hold securities that represent the FT-SE Actuaries All-Share Index “

“Generally the Fund intends to purchase a broad and diverse group of readily marketable stocks of United Kingdom companies traded principally….”

“To closely match the performance of the FTSE1 actuaries All-Share Index on a capital only and total return (after charges) basis.”

“xxxxx FTSE U.K. All Share Index Unit seeks to track the performance of the index”

“ aims to provide long term capital growth by matching the return of the FTSE All-Share Index by investing in….””

And so on……

Two things stand out. They use words like aim, closely and seek, and they fail to describe exactly how they intend to achieve their objectives.

It is clear that none of these funds expects to exactly match the index they are tracking. That is because of factors such as new issues, takeovers and holding un-invested cash or perhaps lack of liquidity with some of the small stocks near the bottom of their respective indices. These complexities mean that the managers must exercise at least a modest degree of subjectivity to address these points and maybe use derivatives to help out.

More important though is how these funds are managed. It is clearly not the case that they just buy the index and leave the market to do the rest. At the heart of this matter is the differentiation between the process and the measure. The process is to invest using a set of rules that could be interpreted by any qualified finance professional, rather than a feeling in someone’s water. That is the passive investing process.

Since it started in the mid-seventies the default assumption is that passive means allocating capital according to the market capitalisation (mkt cap) of a company in relation to that of the index as a whole. In other words the measure used to allocate capital to a company in the index is the…

I'm not a fan of any of the index-weighting schemes that are currently popular. It seems to me that they are all designed for the benefit of the fund provider, not the investors in the fund. i.e. they are designed to scale and make the running of the fund profitable for the vendor.

Market Cap or Fundamentally weighted indices are lower cost than equal weighted funds, but provide FAR less exposure to the underlying driving factors behind share performance.

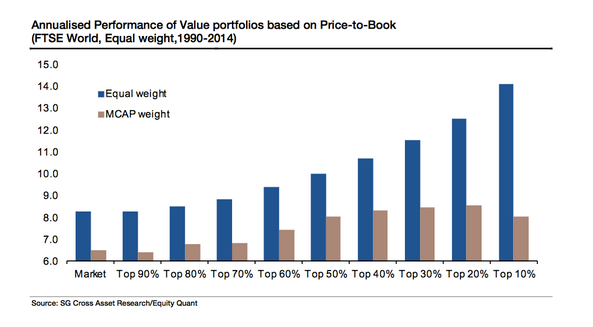

Great research by SocGen shows precisely this ... the blue line below shows equal weighted portfolios of stocks (of different cheapness) versus Market Cap weighted portfolios. No question which wins - equal weighted hands down beats cap weighted.

Private investors are best placed to profit from the value anomaly (and the other anomalies) in the market... just not via ETFs or index funds or smart beta funds... by building their own directly invested portfolios using simple stock selection techniques, equal weighting and diversifying wisely. There's just no point mucking about in funds unless you desperately want to subsidise someone else's Porsche Cayenne.

DYOR etc.