We have some quite dramatic drops today in the Oil and Gas sector providing some bargain values (depending on your point of view) for many stocks.

On my watch list, I have:

Europa Oil & Gas (LON:EOG) is down 10% (after a big fall yesterday) to 27.5p. It is looking very likely that West Firby will come online around about expectations putting Core NAV around the 30p mark. On top of this there is a lot of juicy exploration upside. Their work in Romania looks promising and the big Berenx gas field could be a company maker. Some brokers have a risked NAV in the £2.50 region.

SOCO (LON:SIA) 343p. Lots of downside protection and a takeout bid must be north of 450p. The recent absence of news on the TGD extension looks like a positive as they haven't be immediately knocked back. There might not do much between now and August but when they start pumping at 50K/bpd, the stock will outperform.

Xcite Energy (LON:XEL): It is at 302p and has been over 400p. CPR news due soon. It looks like this could surprise to the upside but the stock has run a long way very quickly this year and so it is taking a pasting.

Gulf Keystone Petroleum (LON:GKP) 118p. If they can resolve poliltical issues in KRG, this could easily double or more. Plenty of oil and gas but still lots of political risk.

Dominion Petroleum (LON:DPL) 5.5p. Some great prospects still waiting for farming news. It has been as high as 7p recently. It is getting a pasting today.

Encore Oil (LON:EO.) - It is back in double figures now. Core NAV must be at least 85p with plenty to play for in greater catcher, the new cather blocks and of course Cladhan. The downside just got reduced substantially by todays falls. I've increased my position.

Sterling Resources (market not open yet) - if anything, the Japanese situation might mean higher UK gas prices making Breagh more valuable. Cladhan drilling now and it could be huge.

I hold all these and have taken…

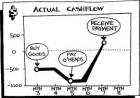

"If you can keep your head..."

Plenty of pain today here too. I've decided to top up on Ithaca at 155p. The good news keeps rolling in there and they are remaining on target for 20kboepd by 2013. Since there last RNS came in they have been as high as 190p and have fallen dramatically today on the back of...no...news. The price of oil has not fallen off a cliff or anything. They're still going to be making buckets of cash.